Financial giants have made a conspicuous bullish move on PayPal Holdings. Our analysis of options history for PayPal Holdings (NASDAQ:PYPL) revealed 17 unusual trades.

Delving into the details, we found 47% of traders were bullish, while 41% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $461,468, and 9 were calls, valued at $1,292,331.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $62.5 to $80.0 for PayPal Holdings over the recent three months.

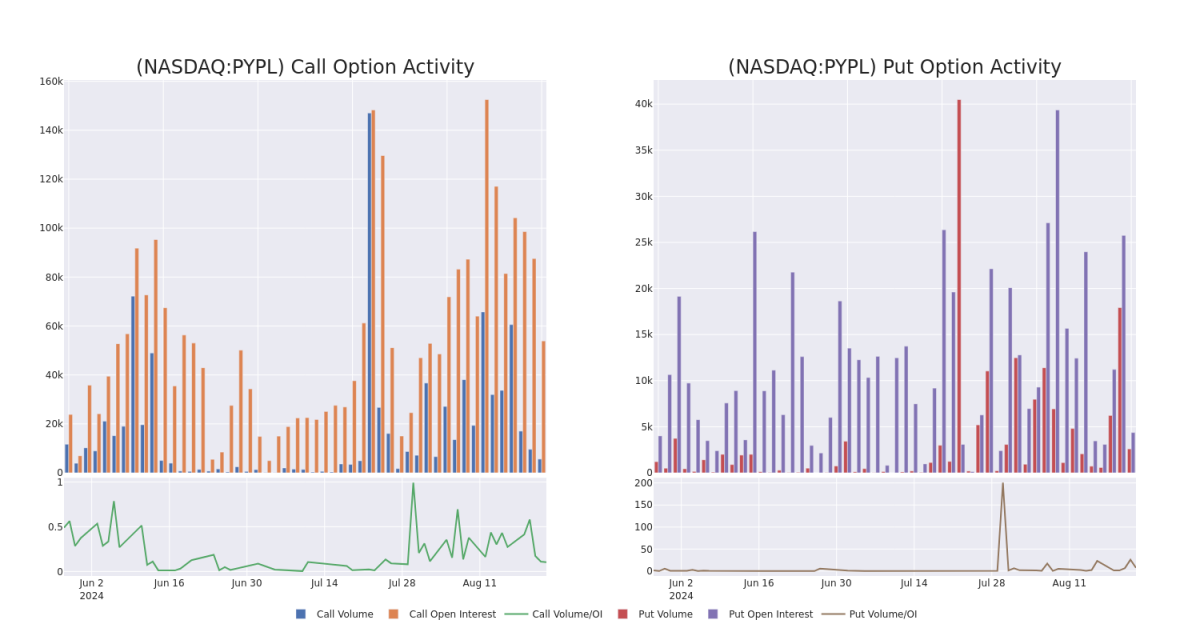

Volume & Open Interest Development

In today's trading context, the average open interest for options of PayPal Holdings stands at 4856.75, with a total volume reaching 8,212.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in PayPal Holdings, situated within the strike price corridor from $62.5 to $80.0, throughout the last 30 days.

In today's trading context, the average open interest for options of PayPal Holdings stands at 4856.75, with a total volume reaching 8,212.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in PayPal Holdings, situated within the strike price corridor from $62.5 to $80.0, throughout the last 30 days.

PayPal Holdings 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | CALL | TRADE | BEARISH | 01/17/25 | $3.6 | $3.45 | $3.5 | $80.00 | $875.0K | 20.7K | 2.6K |

| PYPL | PUT | SWEEP | BULLISH | 10/18/24 | $5.0 | $4.9 | $4.9 | $75.00 | $100.4K | 429 | 208 |

| PYPL | CALL | SWEEP | BEARISH | 10/18/24 | $2.93 | $2.9 | $2.9 | $72.50 | $86.7K | 7.0K | 868 |

| PYPL | PUT | SWEEP | BEARISH | 12/19/25 | $8.3 | $8.25 | $8.25 | $67.50 | $84.1K | 118 | 177 |

| PYPL | PUT | SWEEP | BULLISH | 09/20/24 | $2.69 | $2.65 | $2.65 | $73.00 | $79.5K | 238 | 349 |

About PayPal Holdings

PayPal was spun off from eBay in 2015 and provides electronic payment solutions to merchants and consumers, with a focus on online transactions. The company had 426 million active accounts at the end of 2023. The company also owns Venmo, a person-to-person payment platform.

In light of the recent options history for PayPal Holdings, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of PayPal Holdings

- Currently trading with a volume of 3,221,159, the PYPL's price is down by -0.24%, now at $71.35.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 68 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for PayPal Holdings with Benzinga Pro for real-time alerts.