The heavy dovish shift in Powell's speech brought S&P close to new highs. Small-cap and chip stock indices rose about 3%, and major indices surged more than 1% throughout the week, the best in the small market. Tesla and Nvidia rose more than 4.5% on Friday, and regional bank stock ETFs rose more than 6% at one point. Short-term US bond yields dived into double digits. The US dollar fell 1.7% weekly, spot gold rose more than 1% to 2,510 US dollars, the pound was the highest in the past two and a half years, the yen rose more than 1%, the offshore renminbi rose more than 300 points, and oil rose more than 2% but fell throughout the week.

Federal Reserve Chairman Powell sent the clearest signal so far at the annual meeting of global central banks in Jackson Hole, implying that the Federal Reserve will begin cutting interest rates in September. He also believes that the US economy is growing at a “steady rate”, easing concerns about the recession. His confidence in reducing inflation to 2% increased, and there was no mention of “gradual” interest rate cuts, leaving room for more drastic policy adjustments.

According to some analysts, the Federal Reserve will measure it based on the next economic data, if the August non-agricultural data shows that the labor market is more than weakBefore it came outIt is expected that it should stimulate the Federal Reserve to cut interest rates faster and more drastically. Federal Reserve officials are also “releasing pigeons.” Bostic, the 2024 Polling Commission and Atlanta Federal Reserve Chairman, said they may now be inclined to cut interest rates more than once during the year. Philadelphia Federal Reserve Chairman Huck said that now is the time to start cutting interest rates, and the process should be “orderly.”

Expectations of interest rate cuts are heating up. The CME Fed's observation tool shows that the possibility of cutting interest rates by 50 basis points in September rose to 36.5% from 24% on Thursday. Swap traders currently expect interest rate cuts of more than 100 basis points this year, which means that until December, every remaining FOMC policy meeting will cut interest rates, including a sharp rate cut of 50 basis points.

Expectations of interest rate cuts are heating up. The CME Fed's observation tool shows that the possibility of cutting interest rates by 50 basis points in September rose to 36.5% from 24% on Thursday. Swap traders currently expect interest rate cuts of more than 100 basis points this year, which means that until December, every remaining FOMC policy meeting will cut interest rates, including a sharp rate cut of 50 basis points.

