Has the mysterious power's tactics changed?

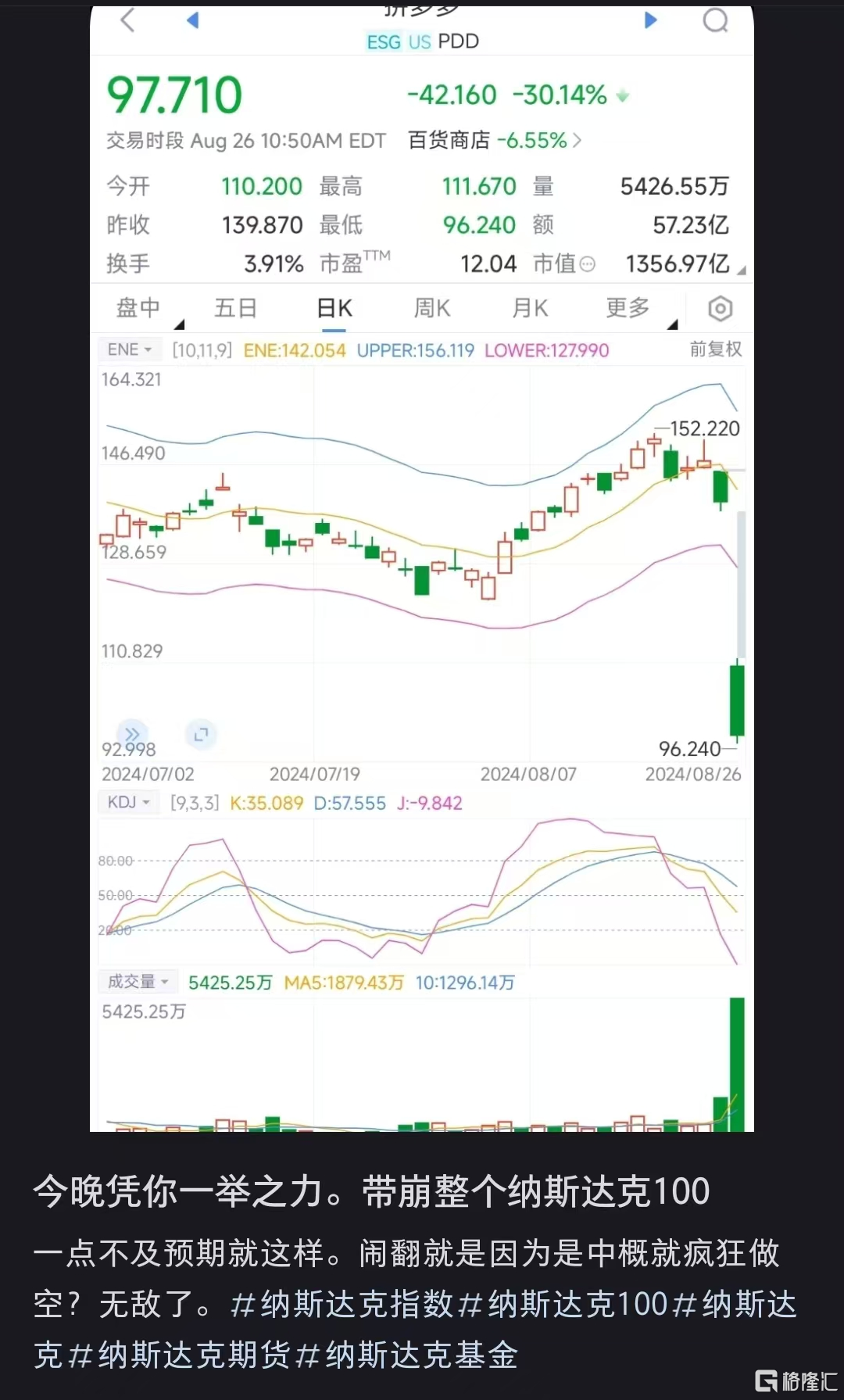

Today, I woke up in a daze and opened a book to see someone on the internet said, "PDD single-handedly brought down the Nasdaq 100." ???

