Earnings Are Growing at Shandong HaihuaLtd (SZSE:000822) but Shareholders Still Don't Like Its Prospects

Earnings Are Growing at Shandong HaihuaLtd (SZSE:000822) but Shareholders Still Don't Like Its Prospects

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. Long term Shandong Haihua Co.,Ltd (SZSE:000822) shareholders know that all too well, since the share price is down considerably over three years. Unfortunately, they have held through a 59% decline in the share price in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 26% lower in that time. Shareholders have had an even rougher run lately, with the share price down 25% in the last 90 days. Of course, this share price action may well have been influenced by the 13% decline in the broader market, throughout the period.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate three years of share price decline, Shandong HaihuaLtd actually saw its earnings per share (EPS) improve by 84% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or else the company was over-hyped in the past, and so its growth has disappointed.

During the unfortunate three years of share price decline, Shandong HaihuaLtd actually saw its earnings per share (EPS) improve by 84% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or else the company was over-hyped in the past, and so its growth has disappointed.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Revenue is actually up 11% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Shandong HaihuaLtd further; while we may be missing something on this analysis, there might also be an opportunity.

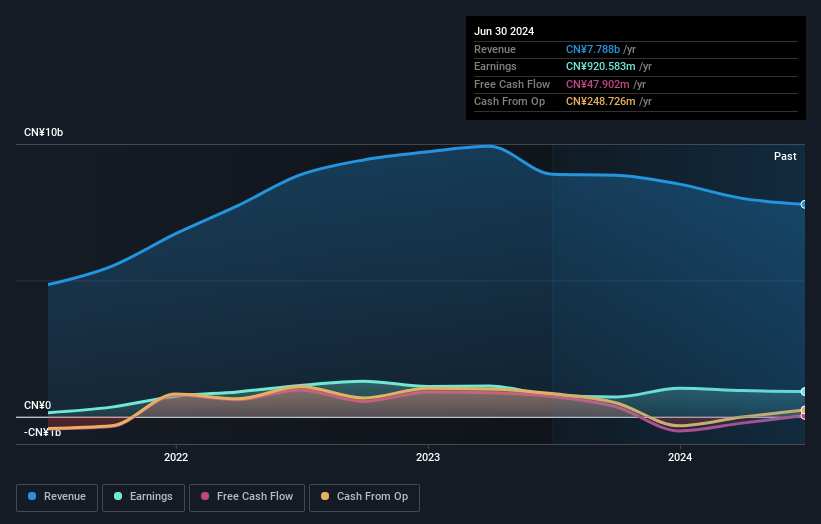

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Shandong HaihuaLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We regret to report that Shandong HaihuaLtd shareholders are down 25% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 17%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Shandong HaihuaLtd (at least 1 which is potentially serious) , and understanding them should be part of your investment process.

Of course Shandong HaihuaLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.