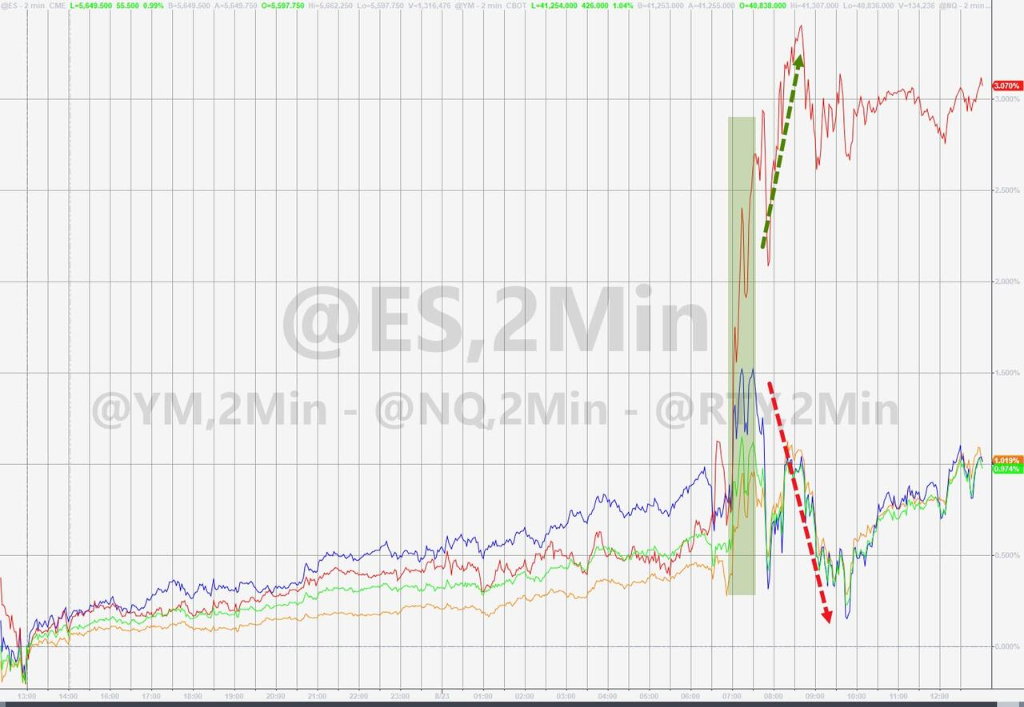

After Powell's speech came out, risk appetite increased, the US stock market opened high, the US dollar index fell sharply, and US bond yields fell across the board. At one point, two-year US bond yields fell by more than 10 basis points. The commodity market was also boosted. The price of gold reached a new high, and the price of oil rose at the same time.

The ECB also showed a tendency to cut interest rates. Bank of Finland Governor Rehn supported cutting interest rates in September. Economists predict that inflation in the Eurozone is expected to fall to 2.2% in August, supporting further interest rate cuts. Furthermore, the growth rate of new home sales in the US hit a record high of more than a year in July.

Small-cap stocks closed up 3.19%, leading the wayRiseThe Dow rose to a high of nearly 500 points and rose above 0.041 million points. The S&P market is close to the highest in history. The Nasdaq index rose 1.8%, the chip stock index rose 2.8%, and Tesla and Nvidia both rose more than 4.5%:

- The US stock index rose across the board and closed near a daily high: the S&P 500 market closed up 1.15% to 5634.61 points, rising 1.45% this week. The Dow, which is closely linked to the economic cycle, closed up 1.14% or 462.3 points to 41175.08 points, rising 1.27% this week. The NASDAQ, which has the majority of technology stocks, closed up 1.47% to 17877.79 points, rising 1.38% this week. The NASDAQ 100 closed up 1.18%. The Nasdaq Technology Market Capitalization Weighted Index (NDXTMC), which measures the performance of NASDAQ's 100 technology components, closed up 1.37%. The Russell 2000 Index, which is more sensitive to the economic cycle, closed up 3.19% and climbed 3.54% this week. The VIX Panic Index closed down 9.63% to 15.86.

- Throughout the week, the Dow rose nearly 1.3%, the S&P market rose 1.5%, the NASDAQ rose 1.4%, the small-cap stock index rose 3.6%, and the chip stock index rose 1.1%.

- At the time of Powell's “turnaround,” US bank stocks rose across the board, and regional bank indices performed brilliantly, making the biggest intraday gain in eight months. SPDR S&P Regional Bank ETF (KRE) closed up 5.1% after rising 6.4%, up more than 5% this week.

Small-cap stocks surged 3.19% and had the highest increase

ETFs in the US stock industry closed higher across the board. Regional bank ETFs rose more than 5%, banking ETFs rose more than 4%, global aviation ETFs rose more than 3%, semiconductor ETFs and optional consumer ETFs each rose around 2%, and global technology stock ETFs, technology industry ETFs, energy industry ETFs, online stock index ETFs, and biotech index ETFs all rose more than 1%.

- The 11 sectors of the S&P 500 index closed higher across the board. The real estate sector closed up 2%, the optional consumer sector rose 1.7%, the information technology/technology sector rose 1.66%, the energy sector rose 1.48%, and the telecom sector rose 0.5% to show the third-lowest performance. The interest-rate sensitive real estate sector registered the highest gains throughout the week.

- The “Seven Sisters of Technology” only fell on Meta. Tesla closed up 4.59%, with a cumulative increase of 1.94% this week, continuing last week's 8.06% rebound; Nvidia rose 4.55%, rising 3.84% this week, continuing last week's 18.93% increase; Google A rose 1.11%, rising 1.63% this week; and Apple rose 1.03%, rising 0.35% this week, continuing last week's 4.66% increase. Amazon rose 0.52%, down 0.01% this week, and rebounded 6.06% last week; Microsoft rose 0.3%, down 0.4% this week; Meta fell 0.74%, rising 0.11% this week, rising 4.82%, 6.07%, and 1.86% in the previous three weeks.

- Apple plans to hold an autumn product launch on September 10 to launch the new iPhone, AirPods, and Watch. Meta cancelled plans to launch a high-end hybrid headset in 2027.

- Chip stocks rose collectively. The Philadelphia Semiconductor Index closed up 2.79%; the industry ETF SOXX closed up 2.68%; Nvidia doubled the long ETF closed up 8.7%. Ansemi Semiconductor closed up 4.08%, Qualcomm closed up 2.66%, Ke Lei closed up 2.42%, Arm Holdings closed 4.56%, and Intel closed up 2.19%. AMD closed up 2.16%, up 4.32% this week. Applied Materials closed up 1.23%. Broadcom closed up 2.48%. TSMC's ADR closed up 2.91%, down 1.87% this week. Meanwhile, Asmack's ADR closed down 0.05%, while Micron Technology closed down 1.35%.

- AI concept stocks generally rose. Snowflake closed up 0.56%, BigBear.ai closed up 6.17%, Nvidia's owned AI voice company SoundHound AI closed up 2.03%, Dell Technology up 2.78%, CrowdStrike up 1.46%, C3.ai up 1.74%, “AI demon stock” microcomputers closed up 1.39%, Oracle closed up 0.8%, and Serve Robotics closed up 0.94%, while Palantir closed down 0.44% and BullFrog AI It closed down 5.19%.

China Securities had mixed ups and downs. The Nasdaq Golden Dragon China Index closed up 0.28% and fell 1.5% throughout the week. Among ETFs, the China Technology Index ETF (CQQQ) closed up 1.37%. The China General Internet Index ETF (KWEB) closed up 0.88%.

Among the popular Chinese securities, Alibaba's total market capitalization exceeds that of Pinduoduo. Station B closed up 15.28%, Artes Solar rose more than 9.8%, Ehang Smart rose by about 5.4%, Jingke Energy rose more than 4.8%, Alibaba rose 2.9%, Zaiding Pharmaceuticals rose about 2.7%, World Data rose about 2.4%, NIO Auto and Douyu rose more than 2.2%, Shell rose about 1.5%, Xiaopeng rose more than 1.4%, Vipshop rose more than 1.3%, Daxin Energy, JD, Yaduo, Good Future, and Boss Direct Hire up to more than 0.8%, Tencent Music, Baidu, NetHome, Auto Easy, Ideal, Qifu Technology, Shanda Technology, and Ctrip closed down at most At 0.99%, Mingchuang Premium, Yum China, and Zhongtong Express fell more than 1.9%, New Oriental fell by about 2.2%, and iQiyi, Baijiayun, and Zhongjin Medical fell at least 10%.

- Diet drug concept stocks generally closed higher. Ventyx Biosciences closed up 14.72%; “affordable diet pill” suppliers Hims, Schudi Biotech ADR, and Amgen rose at least 1.6%; Novo Nordisk ADR also rose less than 0.1%. Eli Lilly closed down more than 0.1% and broke away from the highest level in closing history, rising 3.32% this week, and rising 10.85% and 3.56% in the previous two weeks.

- Among the most volatile individual stocks, one Insurance closed down 92.63%. As of Thursday's close, the stock had risen more than 500% since it went public in March. Sequans Communications closed up 111.71%, and its 4G IoT technology was acquired by Qualcomm. Wok Medical Technology Group (WOK) broke off on the first day of its US IPO, falling 64% to $3.60. The previously offered IPO price was $10.00 per share.

Powell boosted expectations that the Federal Reserve would cut interest rates. European stocks rebounded for the third day in a row, rising 1.3% this week, the longest continuous increase since the end of March:

The Pan-European Stoxx 600 Index closed up 0.46%, rebounded 6.38% since closing on August 5, and rose 1.31% this week, rising for the third consecutive week. The constituent stock Nestlé shares settled down, and Nestlé CEO Mark Schneider left his job due to the company's poor performance.

The German stock index closed up 0.76% and climbed 1.70% this week, rising for the third consecutive week. The French stock index closed up 0.70%, rising 1.71% this week. The UK stock index closed up 0.48%, rising 0.20% this week. The Italian stock index closed up 1.02%, rising 1.84% this week. The Dutch stock index closed up 0.02%, rising 0.32% this week. The Spanish stock index closed up 1.09%, rising 3% this week.