I almost forgot that PDD was also one of the components of the Nasdaq 100 Index, and the only component of Chinese concept stocks in the Nasdaq 100 Index. No wonder it is praised as the "bright spot" of Chinese concept stocks.

When the bright spot of Chinese concept stocks fell, neither the Wall Street tycoons nor the well-known domestic private equity giants could escape the onslaught of last night, it was a disaster for everyone involved.

When the bright spot of Chinese concept stocks fell, neither the Wall Street tycoons nor the well-known domestic private equity giants could escape the onslaught of last night, it was a disaster for everyone involved.

1

An unconventional conference call

Looking at PDD's performance in the second quarter, every number is explosive.

In the second quarter, Pinduoduo's total revenue was 97.06 billion yuan, a year-on-year increase of 86%.

Net profit attributable to ordinary shareholders of Pinduoduo was 32.009 billion yuan, a year-on-year increase of 144%.

Adjusted net profit was 34.4321 billion yuan, a year-on-year increase of 125%.

Looking at this triple-digit growth rate, which company in the internet industry can compete with it? Just like Goldman Sachs' firm belief in Pinduoduo: so far, Pinduoduo is one of the fastest growing companies in the Chinese internet industry in the second quarter.

Unfortunately, the market had high expectations for Pinduoduo, and the most taboo thing for investments is falling short of expectations.

The market expected Pinduoduo's second quarter revenue to be 99.985 billion yuan, but it was actually only 97.0595 billion yuan. It was actually short by 2.926 billion yuan. Keep in mind that Q2's adjusted net profit was as high as 34.4321 billion yuan, which is 4.3 billion yuan more than the market's expectation of 30.1 billion yuan.

A performance that is half good and half bad is like a balance scale, one side up and one side down. It should not lead to a single-day drop of 28% in stock price, directly creating the largest single-day decline since its listing.

A market value of 55 billion dollars disappeared just like that, causing Huang Zheng's wealth to evaporate by 14.1 billion dollars (about 100.4 billion yuan) in a single day, directly falling from the top spot on the Chinese rich list to fourth place.

This brings to mind the remarkable conference call after pdd holdings' financial report was released.

During the financial report conference call, Chen Lei, chairman and co-CEO of pdd holdings, stated that from 2023 to 2024, the quarter-on-quarter revenue growth rate of pdd holdings in the second quarter decreased from 38.9% to 11.8%. "The intensification of the competitive environment is the main theme of the e-commerce industry, and the growth of high income is unsustainable."

Zhao Jiazhen, executive director and co-CEO of pdd holdings, stated that the increasingly fierce competition in the e-commerce industry is inevitable. In such a fierce competitive environment, the revenue growth of pdd holdings may slow down, and the significant decline in second quarter revenue growth rate also indicates that the growth of high income is actually unsustainable.

In addition, in order to support the long-term healthy development of the platform and the construction of high-quality supply, Colin Huang pointed out that PDD Holdings has prepared to sacrifice short-term profit in the near future, and the management has reached consensus on this.

Although the net income growth of 125% year-on-year in this quarter is relatively considerable in the industry, both Chen Lei and Zhao Jiazhen released signals during the financial report conference call that pdd holdings' future profits will decline.

"Pdd holdings' future profits will gradually enter a declining trend, which is a necessary cost for long-term health."

Finally, the management continued to be shocking, stating that due to the intense competition the company faces in multiple business lines, and the overall stage of investment, pdd holdings will not conduct buybacks or dividends in the next few years.

After hearing this conference call, I assume the investment tycoons couldn't help but think of one thing.

"Thank you very much!"

