The spot Ethereum ETF has been launched in the USA for a month, but investors seem to still be uninterested.

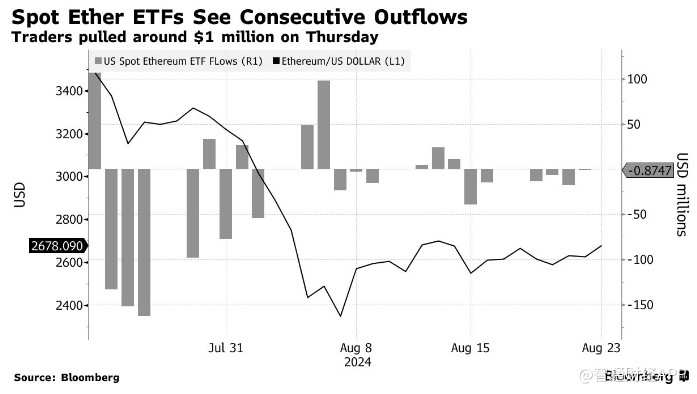

According to the Futu Securities app, the highly anticipated spot Ethereum ETF has been launched in the USA for a month, but investors still seem to be uninterested. Data shows that on Thursday, 9 exchange-traded funds (ETFs) holding Ethereum experienced investor outflows for the sixth consecutive day, marking the longest period of outflows since its listing on July 23rd. During the same period, ETFs holding Bitcoin in the USA saw daily inflows.

'For traditional investors, Bitcoin is usually the entry point into the world of cryptocurrencies,' said Noelle Acheson, author of the newsletter 'Crypto Is Macro Now.' 'Although diversification is becoming increasingly important, Ethereum may eventually catch up, but for now, Bitcoin may continue to outperform.'

The listing of cryptocurrency ETFs in the USA is viewed as a watershed moment for the digital asset industry. The industry has long been grappling with regulators over the issuance of Bitcoin and Ether ETFs. In July of this year, the U.S. Securities and Exchange Commission approved the issuance of spot Ethereum ETFs by institutions including BlackRock, Invesco, and Fidelity Investments.

The listing of cryptocurrency ETFs in the USA is viewed as a watershed moment for the digital asset industry. The industry has long been grappling with regulators over the issuance of Bitcoin and Ether ETFs. In July of this year, the U.S. Securities and Exchange Commission approved the issuance of spot Ethereum ETFs by institutions including BlackRock, Invesco, and Fidelity Investments.

Data shows that the first batch of nine Ethereum ETFs in the USA had a trading volume of over $1 billion on their first day, although this is significantly lower than the $4.6 billion trading volume when the spot Bitcoin ETF was launched in January. Nonetheless, it is still a strong start.

Matthew Sigel, Director of Digital Asset Research at VanEck, said: 'Trading volumes on all exchanges have declined significantly this week.' 'We have seen overall sentiment and positions readjusting, which should bode well for September and October.'

According to Bloomberg data, investors withdrew a net of $1 million from the spot Ethereum ETF in the USA on Thursday. The Ethereum ETF also experienced its lowest daily trading volume since its launch.

The spot Ethereum ETF is experiencing continuous outflows of funds.

Stephane Ouellette, Co-founder and CEO of FRNT Financial, said, "I think it's not surprising that ETF investors are choosing to avoid some risks as the Jackson Hole meeting approaches and interest rate expectations adjust."

Over the past two weeks, market participants have been eagerly awaiting the Jackson Hole Global Central Bank Symposium to further clarify future monetary policies. Earlier on Friday, Federal Reserve Chairman Jerome Powell sent the clearest signal to date of a rate cut during the meeting. He stated that the time for policy adjustments has come.

Ouellette said, "It's important to note that regardless of the outflow situation of ETF funds, it only represents a relatively small portion of the market." He also stated that these funds account for about 2% of Ethereum's market cap.

On Friday, as Powell's remarks sparked a rebound in the financial markets, Ethereum rose by 4% to $2,730. Bitcoin surged over 6.6%, reaching $64,144.9 per coin.

加密货币ETF在美国上市被认为是数字资产行业的分水岭。长期以来,该行业一直在与监管机构就发行比特币和以太币基金进行斗争。今年7月,美国证券交易委员会批准了包括贝莱德、景顺和富达投资在内的机构发行现货以太坊ETF。

加密货币ETF在美国上市被认为是数字资产行业的分水岭。长期以来,该行业一直在与监管机构就发行比特币和以太币基金进行斗争。今年7月,美国证券交易委员会批准了包括贝莱德、景顺和富达投资在内的机构发行现货以太坊ETF。