“Powell turned to Japan” US bond yields fell sharply. Short-term US bond yields declined significantly. After Powell's speech was released, 2-year and 10-year US bond yields declined by more than 10 basis points and 6 basis points respectively. European bond yields followed the significant decline in US bonds:

- US debt: At the end of the session, the two-year US Treasury yield, which is more sensitive to monetary policy, fell 9.46 basis points to 3.9090%. At one point in the intraday period, it fell nearly 11 basis points and fell below 3.90%. This week, it fell 13.86 basis points below the 4% mark. The yield on the US 10-year benchmark treasury bond fell 5.50 basis points to 3.7971%. The cumulative decline this week was 8.55 basis points, all close to erasing all gains since August 5.

- European bonds: The yield on 10-year German bonds, the benchmark for the Eurozone, fell 2.0 basis points, with a cumulative decline of 2.2 basis points this week. Overall, the yield showed a V-shaped trend. The two-year German bond yield fell 2.4 basis points, falling 5.9 basis points this week. The yield on French 10-year treasury bonds fell 2.6 basis points, falling 4.8 basis points this week. The yield on Italian 10-year treasury bonds fell 5.0 basis points, falling 6.5 basis points this week. The yield on Spanish 10-year treasury bonds fell 3.5 basis points, falling 7.0 basis points this week. The yield on Greek 10-year treasury bonds fell 4.5 basis points, falling 6.0 basis points this week. The two-year British bond yield fell 4.4 basis points, falling 0.4 basis points this week. The yield on UK 10-year treasury bonds fell 4.8 basis points, falling 1.4 basis points this week.

US bond yields fell sharply, with short-term treasury yields leading the decline (down 10 bps on Friday of the second year, 14 bps this week, and 2 bps on Friday of the 30-year period)

The US dollar index fell more than 0.8% to a 13-month low. Non-US currencies generally strengthened in the “Powell turned to Japan”. The pound was the highest in the past two and a half years, the yen rose more than 1% to 144, and the offshore renminbi surged 305 points:

- US dollar: The US dollar index DXY, which measures a basket of six major currencies, fell 0.82% to 100.678 points. After issuing Federal Reserve Chairman Powell's speech at 22:00 Beijing time, it dived significantly. It once fell to 100.602 points, falling below the bottom of 100.617 points on December 28, 2023, approaching the bottom of 99.578 points on July 14, 2023. It fell 1.74% this week, showing an overall fluctuating downward trend.

The Bloomberg US dollar index fell 0.97% to 1223.14 points, and fell to 1222.53 points at 02:16, approaching the bottom of December 28, 2023. It fell 1.24% this week. The overall decline widened significantly after Powell's speech.

The dollar fell to a low point during the year

- Non-US currencies generally rose. EUR/USD rose 0.75% to 1.1193, up 1.54% this week; GBP/USD rose 0.95% to 1.3216, the highest since March 2022, up 2.10% this week; USD/CHF fell 0.54% to 0.8477, down 2.18% this week; in commodity currency pairs, the Australian dollar rose 1.37% against the US dollar to 0.6797, up 1.90% this week, and the New Zealand dollar rose 1.61% against the US dollar to 0.6236, up 3.01% this week, and down 0.79% against the Canadian dollar to 1.3510. It dropped 1.24% this week.

- According to the analysis, the relative resilience of the UK PMI data indicates that the possibility of continuous interest rate cuts is extremely low. There is room for further support for the pound in the coming weeks. Currently, the British pound is the currency of choice for expressing investment views on shorting the US dollar.

- Yen: The yen rose 1.31% against the US dollar to 144.37 yen, and rose to 144.05 yen at 03:36, rising 2.21% this week. The yen rose 0.57% against the euro to 161.60 yen, up 0.74% this week; the yen rose 0.35% against the British pound to 190.786 yen, up 0.15% this week.

- According to the news, Bank of Japan Governor Ueda Kazuo first claimed on Friday after “Black Monday” that the Bank of Japan does not plan to raise interest rates hastily, but will continue to adjust monetary policy if the economic trend is in line with expectations. According to the analysis, Kazuo Ueda remains neutral and cautious in his remarks; it is not a pigeon, not an eagle, so as not to disrupt the market. Japan's Finance Minister Shunichi Suzuki said that there will be conditional foreign exchange intervention for sudden exchange rate fluctuations.

- Offshore RMB: Offshore RMB (CNH) rose 305 points against the US dollar at the end of the session to 7.1,162 yuan. Overall intraday trading was in the 7.1488-7.1132 yuan range, with a cumulative increase of about 470 points this week.

