Financial giants have made a conspicuous bullish move on Abercrombie & Fitch. Our analysis of options history for Abercrombie & Fitch (NYSE:ANF) revealed 24 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 41% showed bearish tendencies. Out of all the trades we spotted, 14 were puts, with a value of $884,612, and 10 were calls, valued at $392,372.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $110.0 to $190.0 for Abercrombie & Fitch over the last 3 months.

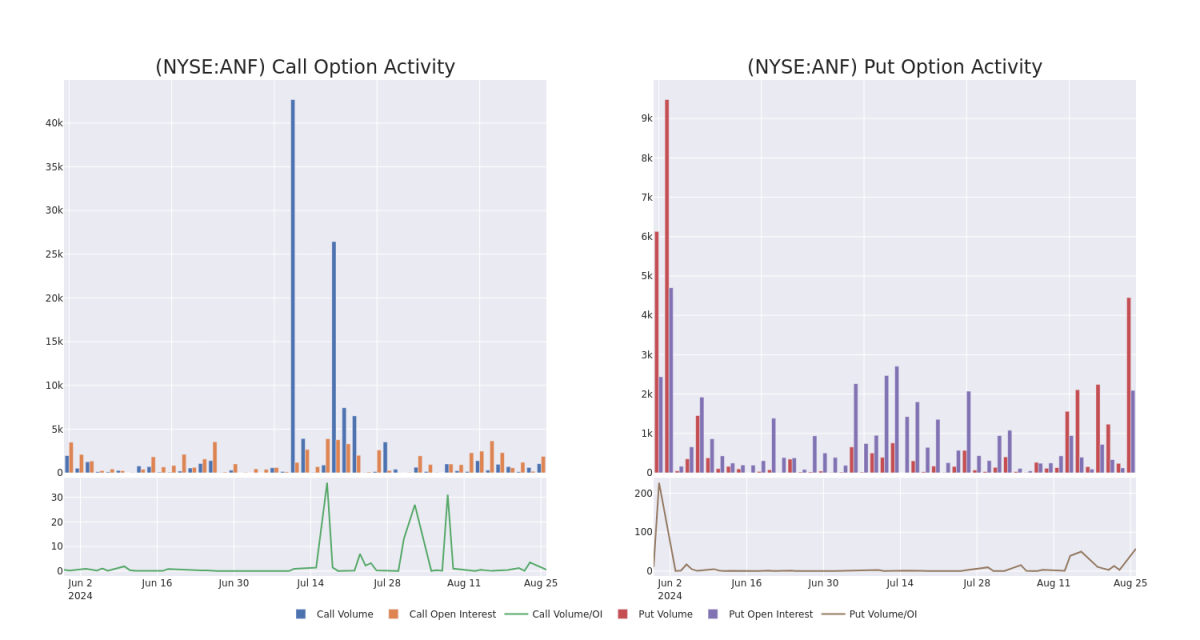

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Abercrombie & Fitch's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Abercrombie & Fitch's whale activity within a strike price range from $110.0 to $190.0 in the last 30 days.

Abercrombie & Fitch Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ANF | PUT | TRADE | BEARISH | 10/18/24 | $6.6 | $6.3 | $6.5 | $145.00 | $175.5K | 29 | 303 |

| ANF | PUT | TRADE | BULLISH | 08/30/24 | $7.4 | $7.3 | $7.3 | $157.50 | $73.0K | 1.4K | 318 |

| ANF | PUT | SWEEP | BEARISH | 08/30/24 | $7.2 | $7.0 | $7.2 | $157.50 | $72.0K | 1.4K | 518 |

| ANF | PUT | SWEEP | BEARISH | 08/30/24 | $7.2 | $6.8 | $7.2 | $157.50 | $71.9K | 1.4K | 618 |

| ANF | PUT | TRADE | BULLISH | 08/30/24 | $7.2 | $7.1 | $7.1 | $157.50 | $71.0K | 1.4K | 718 |

About Abercrombie & Fitch

Abercrombie & Fitch Co is a specialty retailer that sells casual clothing, personal-care products, and accessories for men, women, and children. It sells direct to consumers through its stores and websites, which include the Abercrombie & Fitch, Abercrombie kids, and Hollister brands. Most stores are in the United States, but the company does have many stores in Canada, Europe, and Asia. All stores are leased. Abercrombie ships to well over 100 countries via its websites. The company sources its merchandise from dozens of vendors that are primarily located in Asia and Central America. Abercrombie has two distribution centers in Ohio to support its North American operations. It uses third-party distributors for sales in Europe and Asia.

Current Position of Abercrombie & Fitch

- With a volume of 497,729, the price of ANF is down -2.64% at $165.35.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 2 days.

Professional Analyst Ratings for Abercrombie & Fitch

In the last month, 1 experts released ratings on this stock with an average target price of $208.0.

- Maintaining their stance, an analyst from Telsey Advisory Group continues to hold a Outperform rating for Abercrombie & Fitch, targeting a price of $208.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Abercrombie & Fitch options trades with real-time alerts from Benzinga Pro.