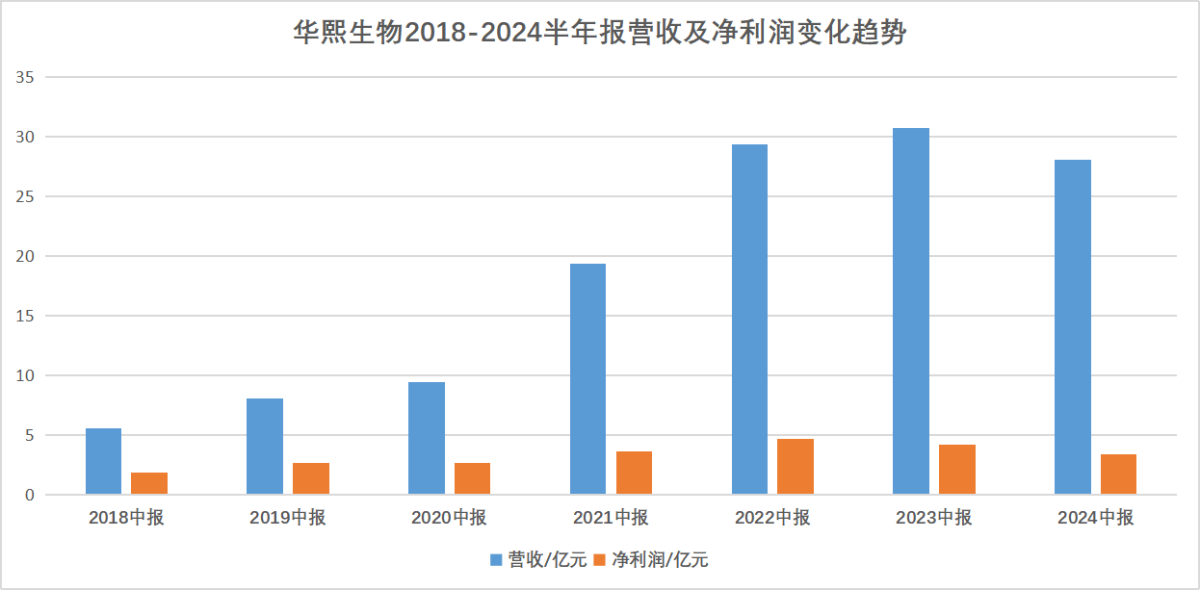

Bloomage Biotechnology Corporation Limited once again experienced a double decline in revenue and net income in the first half of the year. The company achieved a revenue of 2.81 billion yuan, a year-on-year decrease of 8.61%; and achieved a net income of 0.342 billion yuan, a year-on-year decrease of 19.51%. Although the raw material business and medical terminal business performed well, the two new sectors that have been strongly promoted in recent years, functional skincare products and functional food, have seen a simultaneous decline in growth.

On August 24th, the Star Daily reported that on the evening of August 23rd, Bloomage Biotechnology Corporation Limited, one of the 'Three Musketeers of Hyaluronic Acid', announced its half-year performance report. The financial report shows that Bloomage Biotechnology Corporation Limited achieved a revenue of 2.81 billion yuan in the first half of the year, a year-on-year decrease of 8.61%; and achieved a net income of 0.342 billion yuan, a year-on-year decrease of 19.51%.

This is not the first time that Bloomage Biotechnology Corporation Limited has experienced a decline in both revenue and net income since its listing.

In the 2023 financial report, Bloomage Biotechnology Corporation Limited's revenue and net income both experienced a simultaneous decline for the first time since its listing, with a year-on-year decrease of 4.45% and 38.97% respectively. However, in the performance of 2024 Q1, Bloomage Biotechnology Corporation Limited's revenue and net income showed a rebound trend, with a year-on-year increase of 4.24% and 21.39% respectively.