- Most cryptocurrencies have risen. Bitcoin, the largest market capitalization leader, rose 5.91% at the end of the session to $63915.00. Powell's speech broke the silence of the market. The increase expanded rapidly. This week, it had a cumulative increase of 6.54%, fluctuating upward. Spot Bitcoin has accumulated a cumulative increase of more than 8.5% in the last seven calendar days (since trading ended last Friday) to above $64,300. The overall increase increased significantly after Powell's speech. Ethereum, the second-largest, rose 5.50% at the end of the session to $2760.50, rising 4.74% this week.

Bitcoin soared to 0.064 million dollars

Interest rate cuts can stimulate economic growth and benefit oil demand. US oil and oil have rebounded for the second day in a row, rising more than 2.3% on Friday, but the two are still falling this week. Therefore, the advance of the previous cease-fire agreement helped ease supply concerns and the slowdown in oil demand prospects. European gas futures fell more than 7% this week:

- US Oil: WTI crude oil futures for October closed up $1.82, or 2.49%, to $74.83 per barrel. This week's cumulative decline was 2.37%. US stocks rose more than 2.8% to 75.06 US dollars/barrel after noon trading, a new intraday high since August 19.

- Oil: Brent crude oil futures closed up 1.80 US dollars in October, up about 2.33% to 79.02 US dollars/barrel. This week's cumulative decline was 0.83%. US stocks rose nearly 2.7% to 79.27 US dollars/barrel after noon trading.

According to Wall Street Bank, ING analysts pointed out that OPEC+ is still concerned about the recent weakness in the oil market and may have to abandon plans to increase crude oil supply starting in October. Of course, this will depend on the oil market's trading situation at the end of September. Morgan Stanley said on Friday that falling oil inventories are supporting oil prices. Oil stocks have declined by about 1.2 million barrels per day for the past four weeks, and this situation is expected to continue in the third quarter. According to some analysts, the previous decline caused the oil market to approach the oversold region. The US CFTC said that the bullish sentiment for WTI crude oil hit an 11-week low.

- Natural gas: US natural gas futures for September closed down nearly 1.51% to $2.0220 per million British thermal units. This week's cumulative decline was 4.76%. TTF Dutch gas futures, the benchmark for Europe, fell 0.34% to 36.700 euros/megawatt-hour, falling 7.15% this week, and overall fluctuated downward. ICE British gas futures rose 0.55% to 88.000 pencies/kilocalories, with a cumulative decline of 7.64% this week, showing an overall volatile downward trend.

Oil prices also rose sharply, rebounding further from the low in early August

Weakening US dollar and US bond yields supported higher precious metals. Spot gold rose at an intraday high of nearly 1.4%, silver once rose more than 3.1%, and London industrial basic metals rose collectively. Copper closed up 1.73%. Lunzinc's weekly increase was the best since April:

- Gold: COMEX's December gold futures rose 1.20% to $2546.80 per ounce at the end of the session, rising 0.39% this week. After Powell's speech came out, spot gold rose nearly 1.4%, reaching a new daily high of 2518.36 US dollars/ounce, approaching the record high of 2531.75 US dollars set on August 20, and has risen 2.27% this week.

- Silver: COMEX September silver futures rose 2.78% to $29.855 per ounce at the end of the session, rising 3.50% this week. After Powell's speech came out, spot silver rallied in the short term. US stocks rose above the $30 mark by 3.1% in early trading, and finally closed up 2.86% to 29.8,157 US dollars/ounce, rising 2.89% this week.

- The analysis points out that Powell's dovish signals triggered another surge in gold prices, and it is expected that gold will continue to rise until the September Federal Reserve meeting. Driven by expectations of interest rate cuts, the price of gold is expected to rise to the range of 2,550 to 2,600 US dollars. According to US CFTC data, gold bullish sentiment hit a four-year high.

- London's industrial base metals rose collectively. The economic weather vane “Dr. Copper” closed up 1.73% to 9,288 US dollars/ton, with a cumulative increase of more than 1.88% this week. Lunn lead rose by about 3.12%, and this week it has risen by about 3.98%. Renxi rose more than 1.84%, rising more than 3.16% this week. Lunan aluminum rose 2.50%, rising about 7.44% this week. Lunzine rose about 1.89%, rising 5.43% this week. Lunn nickel rose more than 0.93%, rising 2.35% this week. Luncobalt settled down, falling by about 2.41% this week.

