Reading International, Inc. (NASDAQ:RDI) shares have had a really impressive month, gaining 36% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 25% in the last twelve months.

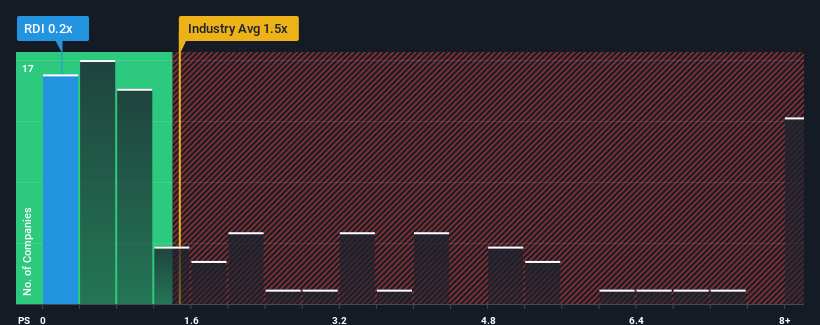

Even after such a large jump in price, Reading International may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Entertainment industry in the United States have P/S ratios greater than 1.5x and even P/S higher than 5x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

What Does Reading International's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Reading International's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Reading International's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Reading International's to be considered reasonable.

There's an inherent assumption that a company should underperform the industry for P/S ratios like Reading International's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.6%. Even so, admirably revenue has lifted 147% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 14% as estimated by the sole analyst watching the company. With the industry only predicted to deliver 11%, the company is positioned for a stronger revenue result.

With this information, we find it odd that Reading International is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Reading International's P/S Mean For Investors?

Despite Reading International's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Reading International's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 4 warning signs for Reading International you should be aware of, and 1 of them can't be ignored.

If you're unsure about the strength of Reading International's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.