In the 2023 financial report, Bloomage Biotechnology Corporation Limited's revenue and net income both experienced a simultaneous decline for the first time since its listing, with a year-on-year decrease of 4.45% and 38.97% respectively. However, in the performance of 2024 Q1, Bloomage Biotechnology Corporation Limited's revenue and net income showed a rebound trend, with a year-on-year increase of 4.24% and 21.39% respectively.

Bloomage Biotechnology Corporation Limited, which had been performing well, seems to have come to a 'crossroads' where growth or retreat is possible, with variables at any time.

Bloomage Biotechnology Corporation Limited mainly divides its business into four sectors: raw material business, medical terminal business, functional skincare product business, and functional food business.

From the operating data of the reporting period, the raw material business of Bloomage Biotechnology Corporation Limited achieved a revenue of 0.63 billion yuan in the first half of the year, with a year-on-year growth rate of 11.02%. The overall gross margin of the raw material business (excluding FoshTech) was 70.71%, showing good profit capabilities and cost control level.

After 2-3 years of transformation, the medical terminal business sector has continued to maintain high-speed growth, achieving revenue of 0.743 billion yuan, a year-on-year increase of 51.92%. Among them, revenue from skin medical products reached 0.555 billion yuan, a significant increase of 70.14% year-on-year, especially the differentiated and advantageous category of micro cross-linked hyaluronic acid wrinkle filler with a revenue growth of over 200%.

Although the raw materials business and the medical terminal business have performed well, the two new sectors that Bloomage Biotechnology has strongy promoted in recent years have both experienced a decline in growth. Among them, the functional skincare business achieved revenue of 1.381 billion yuan in the first half of the year, a year-on-year decrease of 29.74%, accounting for 49.29% of the company's main business income.

The controversial and highly watched functional food sector since going public achieved revenue of 29.22 million yuan in the first half of the year, a year-on-year decrease of 11.23%.

In 2020, Bloomage Biotechnology's functional skincare business achieved an explosive growth in revenue, surpassing raw material products for the first time and taking the first place in the company's revenue. The revenue proportion also rose from 8.79% in 2016 to 72.44% in 2022, making it the well-deserved "growth engine" at that time.

Why is there a current trend of weak growth? Bloomage Biotechnology stated that since 2023, the company has taken the initiative to transform the functional skincare business, making phased adjustments to its major brands. Currently, the phased adjustments to the major brands are still ongoing, and the results of the transformation will still take time to show.

As for the "slowdown" of the functional skincare business sector, Bloomage Biotechnology further explained that the company has focused mainly on adjusting the team, streamlining internal operations, reviewing strategies, and correcting actions. Operating measures have tightened, and market expansion has not been able to fully unfold, thus inevitably affecting short-term operating results.

The functional food business is still in the adjustment phase and the early stage of consumer education within the Bloomage Biotechnology system. Bloomage Biotechnology has taken proactive measures, including establishing subsidiaries to achieve more independent market-oriented operations and enhance the flexibility and vitality of business operations.

One cannot help but mention that "management" and "transformation" are the "high-frequency" terms that appear in Bloomage Biotechnology's semi-annual report, which is hard not to associate with the biggest controversy in the skincare industry in the first half of the year, involving the brand creator of Kochee, one of Bloomage Biotechnology's brands, and a series of disputes with the company.

From the results, currently, bloomage biotechnology corporation limited is still making stage adjustments to its major brands, and the effects of the transformation still need time to manifest.

The hyaluronic acid track was once known as the 'Maotai of women'. According to starmine data, as of the time of writing, the market cap of bloomage biotechnology corporation limited has evaporated by 42.83% in the past year, currently standing at 25.462 billion yuan.

华熙生物2023财报中,营收和净利曾出现上市以来首次双双下滑,分别同比下降了4.45%和38.97%。但在2024Q1的业绩表现中,华熙生物营收及净利又呈现回暖趋势,同比上升了4.24%及21.39%。

华熙生物2023财报中,营收和净利曾出现上市以来首次双双下滑,分别同比下降了4.45%和38.97%。但在2024Q1的业绩表现中,华熙生物营收及净利又呈现回暖趋势,同比上升了4.24%及21.39%。