Qualcomm Options Trading: A Deep Dive Into Market Sentiment

Qualcomm Options Trading: A Deep Dive Into Market Sentiment

Financial giants have made a conspicuous bearish move on Qualcomm. Our analysis of options history for Qualcomm (NASDAQ:QCOM) revealed 9 unusual trades.

Delving into the details, we found 33% of traders were bullish, while 44% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $169,242, and 5 were calls, valued at $247,543.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $167.5 to $180.0 for Qualcomm over the recent three months.

Volume & Open Interest Development

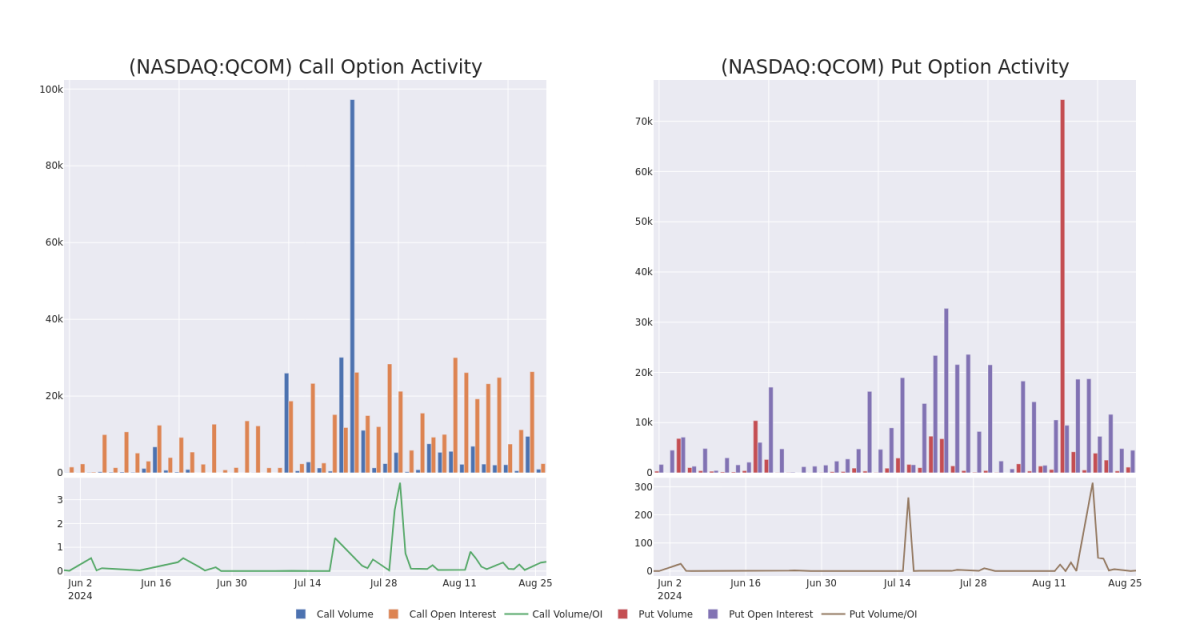

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Qualcomm's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Qualcomm's whale activity within a strike price range from $167.5 to $180.0 in the last 30 days.

Qualcomm 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| QCOM | PUT | TRADE | BEARISH | 08/15/25 | $22.15 | $21.95 | $22.15 | $170.00 | $64.2K | 140 | 32 |

| QCOM | CALL | SWEEP | BEARISH | 09/06/24 | $1.82 | $1.69 | $1.69 | $177.50 | $56.9K | 106 | 705 |

| QCOM | CALL | TRADE | BULLISH | 11/15/24 | $13.4 | $13.25 | $13.4 | $170.00 | $53.6K | 881 | 62 |

| QCOM | CALL | TRADE | NEUTRAL | 11/15/24 | $13.3 | $12.9 | $13.13 | $170.00 | $52.5K | 881 | 5 |

| QCOM | CALL | TRADE | BEARISH | 09/27/24 | $6.0 | $5.7 | $5.73 | $175.00 | $51.5K | 140 | 11 |

About Qualcomm

Qualcomm develops and licenses wireless technology and designs chips for smartphones. The company's key patents revolve around CDMA and OFDMA technologies, which are standards in wireless communications that are the backbone of all 3G, 4G, and 5G networks. Qualcomm's IP is licensed by virtually all wireless device makers. The firm is also the world's largest wireless chip vendor, supplying nearly every premier handset maker with leading-edge processors. Qualcomm also sells RF-front end modules into smartphones, as well as chips into automotive and Internet of Things markets.

In light of the recent options history for Qualcomm, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Qualcomm

- With a volume of 1,896,033, the price of QCOM is up 0.94% at $171.08.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 64 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Qualcomm with Benzinga Pro for real-time alerts.