2

Global giants favor pdd holdings

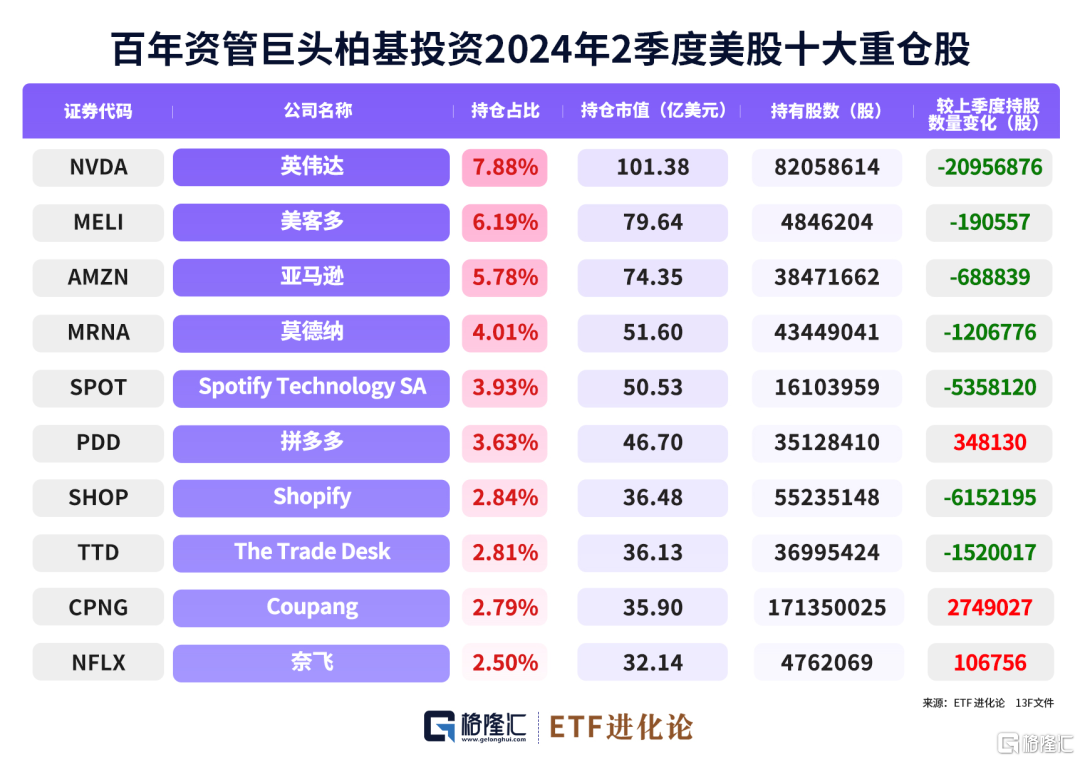

The 13F report shows that pdd holdings are the preferred choice of global capital giants.

In the second quarter, the century-old asset management giant, Berkshire Hathaway, increased its holdings of pdd holdings by 0.0348 million shares to 35.13 million shares, making it one of the top six heavy-weight stocks with a market value of up to $4.67 billion.

(The content of this article is a list of objective data and information and does not constitute any investment advice)

In the second quarter, the hundred billion private equity fund, Jinglin Asset Management, made a rapid move by directly increasing its holdings of pdd holdings by 1.57 million shares, with a market value of up to $0.692 billion.

Gaoyi Asset increased its holdings of PDD, its largest position, by 447,000 shares to 1.585 million shares in the second quarter, an increase of 39% in shareholding. The market value of its holdings is $0.211 billion.

Gao Ling reduced its holdings of PDD by 2.8991 million shares to 8.8924 million shares in the second quarter, a 24.59% decrease in shareholding. However, PDD is still its largest position with a market value of $1.182 billion, accounting for 29% of its investment portfolio.

David Tepper's Appaloosa, a hedge fund giant, reduced its holdings of PDD by 0.16 million shares in the second quarter, but the market value of its holdings is still $0.258 billion, making it the seventh largest position.

Known as the "Chinese Warren Buffett," Duan Yongping also reduced his holdings of PDD by 7,000 shares in the second quarter, with a market value of $0.014 billion.

Pdd holdings remains the ninth largest holding in the second quarter of the Saudi Arabian Sovereign Wealth Fund PIF, with a holding market cap of $0.226 billion.

