Financial giants have made a conspicuous bullish move on Trade Desk. Our analysis of options history for Trade Desk (NASDAQ:TTD) revealed 12 unusual trades.

Delving into the details, we found 58% of traders were bullish, while 41% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $174,432, and 9 were calls, valued at $442,687.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $75.0 to $115.0 for Trade Desk over the recent three months.

Insights into Volume & Open Interest

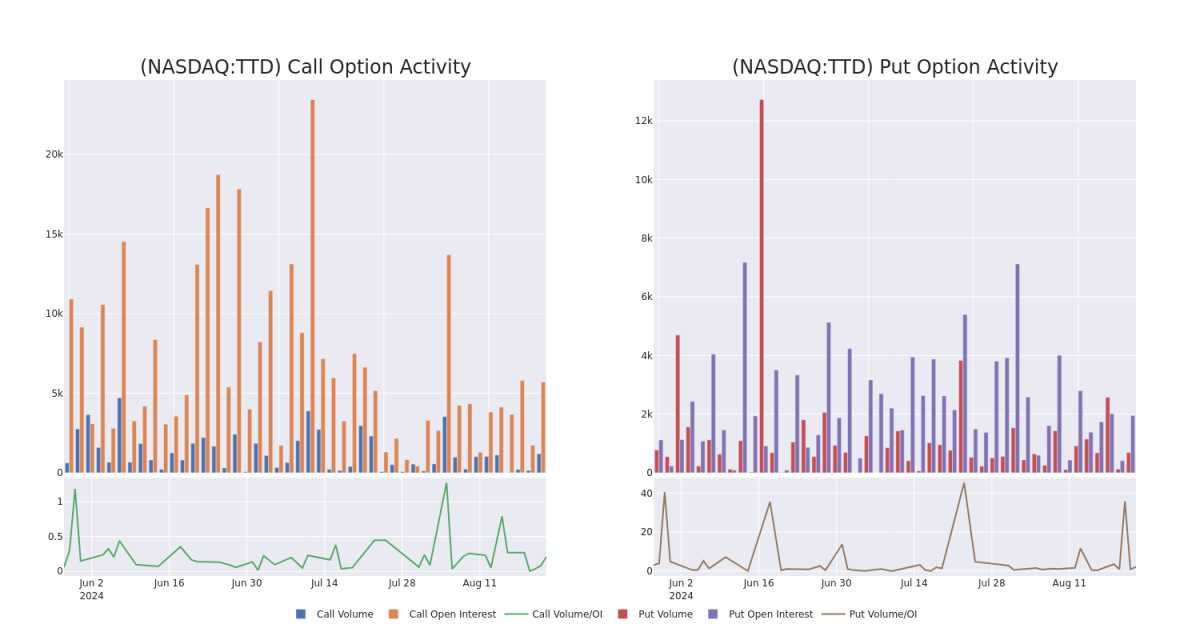

In terms of liquidity and interest, the mean open interest for Trade Desk options trades today is 765.9 with a total volume of 1,887.00.

In terms of liquidity and interest, the mean open interest for Trade Desk options trades today is 765.9 with a total volume of 1,887.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Trade Desk's big money trades within a strike price range of $75.0 to $115.0 over the last 30 days.

Trade Desk Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TTD | PUT | SWEEP | BULLISH | 10/18/24 | $5.0 | $4.95 | $4.95 | $105.00 | $84.1K | 266 | 200 |

| TTD | CALL | TRADE | BEARISH | 08/23/24 | $24.8 | $24.25 | $24.46 | $80.00 | $66.0K | 152 | 121 |

| TTD | CALL | TRADE | BULLISH | 08/23/24 | $2.68 | $2.31 | $2.68 | $102.00 | $64.8K | 1.2K | 329 |

| TTD | PUT | TRADE | BEARISH | 10/18/24 | $4.95 | $4.9 | $4.95 | $105.00 | $64.8K | 266 | 332 |

| TTD | CALL | SWEEP | BEARISH | 09/06/24 | $2.25 | $2.08 | $2.1 | $105.00 | $55.8K | 216 | 301 |

About Trade Desk

The Trade Desk provides a self-service platform that helps advertisers and ad agencies programmatically find and purchase digital ad inventory (display, video, audio, and social) on different devices like computers, smartphones, and connected TVs. It utilizes data to optimize the performance of ad impressions purchased. The firm's platform is referred to as a demand-side platform in the digital ad industry. The firm generates its revenue from fees based on a percentage of what its clients spend on advertising.

Following our analysis of the options activities associated with Trade Desk, we pivot to a closer look at the company's own performance.

Current Position of Trade Desk

- With a volume of 1,103,137, the price of TTD is up 1.66% at $104.88.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 76 days.

Expert Opinions on Trade Desk

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $114.0.

- Maintaining their stance, an analyst from Macquarie continues to hold a Outperform rating for Trade Desk, targeting a price of $115.

- An analyst from Citigroup has decided to maintain their Buy rating on Trade Desk, which currently sits at a price target of $115.

- Consistent in their evaluation, an analyst from BTIG keeps a Buy rating on Trade Desk with a target price of $114.

- An analyst from Macquarie has decided to maintain their Outperform rating on Trade Desk, which currently sits at a price target of $115.

- In a cautious move, an analyst from Stifel downgraded its rating to Buy, setting a price target of $111.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.