Possible Bearish Signals With Limbach Holdings Insiders Disposing Stock

Possible Bearish Signals With Limbach Holdings Insiders Disposing Stock

Limbach Holdings, Inc. (NASDAQ:LMB) shareholders may have reason to be concerned, as several insiders sold their shares over the past year. When evaluating insider transactions, knowing whether insiders are buying is usually more beneficial than knowing whether they are selling, as the latter can be open to many interpretations. However, shareholders should take a deeper look if several insiders are selling stock over a specific time period.

Limbach Holdings, Inc.(NASDAQ:LMB)的股东可能有理由担忧,因为过去一年有几位内部人士出售了他们的股票。在评估内部交易时,了解内部人士是否在购买通常比了解他们是否在出售更有益,因为后者可能有许多解释。然而,如果有几个内部人士在特定时间段内出售股票,股东应该更深入地观察。

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, we do think it is perfectly logical to keep tabs on what insiders are doing.

虽然我们绝不建议投资者仅基于公司董事所做的事情来作出决策,但我们认为密切关注内部人士所做的事情是完全合理的。

Limbach Holdings Insider Transactions Over The Last Year

过去一年里,Limbach Holdings的内部交易

In the last twelve months, the biggest single sale by an insider was when the Independent Director, Michael McNally, sold US$400k worth of shares at a price of US$51.56 per share. That means that even when the share price was below the current price of US$65.36, an insider wanted to cash in some shares. When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. While insider selling is not a positive sign, we can't be sure if it does mean insiders think the shares are fully valued, so it's only a weak sign. This single sale was just 12% of Michael McNally's stake.

在过去的十二个月里,一位独立董事Michael McNally以每股51.56美元的价格出售了总值40万美元的股票。这意味着即使股价低于目前的65.36美元,该内部人士仍想套现一些股票。当内部人士以低于当前股价的价格出售股票时,这表明他们认为较低的价格是公平的。这让我们想知道他们对(更高的)最近估值的看法。尽管内部人士出售股票不是一个积极的信号,但我们不能确定这是否意味着内部人士认为股票已经充分估值,因此这只是一个弱信号。这次单一交易仅占了Michael McNally所持股份的12%。

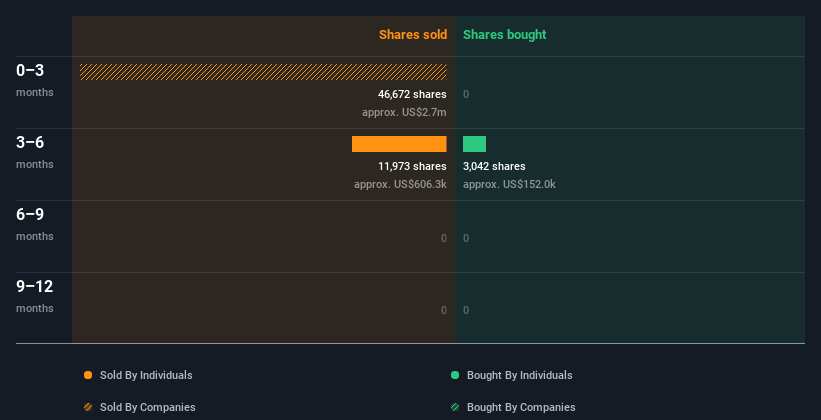

In the last twelve months insiders purchased 3.04k shares for US$149k. But they sold 11.97k shares for US$605k. Over the last year we saw more insider selling of Limbach Holdings shares, than buying. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

在过去的十二个月内,内部人士购买了0.304万股,价值14.9万美元。但他们卖出了1.197万股,总价值60.5万美元。在过去一年里,我们看到Limbach Holdings的内部人士出售股票的情况超过了购买。您可以在下图中看到过去一年内公司和个人的内部交易情况。如果您想知道确切的卖出者、金额和时间,请点击下面的图表!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: Most of them are flying under the radar).

如果你喜欢购买内部人员正在购买而不是销售的股票,那么你可能会喜欢这份免费的公司列表。(提示:它们中的大部分都被忽视了。)

Does Limbach Holdings Boast High Insider Ownership?

Limbach Holdings是否拥有高内部持股?

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. A high insider ownership often makes company leadership more mindful of shareholder interests. Insiders own 8.6% of Limbach Holdings shares, worth about US$64m. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

另一种检验公司领导层与其他股东之间一致性的方法是查看他们拥有的股票数量。高内部持股往往使公司领导更加关注股东利益。内部持股8.6%,价值约6400万美元。这种内部持股水平很好,但仅略低于非常突出。它确实表明了合理的一致性程度。

So What Do The Limbach Holdings Insider Transactions Indicate?

那么Limbach Holdings内部交易表示什么?

It doesn't really mean much that no insider has traded Limbach Holdings shares in the last quarter. Still, the insider transactions at Limbach Holdings in the last 12 months are not very heartening. The modest level of insider ownership is, at least, some comfort. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. While conducting our analysis, we found that Limbach Holdings has 1 warning sign and it would be unwise to ignore it.

上个季度没有内部人士交易Limbach Holdings股票并没有太大意义。然而,过去12个月Limbach Holdings的内部交易并不令人鼓舞。适度的内部持股水平至少让人感到一些安慰。因此,了解内部人士在买卖方面的行为对了解一家公司所面临的风险也是有帮助的。在我们的分析中,我们发现Limbach Holdings有一个警示信号,忽视它是不明智的。

But note: Limbach Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

但请注意:limbach可能不是最好的买入股票。因此,请查看此免费列表,其中包含具有高roe和低负债的有趣公司。

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

对于本文而言,内部人是指向相关监管机构报告其交易的个人。我们目前仅考虑公开市场交易和直接利益的私人处置,但不包括衍生交易或间接利益。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。