What the Options Market Tells Us About Broadcom

What the Options Market Tells Us About Broadcom

Investors with a lot of money to spend have taken a bearish stance on Broadcom (NASDAQ:AVGO).

有大量资金的投资者对博通(纳斯达克:AVGO)采取了看淡的立场。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录上看到交易时发现了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with AVGO, it often means somebody knows something is about to happen.

无论这些投资者是机构还是富有的个人,我们并不知道。但当AVGO发生这样的事情时,往往意味着有人知道即将发生的事情。

So how do we know what these investors just did?

那么我们如何知道这些投资者刚刚做了什么呢?

Today, Benzinga's options scanner spotted 41 uncommon options trades for Broadcom.

今天,Benzinga的期权扫描器发现了41笔不寻常的博通期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 31% bullish and 48%, bearish.

这些大额交易者的整体情绪在31%看好和48%看淡之间分歧。

Out of all of the special options we uncovered, 16 are puts, for a total amount of $984,754, and 25 are calls, for a total amount of $1,927,135.

在我们发现的所有特殊期权中,有16个看跌期权,总金额为$984,754,有25个看涨期权,总金额为$1,927,135。

What's The Price Target?

目标价是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $100.0 and $210.0 for Broadcom, spanning the last three months.

在评估交易量和未平仓量之后,很明显市场的主要市场动力集中在Broadcom的价格区间,从$100.0到$210.0,覆盖了过去三个月的时间。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

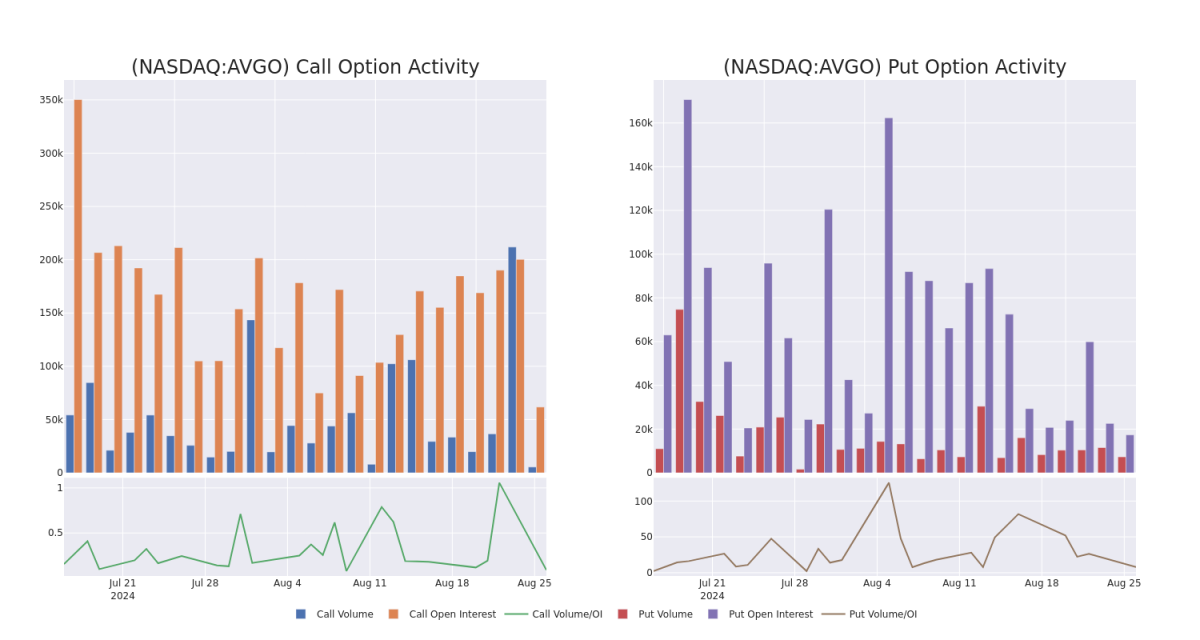

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Broadcom's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Broadcom's whale trades within a strike price range from $100.0 to $210.0 in the last 30 days.