[The following updates were made before 23:00 on August 23]

On Friday, August 23, Federal Reserve Chairman Powell “released pigeons” at the annual meeting of global central banks in Jackson Hole, saying that it is time to adjust policies and not seek or welcome the job market to continue to cool down. My confidence in reducing inflation to 2% has increased, which confirmed the market's expectations that Powell will deliver a “dovish” speech.

According to the analysis, Federal Reserve Chairman Powell's shift policy has already been completed. Powell showed complete dovism in his speech. Two years ago, he also stated during the same period that the Federal Reserve would accept the recession as a cost to restore inflation.

After Powell's speech came out, expectations of interest rate cuts heated up sharply, boosting the upward trend in risk appetite. After opening higher, the US dollar index fell sharply, and US bond yields dived across the board, driving commodity prices. Spot gold hit new highs, and oil prices also rose.

The rise of US stocks accelerated after opening higher:

- The Nasdaq, which has the majority of technology stocks, opened 153.37 points or rose 0.87%; the S&P 500 market opened 31.85 points or rose 0.57%, and now the increase increased by more than 1.2%; the Dow, which is closely related to the economic cycle, opened 166.34 points or 0.41% higher, and now increased by more than 1%; the Russell 2000 small-cap stock index once rose more than 2.7%.

- At the beginning of the US stock market, most major industry ETFs rose. Regional bank ETFs, semiconductor ETFs, and global technology stock index ETFs all rose more than 1%.

- The “Seven Sisters of Science and Technology” collectively rose higher. Nvidia's increase increased by more than 4.6%, Tesla once rose more than 5%, Apple once rose more than 1.6%, Amazon once rose more than 1.5%, the “metaverse” Meta rose by more than 1.4% and then cut in half, Google A once rose more than 1.3%, and Microsoft once raised more than 0.8% and then returned most of its gains.

- Chip stocks are rising at an accelerated pace. The Philadelphia Semiconductor Index rose more than 3.5% at one point. Qualcomm rose more than 3.1%, Broadcom rose more than 3.6%, Intel rose more than 3.9%, and TSMC's ADR rose more than 4%. Micron Technology once fell more than 2.4%, but now the decline has been cut in half.

- Most AI concept stocks rose. BullFrog AI once fell more than 2.9%, and Oracle fell more than 0.3%, while SoundHound AI, an AI voice company owned by Nvidia, once rose more than 3.6%, and the “AI monster stock” ultra-microcomputer rose more than 3.3%, then regained most of its gains.

- The Chinese securities market rose more and fell less. At one point, the Nasdaq Golden Dragon China Index rose more than 0.7%. Among popular Chinese securities, Bilibili once rose more than 14%, Alibaba rose more than 3.3%, while Pinduoduo once fell more than 6.1%.

- Notably, Alibaba's total market capitalization exceeds that of Pinduoduo.

- After Powell's speech was published, the US dollar index fell sharply, which was beneficial to the G10 currency. The ICE dollar index dived from above 101.50 points to below 100.90 points, and the overall decline during the day extended to more than 0.6%, approaching the bottom of December 28, 2023. The Bloomberg US dollar index fell about 0.8%. Non-US currencies rose, and the yen rose more than 0.7% against the US dollar to break 145. The pound rose more than 0.6% against the US dollar to 1.32, a new high since March 2022.

- The “bull market intensified” in US bonds, and US bond yields dived across the board. After Powell's speech came out, the US 10-year Treasury yield dived from 3.8350% to close to 3.8%, and the overall decline during the day widened to more than 5 basis points. The two-year US Treasury yield dived from above the 4% integer psychological threshold to below 3.9450%, falling about 6 basis points overall during the day.

- The weakening of US dollar and US bond yields boosted commodity prices, and gold prices rose in the short term. Spot gold rose more than 1.2%, reaching a new high of 2515.55 US dollars/ounce. After Powell's speech was released, it rose more than $15. Silver is approaching the $30 mark. Oil prices have also risen; at one point, US oil rose by more than 2.4%.

