Trade Pulse Power Inflow Alert: Mercadolibre Inc. MELI Rises Over 1.5% After Signal

Trade Pulse Power Inflow Alert: Mercadolibre Inc. MELI Rises Over 1.5% After Signal

MercadoLibre, Inc. (NASDAQ:MELI) achieves 1.5% Growth on the Day Following TradePulse Power Inflow Signal

MercadoLibre, Inc. (納斯達克:MELI) 在交易脈衝Power Inflow 信號後的第二天實現1.5%的增長

Today, TradePulse's latest Power Inflow alert indicated institutional volume is coming into MercadoLibre Inc.( MELI), signaling a shift from net selling to buying. This shift is a key indicator of rising investor confidence and the potential for an uptrend in MELI's stock.

今天,TradePulse最新的Power Inflow警報顯示機構成交量正在流入MercadoLibre Inc.(MELI),標誌着從淨賣出到買入的轉變。這種轉變是投資者信心上升和MELI股票可能上升趨勢的關鍵指標。

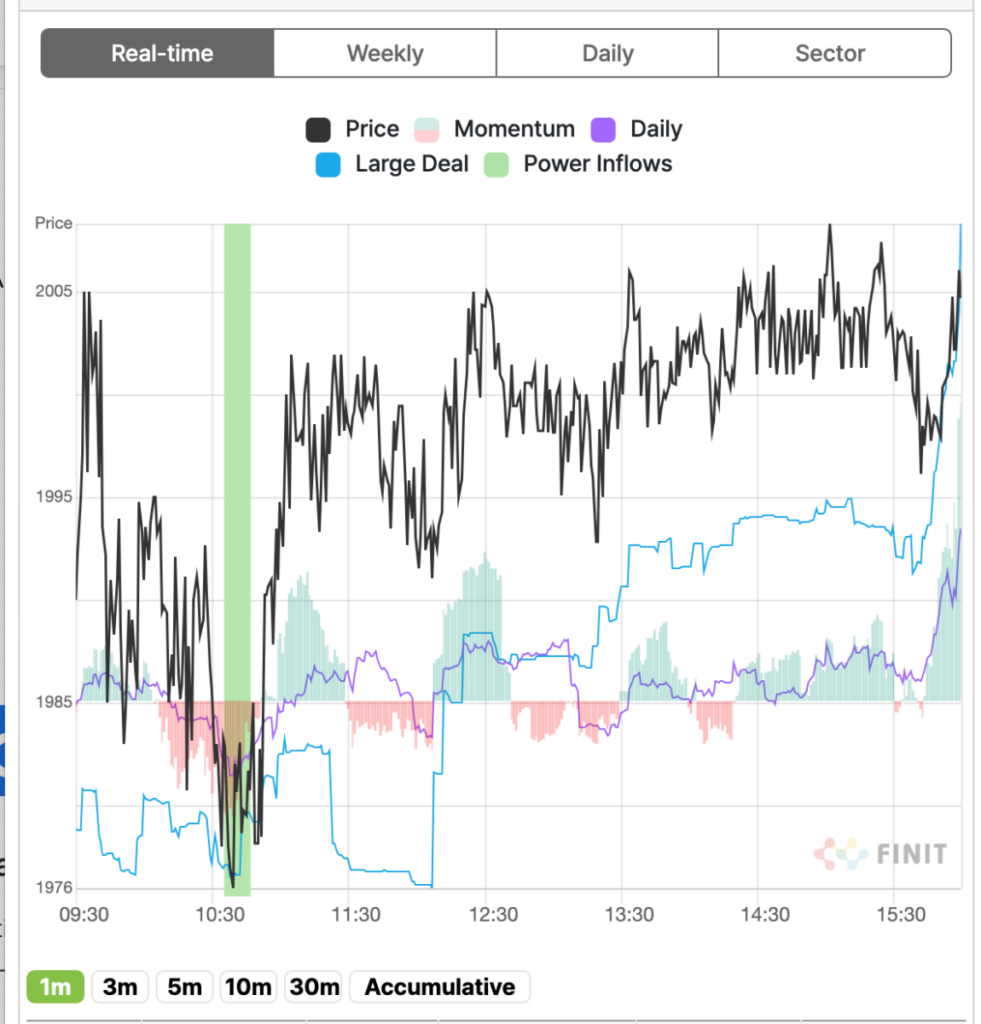

At 10:45 AM ET on August 26th, MELI registered a Power Inflow at a price of $1979.56 Following this signal, the stock reached its high point at 3:02 EDT, climbing over 25 points ($2008.33) during the day, which translates to an approximate increase of 1.5%. This alert is crucial for investors relying on order flow analytics, suggesting the beginning of an uptrend and presenting a valuable opportunity for those anticipating higher prices. Observers are now closely monitoring MELI for sustained positive momentum, viewing this as a bullish sign.

