Trade Pulse Power Inflow Alert: Bookings Holdings Inc. BKNG Generates A Power Inflow Signal BKNG Rises 35 Points

Trade Pulse Power Inflow Alert: Bookings Holdings Inc. BKNG Generates A Power Inflow Signal BKNG Rises 35 Points

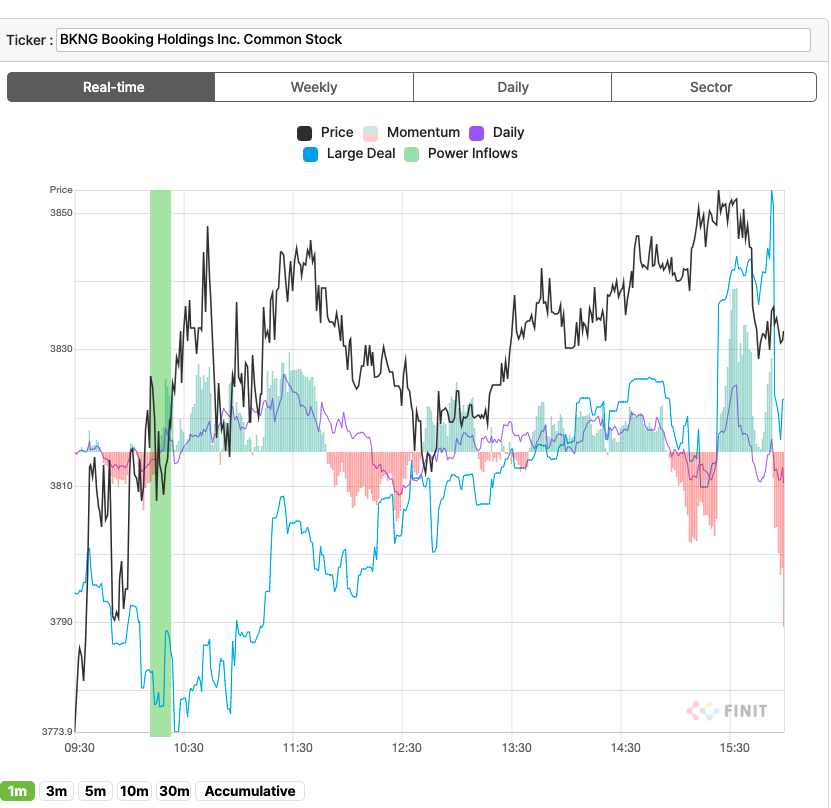

BKNG rises after the signal. The TradePulse Power inflow Signal was triggered at 10:21 am EDT. and the stock hit its high at 3:24 EDT.

信號發出後 BKNG 上漲。TradePulse Power流入信號是在美國東部時間上午10點21分觸發的,該股在美國東部時間3點24分觸及高點。

Today, Booking Holdings,Inc. experienced a Power Inflow, a crucial event for investors who use order flow analytics in their investment strategies. This Power Inflow shifts from a net selling or distribution phase to a net buying or accumulation environment, illustrating a significant inflow that exceeds outflow. Such a change is commonly viewed as a sign of heightened investor confidence and a short-term uptrend in the stock.

今天,Booking Holdings, Inc.經歷了Power Inflow,這對於在投資策略中使用訂單流分析的投資者來說是一個關鍵事件。這種電力流入從淨賣出或分配階段轉變爲淨買入或累積環境,這表明大量流入超過了流出。這種變化通常被視爲投資者信心增強和股票短期上漲趨勢的標誌。

At 10:21 AM ET on August 23rd, Booking Holdings Inc. (NASDAQ:BKNG) recorded a Power Inflow at a trading price of $3818.99 This occurrence is essential for investors who base their trading decisions on order flow analytics. The Power Inflow indicates the potential start of an uptrend in Booking Holdings Inc. stock, presenting an opportunity for investors to profit from anticipated price rises. Bullish stakeholders diligently seek to confirm sustained positive momentum in BKNG stock price, and this development is viewed as a favorable sign.

美國東部時間8月23日上午10點21分,Booking Holdings Inc.(納斯達克股票代碼:BKNG)創下了交易價格爲3818.99美元的Power Inflow,這種情況對於基於訂單流分析做出交易決策的投資者來說至關重要。電力流入表明Booking Holdings Inc.股票可能開始上漲,這爲投資者提供了從預期的價格上漲中獲利的機會。看漲的利益相關者努力確認BKNG股價的持續積極勢頭,這一事態發展被視爲一個有利的信號。

Power Inflow signal description:

功率流入信號描述:

Order flow analytics, or transaction/market flow analysis, involves a comprehensive analysis of order volumes from both retail and institutional traders. This method scrutinizes the flow of buy and sell orders, paying close attention to factors such as order size, timing, and other relevant characteristics that form patterns to generate actionable insights and improve trading decisions. This approach is particularly appreciated for its effectiveness in identifying bullish signals among proactive traders.

訂單流分析或交易/市場流量分析涉及對零售和機構交易者的訂單量的全面分析。該方法仔細檢查買入和賣出訂單的流程,密切關注訂單規模、時間和其他形成模式的相關特徵等因素,以生成可操作的見解並改善交易決策。這種方法因其在識別主動交易者的看漲信號方面的有效性而受到特別讚賞。

Generally manifesting within the first two hours of market opening, a Power Inflow serves as an indicator of the likely trend for the stock throughout the day.

Power Inflow 通常出現在市場開盤的前兩個小時內,可作爲該股全天可能走勢的指標。

Incorporating order flow analytics into their trading strategies helps market participants to more precisely evaluate market dynamics, uncover trading opportunities, and potentially enhance their trading outcomes. However, the importance of implementing strong risk management strategies cannot be emphasized enough. Effective risk management is vital for safeguarding capital and minimizing potential losses, thereby fostering a more disciplined approach to navigating market uncertainties and enhancing the prospects for long-term trading success.

將訂單流分析納入其交易策略有助於市場參與者更精確地評估市場動態,發現交易機會,並有可能改善他們的交易結果。但是,實施強有力的風險管理戰略的重要性怎麼強調都不爲過。有效的風險管理對於保護資本和最大限度地減少潛在損失至關重要,從而促進採取更嚴格的方法來應對市場的不確定性並改善長期交易成功的前景。

Market News and Data are brought to you by Benzinga APIs and include firms, like Finit USA, responsible for parts of the data within this article.

市場新聞和數據由Benzinga API提供給您,其中包括負責本文中部分數據的公司,例如Finit USA。

2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2024 benzinga.com。Benzinga不提供投資建議。版權所有。

After Market Close UPDATE:

收盤後更新:

The price at the time of the Power Inflow was $3818.99. The returns on the High price ($3853.37) and Close price ($3832.63) were as follows, 0.9% and 0.3%. That is why it is important to have a trading plan that includes Profit Targets and Stop Losses that reflect your risk appetite. In this case the high of the day and close were the same price and return.

電力流入時的價格爲3818.99美元。最高價(3853.37美元)和收盤價(3832.63美元)的回報率如下,分別爲0.9%和0.3%。這就是爲什麼制定一個包含利潤目標和止損以反映您的風險偏好的交易計劃很重要的原因。在這種情況下,當天的最高點和收盤價是相同的價格和回報。

Past Performance is Not Indicative of Future Results

過去的表現並不代表未來的業績

Power Inflow signal description:

Power Inflow signal description: