With the approaching window of the Federal Reserve's interest rate cut, highly interest rate-sensitive industries such as pharmaceuticals are enjoying a positive market outlook.

Many authoritative institutions have voiced out, pointing out that pharmaceutical stocks, due to their sensitive response to interest rate changes, are highly likely to stand out and become the darling of the capital market under the catalyst of interest rate cuts. Among them, many stocks that combine cost-effectiveness and outstanding potential are quietly brewing rich investment opportunities, waiting for investors to discover.

Recently, Yashibaibang, the largest digital comprehensive service platform for out-of-hospital pharmaceutical industry in China, released the performance data for the first half of 2024. The company's revenue continues to maintain double-digit growth, and its net profit has turned positive for the first time. The adjusted net profit has grown by 30.3% year-on-year to 91.411 million RMB (the same unit below).

So, while digital pharmaceutical companies are generally in the 'burning money' stage of exploration and investment, how is Yashibaibang able to stand out, quickly achieve profitability, and maintain sustainable growth? How should the future development be viewed?

So, while digital pharmaceutical companies are generally in the 'burning money' stage of exploration and investment, how is Yashibaibang able to stand out, quickly achieve profitability, and maintain sustainable growth? How should the future development be viewed?

Net profit turns positive, outperforming market expectations

From the results, based on the latest disclosed semi-annual report data from the company, it can be seen that while maintaining revenue and profit growth, the company's operational efficiency has also significantly improved.

In the first half of 2024, in the face of many uncertainties in the external environment, the company's profitability has continued to improve steadily, with a net profit of 13.35 million RMB turning positive, compared to a loss of 3.177 billion RMB in the same period last year. This year, it has achieved a significant turnaround from loss to profit. The initial scale of adjusted net profit has reached 91.411 million RMB, with a year-on-year growth of 30.3%. The operational efficiency has continued to improve, the capital structure is healthy, and the asset quality is good, showing excellent performance.

Looking at the revenue side, the company's revenue growth is rapid. In the first half of 2024, the company's total revenue was 8.814 billion RMB, a year-on-year increase of 10.6%, significantly outperforming the industry average growth rate.

From the perspective of expenditure, the company's research and development investment has been continuously increasing, while the three expenses have been continuously decreasing. On the one hand, in the first half of 2024, the company spent approximately 45.7 million on research and development, an increase of 14.5% year-on-year. On the other hand, the company has controlled the sales expense ratio, management expense ratio, and financial expense ratio.

From the perspective of profitability, the company has significantly reduced costs and improved efficiency, and its profitability has been steadily improving. According to the company's announcement, the net income in the first half of 2024 has changed from a large loss to a positive for the first time, with a net income of 91.411 million yuan, demonstrating sustained profitability.

From the perspective of operational efficiency, under the intelligent supply chain management system, the company's overall operational efficiency has gradually improved.

According to the announcement, the company is able to process and complete orders in an average of about 3 hours, far exceeding the industry average. In the first half of 2024, the company's inventory turnover days remained at around 31.0 days, accounts payable days were 60.6 days, accounts receivable turnover days were about 0.6 days, and the cash cycle was about -28.9 days. The company has achieved efficient cash management, bringing a large amount of idle cash to the platform, supplementing the company's liquidity, and providing support for rapid expansion of the overall business scale.

It is worth noting that the company's user base and user stickiness are also continuously improving, maintaining a leading position in the industry. According to the financial report, in the first half of 2024, the cumulative registered buyers of Pharmacist Help exceeded 741,000, including approximately 426,000 pharmacies and approximately 310,000 primary medical institutions, which demonstrates the company's extensive layout and deep penetration in the pharmaceutical industry chain, laying a solid foundation for its business growth.

From the perspective of users, the average monthly active buyers in the first half of 2024 reached 425,000, a year-on-year increase of 20.4%. The average monthly paying buyers reached 396,000, a year-on-year increase of 19.6%. The payment rate exceeded 93%, and the average monthly order volume per paying buyer remained at a high level of around 28 orders, similar to the previous year.

With the support of digital capabilities, the company's management efficiency has also improved. Compared with the same period last year, the business expansion team's efficiency has further improved, with each member being able to manage an average of about 150 pharmacies, an increase of more than 14 compared to the same period last year. In the first half of 2024, each member of the business expansion team brought approximately 8.2 million yuan in GMV, a year-on-year increase of 6.4%.

Overall, the company's financial condition is good, with quality assets and a lower asset-liability ratio compared to peers. The company has abundant cash flow (as of June 30, 2024, the company's cash and cash equivalents were 1.405 billion yuan) and is able to go further in the cold winter and develop more steadily when spring arrives.

How should we look at it in the future?

To answer the second question, how should we look at the future development after Net Income turns positive? In my opinion, we can discuss it from three dimensions: industry changes, company development strategy, and valuation.

Firstly, from the perspective of industry development, as online purchases of medicines and medical insurance reimbursements become more widespread, and as there are more outpatient integrated pharmacies, the governance of online and offline prices is being implemented. The pharmaceutical industry is entering an era of accelerated shuffling, and the pharmaceutical distribution field is also undergoing transformation.