美國東部時間8月26日上午10:45,MELI以1979.56美元的價格註冊了一個Power Inflow信號。隨後,股票在EDT時間3:02達到了最高點,一天上漲了25點以上(2008.33美元),大約增長了1.5%。這一警報對依賴訂單流分析的投資者至關重要,暗示了上升趨勢的開始,併爲那些預期價格上漲的人提供了寶貴的機會。觀察者們正在密切關注MELI是否能保持積極勢頭,將其視爲看好的跡象。

Understanding Power Inflow:

理解Power Inflow:

A Power Inflow is identified by a surge in buy orders over sell orders, typically occurring within the first one or two hours after the market opens. This phenomenon is observed in ten to twenty stocks daily, reflecting the initial strategies and reactions of large institutional investors. Analyzing the size, timing, and price of these transactions helps signal shifts in market sentiment and potential price changes. For those interested in monitoring more stocks exhibiting Power Inflows, visiting the TradePulse website provides comprehensive insights and updates on daily occurrences.

Power Inflow是指買單激增超過賣單,通常發生在市場開盤後的一兩個小時內。每天大約有十到二十支股票出現這種現象,反映了大型機構投資者的初始策略和反應。分析這些交易的規模、時間和價格有助於識別市場情緒的轉變和潛在的價格變動。對於那些對更多展現Power Inflow的股票感興趣的人,訪問TradePulse網站可以提供關於每日事件的全面洞察和更新。

Importance of Power Inflow:

Power Inflow的重要性:

Power Inflows are crucial as they offer early indications of potential uptrends, enabling traders to act even before the market fully adjusts. Although not always marking the lowest point, stocks tend to rise following a Power Inflow. This makes these signals especially valuable for identifying strategic entry points and planning short-term investments, as they provide an opportunity to capitalize on upward momentum ahead of wider market recognition.

Power Inflow至關重要,因爲它們提供了潛在上升趨勢的早期跡象,使交易者可以在市場完全調整之前就採取行動。雖然並非總是最低點,但股票往往會在Power Inflow後上漲。這使這些信號特別有價值,可以用於確定戰略性進入點和規劃短期投資,因爲它們提供了在更廣泛市場認可之前就利用上漲勢頭的機會。

Strategic Actions Following a Power Inflow:

權力流入後的戰略行動:

After detecting a Power Inflow, traders should view it as a potential entry buying point but also confirm the trend with TradePulse's additional indicators such as Momentum, Daily, and Large Deal flows to ensure its strength and viability. Prompt action, combined with strategic stop-loss settings, can maximize returns and minimize risks. This comprehensive approach allows traders to make more informed decisions, optimizing their trading strategies in alignment with real-time market dynamics.

在檢測到權力流入後,交易員應將其視爲潛在的入場買點,但也應通過TradePulse的額外指標如動量、日常和大單流量來確認趨勢,以確保其強度和可行性。及時採取行動,結合戰略止損設置,可以最大化收益和最小化風險。這種全面的方法使交易員能夠做出更明智的決策,優化其交易策略以與實時市場動態保持一致。

Market News and Data are brought to you by Benzinga APIs and include firms, like Finit USA, responsible for parts of the data within this article.

市場新聞和數據由Benzinga APIs帶給您,包括像Finit USA這樣的公司,它負責本文中部分數據的處理。

2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2024年Benzinga.com保留版權所有,Benzinga.com不提供投資建議。

After Market Close UPDATE:

收盤後更新:

The price at the time of the Power Inflow was $1979.56. The returns on the High price (2008.33) and Close price ($2004.70) after the Power Inflow were respectively 1.5%% and 1.3%. That is why it is important to have a trading plan that includes Profit Targets and Stop Losses that reflect your risk appetite. In this case the high of the day and close were the same price and return.

權力流入時的價格爲$1979.56。權力流入後的最高價格(2008.33)和收盤價格($2004.70)的回報率分別爲1.5%%和1.3%。這就是爲什麼有必要制定包括盈利目標和止損的交易計劃,以反映您的風險偏好。在這種情況下,當天的最高價和收盤價是相同的價格和回報率。

Past Performance is Not Indicative of Future Results

過往表現並不代表未來結果