在交易期权时,观察成交量和未平仓量是一个强有力的手段。这些数据可以帮助您跟踪Broadcom特定行权价的期权的流动性和兴趣。下面,我们可以观察最近30天内,从$100.0到$210.0的行权价区间内,所有Broadcom的大额交易的看涨和看跌期权的成交量和未平仓量的变化。

Broadcom Option Volume And Open Interest Over Last 30 Days

博通过去30天的期权成交量和未平仓合约数量

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AVGO | CALL | TRADE | BEARISH | 09/06/24 | $65.2 | $64.6 | $64.6 | $100.00 | $645.9K | 683 | 250 |

| AVGO | PUT | SWEEP | BEARISH | 08/30/24 | $3.6 | $3.5 | $3.6 | $160.00 | $318.6K | 2.3K | 1.7K |

| AVGO | CALL | SWEEP | BULLISH | 09/06/24 | $4.2 | $4.1 | $4.16 | $170.00 | $208.5K | 6.2K | 876 |

| AVGO | CALL | TRADE | BULLISH | 01/17/25 | $33.8 | $33.3 | $33.6 | $140.00 | $168.0K | 5.4K | 50 |

| AVGO | PUT | SWEEP | BEARISH | 09/20/24 | $3.7 | $3.6 | $3.7 | $148.00 | $92.5K | 1.3K | 262 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 博通 | 看涨 | 交易 | 看淡 | 09/06/24 | $65.2 | $55.3 | $55.3 | $100.00。 | RSI indicators hint that the underlying stock may be approaching overbought. | 683 | 250 |

| 博通 | 看跌 | SWEEP | 看淡 | 08/30/2024 | $3.6 | $3.5 | $3.6 | $160.00 | $318.6K | 2.3K | 1.7K |

| 博通 | 看涨 | SWEEP | 看好 | 09/06/24 | $4.2 | $4.1 | $4.16 | $170.00 | 6.2千 | 876 | |

| 博通 | 看涨 | 交易 | 看好 | 01/17/25 | $33.8应该是指目标价$33.8。 | $33.3 | $33.6 | $140.00 | $168.0K | 5,400 | 50 |

| 博通 | 看跌 | SWEEP | 看淡 | 09/20/24 | $3.7 | $3.6 | $3.7 | $148.00 | $92.5K | 1.3K | 262 |

About Broadcom

关于博通

Broadcom is the sixth-largest semiconductor company globally and has expanded into various software businesses, with over $30 billion in annual revenue. It sells 17 core semiconductor product lines across wireless, networking, broadband, storage, and industrial markets. It is primarily a fabless designer but holds some manufacturing in-house, like for its best-of-breed FBAR filters that sell into the Apple iPhone. In software, it sells virtualization, infrastructure, and security software to large enterprises, financial institutions, and governments.Broadcom is the product of consolidation. Its businesses are an amalgamation of former companies like legacy Broadcom and Avago Technologies in chips, as well as Brocade, CA Technologies, and Symantec in software.

博通是全球第六大半导体公司,已扩展到各种软件业务,年收入超过300亿美元。它在无线、网络、宽带、存储和工业市场销售17个核心半导体产品系列。它主要是一家半导体设计公司,但拥有一些内部制造能力,例如为苹果iPhone销售的最佳FBAR滤波器。在软件方面,它向大型企业、金融机构和政府销售虚拟化、基础设施和安全软件。博通是合并的产物。其业务是由之前的公司如传统的博通和芯讯科技以及Brocade、CA技术和赛门铁克在软件方面的业务组成的。

Following our analysis of the options activities associated with Broadcom, we pivot to a closer look at the company's own performance.

在分析与博通相关的期权活动之后,我们转而更近距离地关注公司的表现。

Broadcom's Current Market Status

- With a volume of 4,345,602, the price of AVGO is down -3.02% at $161.33.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 10 days.

- RSI指标暗示该股票可能要超买了。

- 下一次财报预计将于10天后发布。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Broadcom with Benzinga Pro for real-time alerts.

期权交易涉及更大的风险,但也可能带来更高的利润。精明的交易员通过持续教育、战略性的交易调整、利用各种因子和保持对市场动态的关注来减轻这些风险。通过Benzinga Pro实时警报了解博通的最新期权交易。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with AVGO, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with AVGO, it often means somebody knows something is about to happen.