For example, in terms of medical insurance price comparison, policies guide retail channels to price reasonably, and constantly compare offline pharmacy prices, online pharmacy prices, online and offline prices, and prices inside and outside hospitals in real time. This further enhances market transparency and drives retail pharmacies to seek high-quality supply chains in order to obtain relatively more comprehensive pricing and product selection space. Faced with the new policy environment, NetEase Medicine fully utilizes its channel and pricing advantages, continuously expands the number of upstream merchants, enriches the range of products supplied, and provides downstream pharmacies with broader purchasing choices, helping them minimize procurement costs and further expand the coverage of NetEase Medicine.

While continuously enhancing its service competitiveness, NetEase Medicine also focuses on expanding the exclusive strategic cooperation brand and the self-owned brand "Happy Pharmacist" product business during the reporting period. The GMV of these two segment business products reached 0.224 billion yuan, a year-on-year increase of 94%. Among them, "Happy Pharmacist" has launched 170 varieties, serving more than 0.3 million purchasing customers, with significant growth in GMV and the purchasing amount of primary medical institutions, as well as a substantial increase in paying users, achieving a double harvest. The effectiveness of the large single-product strategy is remarkable, and the new product "Huoxiang Zhengqi Oral Liquid" has covered 0.1 million terminals in its 5th month on the market, with sales exceeding tens of millions in June, making significant contributions from individual pharmacies and grassroots medical institutions.

As the largest digital comprehensive service platform for out-of-hospital pharmaceutical industry in China, NetEase Medicine is expected to further increase its market share and improve its competitive barriers in industry development by virtue of its leading scale effect and stronger bargaining power.

Secondly, from the perspective of company development strategy, NetEase Medicine is constantly investing in digitalization and actively exploring innovative businesses to create new growth drivers.

In terms of platform business, NetEase Medicine will upgrade a more comprehensive digital operational system for upstream sellers, assist the long-term growth of third-party businesses, and focus on expanding traditional Chinese medicine business. In the field of self-operated business, NetEase Medicine will further develop same-city car delivery services based on improving the layout of self-operated warehouses, achieving same-day delivery for more cities where the main warehouses are located and surrounding cities. At the same time, the company plans to gradually carry out medical cold chain distribution operations in major cities to further improve the breadth of supply and delivery efficiency.

In addition, leveraging existing business advantages, Pharmacist Assistant will fully tap into incremental value. According to the plan, the company will launch the 'Spectrum Cabin' smart medical solution in the second half of the year, by integrating real-time testing equipment, clinic SaaS, AI doctor assistant system, to help grassroots medical workers provide more efficient and professional services to patients.

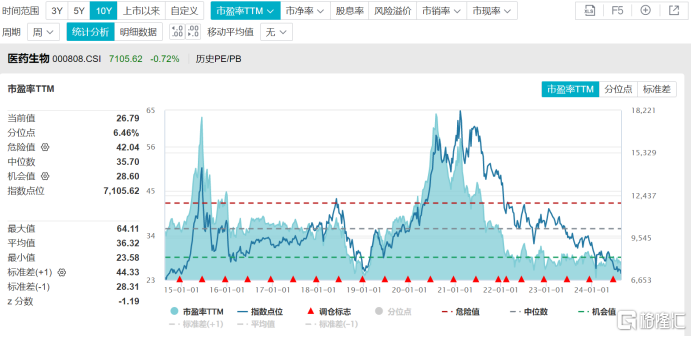

Finally, from a valuation perspective, the current csi sws health care index valuation is attractive, with undervalued and high cost-effective quality stocks expected to be favored.

According to WIND data, the csi sws health care index PE (TTM) is only 26.79 times, which is at 6.46% in the past ten years, far below the historical average of 28.60 times, making the valuation attractive.

Several brokerages point out that in the era of aging population, the medical industry still belongs to a blue ocean market with long-term growth potential. After more than 3 years of systematic adjustments, as the bearish factors in the sector gradually clear out and the painful period ends, the industry growth rate is expected to show a trend from low to high, and the capital markets will focus more on bottom medical assets with low valuations and operational margin improvements.

Pharmacist Assistant, after announcing its first half performance and achieving a substantial turnaround in net income, based on adjusted net income estimation, the company's expected annual PE ratio may have dropped to below 25 times, slightly lower than the industry average data. This means that in the Hong Kong stock industry/sector, the company's valuation has taken a relatively favorable position.

Chart 1: csi sws health care index PE (TTM)

Data Source: WIND, Guolonghui compiled data as of the market close on August 21, 2024.

Summary

Currently, Yaoshi Bang is in the high-speed growth stage of digitalization of the extra-hospital pharmaceutical circulation, with a high ceiling. Policy changes are even more favorable for the head development, and it is expected to continue the competitive pattern of the strong getting stronger in the future.

Its unique business model of 'platform + self-operated' has been successfully implemented, and its profit-making ability is clearly visible. Subsequent performance is expected to accelerate realization, and the intrinsic value may gradually be recognized by the market. The future development is worth looking forward to.

那么,在医药数字化企业普遍处于探索与投入并重的"烧钱"阶段时,药师帮为何能独树一帜,迅速实现盈利并维持增长的可持续性的?后续发展又该如何来看?

那么,在医药数字化企业普遍处于探索与投入并重的"烧钱"阶段时,药师帮为何能独树一帜,迅速实现盈利并维持增长的可持续性的?后续发展又该如何来看?