[The following updates were made before 21:50]

The Jackson Hole Global Central Bank Annual Meeting has begun. Many Federal Reserve officials support the September interest rate cut. Powell will deliver a big speech today.

Waiting for Powell's signal about interest rate cuts. Before the US stock market today, futures on the three major US indices rose higher, Chinese securities generally rose, Bilibili rose nearly 6%, and chip stocks rose.

The three major US stock indices collectively opened higher. Bilibili rose 9% and Nvidia rose 2%.

European stocks opened slightly higher, and the German DAX index rose 0.24%.

Most Asia-Pacific stock indexes closed higher. The Nikkei 225 index rose 0.4%, and the Vietnam VN index rose 0.2%

US bond yields fell slightly, and US Atlanta Federal Reserve Chairman Bostic said the Federal Reserve was “close” to cutting interest rates.

Spot gold rose 0.66% during the day, once again rising above $2,500.

Oil prices rose, and WTI crude oil rose 2% at one point.

[The following content is updated at 21:30]

US stocks opened slightly higher. The NASDAQ rose 0.9%, the Dow rose 0.4%, and the S&P 500 index rose 0.6%.

Conductor stocks and Chinese securities generally rose. Bilibili rose about 9%, Nvidia rose about 2%, and JD rose about 1%.

Some monkeypox concept stocks rose, and GeoVax Labs rose about 5%.

Youjia Insurance fell about 83%, and by the close of trading on Thursday, the stock had risen more than 500% since it went public in March.

Sequans Communications rose more than 210%, and its 4G IoT technology was acquired by Qualcomm.

[The following content is updated at 20:50]

Digital service provider Youjia Insurance once plummeted 89% during pre-market transactions, continuing the previous day's decline. The stock surged 396% in the 11 trading days ending Wednesday and hit a record high. By Thursday's close, the stock was up 538% since listing in March.

WTI crude oil rose by 2% during the day and is now reported at $74.25 per barrel; Brent crude oil's intraday increase is now 1.3% to $77.25 per barrel.

Spot gold rose 0.66% during the day, once again rising above $2,500.

[The following content was updated at 16:10]

Futures on the three major US indices rose, while Nasdaq futures rose 0.6%.

Most semiconductor stocks rose, with Nvidia up more than 1% and TSMC up 1.5%.

China Securities generally rose. Bilibili rose nearly 6%, Alibaba rose more than 2%, and JD rose nearly 2%. NetEase did not fluctuate much before the market. US stocks closed down 11% after the release of the overnight quarterly report.

Major European stock indexes opened slightly higher. The European Stoxx 50 index opened up 0.14%, the German DAX index rose 0.24%, the British FTSE 100 index rose 0.27%, and the French CAC 40 index rose 0.13%. Currently, European stocks are maintaining their opening gains.

Most Asia-Pacific stock indexes closed higher, and the Nikkei 225 index closed up 0.4% at 38364.27 points. Vietnam's VN Index closed up 0.2% to 1285.32 points. South Korea's Seoul Composite Index closed down 0.2%.

Major commodities rose, and spot gold remained around $2,500. UBS anticipates that capital inflows to gold ETFs will increase further as the Federal Reserve begins to cut interest rates and the cost of holding gold falls.

The news calendar shows that today at 22:00 Beijing time, Federal Reserve Chairman Powell will speak on the economic outlook at the Jackson Hole annual meeting, and the US July new home sales data will be released; at 23:00, Bank of England Governor Bailey will speak at the Jackson Hole annual meeting, US Philadelphia Federal Reserve Chairman Patrick Harker (Patrick Harker) was interviewed by Bloomberg; at 00:30 the next day, Chicago Federal Reserve Chairman Goolsbee spoke on CNBC.

降息预期升温,芝商所美联储观察工具显示,9月降息50个基点的可能性从周四的24%上升至36.5%。掉期交易员目前预计今年的降息幅度将超过100个基点,这意味着到12月为止,每次剩余的FOMC政策会议都会降息,包括一次50个基点的大幅降息。

降息预期升温,芝商所美联储观察工具显示,9月降息50个基点的可能性从周四的24%上升至36.5%。掉期交易员目前预计今年的降息幅度将超过100个基点,这意味着到12月为止,每次剩余的FOMC政策会议都会降息,包括一次50个基点的大幅降息。