In the midst of the market panic buying frenzy, often referred to as the "Chinese Buffett," Dong Yongping, expressed on social media: "Start selling some put options. Although I don't fully understand the business model of PDD, over these years, it seems quite interesting."

Furthermore, today, a netizen named "Joe is about to take off" asked Dong Yongping (invisible in the great way) if the statement that purchasing shares of a good company equates to buying a part of that company holds true if the company does not engage in long-term buybacks or dividends.

Dong Yongping responded that there is no direct linear relationship between good companies and engaging in buybacks.

He also used Warren Buffett's Berkshire Hathaway as an example, "You can see how many years it took for Buffett's BRK to start a buyback, then you will understand, unless you refuse to. However, good companies will eventually start paying dividends, buying back shares, or both due to drowning in cash (BRK still does not pay dividends)."

As of the time of writing, PDD's pre-market trading rebounded by 3%.

3

Has the mysterious power's tactics changed?

Today, the A-share market opened and traded low throughout the day, with the Shenzhen Component Index and the ChiNext Price Index both falling more than 1% at one point, hitting new lows since February 6. At the close, the Shanghai Composite Index fell by 0.24%, the Shenzhen Component Index fell by 1.11%, and the ChiNext Price Index fell by 0.94%.

In the sluggish market, funds are starting to flock to sectors with dividends and high dividends. Bank stocks continue to perform well, with ICBC, ABC, Bank of China, and CCB collectively hitting new historical highs during trading hours. At the same time, heavyweight stocks such as the three major oil companies, China Life Insurance, and China Mobile are also rising collectively.

In an environment of stock game, large-cap stocks are draining liquidity. The ChiNext Price Index and the Shenzhen Component Index once again fell to new lows since February 6, and it looks like they are about to return to the darkest moment of February 5. A mysterious force has come up with a new strategy!

During the final moments of trading at 11:15 today noon, four China Southern CSI 1000 ETFs suddenly saw a surge in volume. At 14:15, the China Southern CSI 1000 ETFs saw a second wave of collective high volume trading.

As of the close, the trading volume of Southern Fund CSI 1000ETF, Huaxia Fund CSI 1000ETF, GF Fund CSI 1000ETF Index, and Fuguo Fund 1000ETF today are 165.4 million yuan, 107.4 million yuan, 66.2 million yuan, and 417 million yuan respectively, all of which exceed the total trading volume of yesterday. The four CSI 1000ETFs totaled 380.6 million yuan today, an increase of 98.64% compared to yesterday's 191.6 million yuan.

Except for the CSI 1000ETF, the four SSE 300ETFs continue to maintain a high trading volume. At the end of yesterday's session, the SSE 300ETFs collectively had a trading volume of over 1.0991 billion yuan, which is 1.5 times larger than the previous trading day's 435.3 million yuan. Today, the total trading volume of the four SSE 300ETFs is still 870.6 million yuan.

From this we can see that as the A-share market approaches the previous low point, the tactics of mysterious funds have changed. Instead of focusing only on the four SSE 300ETFs, they are diversifying their investments and buying both SSE 300ETF and CSI 1000ETF in order to achieve resonance between large and small cap stocks.

Yesterday, this approach worked well, but today the market selling pressure is too heavy, and funds are flowing back into heavyweight stocks such as banks and petroleum, causing the SZSE Component Index, Chinext Price Index, and SSE Science and Technology Innovation Board 50 Index to hit new interim lows, approaching the low point in February this year, except for the Shanghai Composite Index.

The market is approaching the previous low point again. Will the next target be added to the CSI 2000ETF?

当中概之光倒下,无论是叱咤风云的华尔街大佬们,还是国内大名鼎鼎的私募大佬们,无一能躲过昨晚的暴击,怎一个惨字了得。

当中概之光倒下,无论是叱咤风云的华尔街大佬们,还是国内大名鼎鼎的私募大佬们,无一能躲过昨晚的暴击,怎一个惨字了得。