Financial giants have made a conspicuous bearish move on Gilead Sciences. Our analysis of options history for Gilead Sciences (NASDAQ:GILD) revealed 10 unusual trades.

Delving into the details, we found 20% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $310,182, and 2 were calls, valued at $112,717.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $60.0 and $79.0 for Gilead Sciences, spanning the last three months.

Insights into Volume & Open Interest

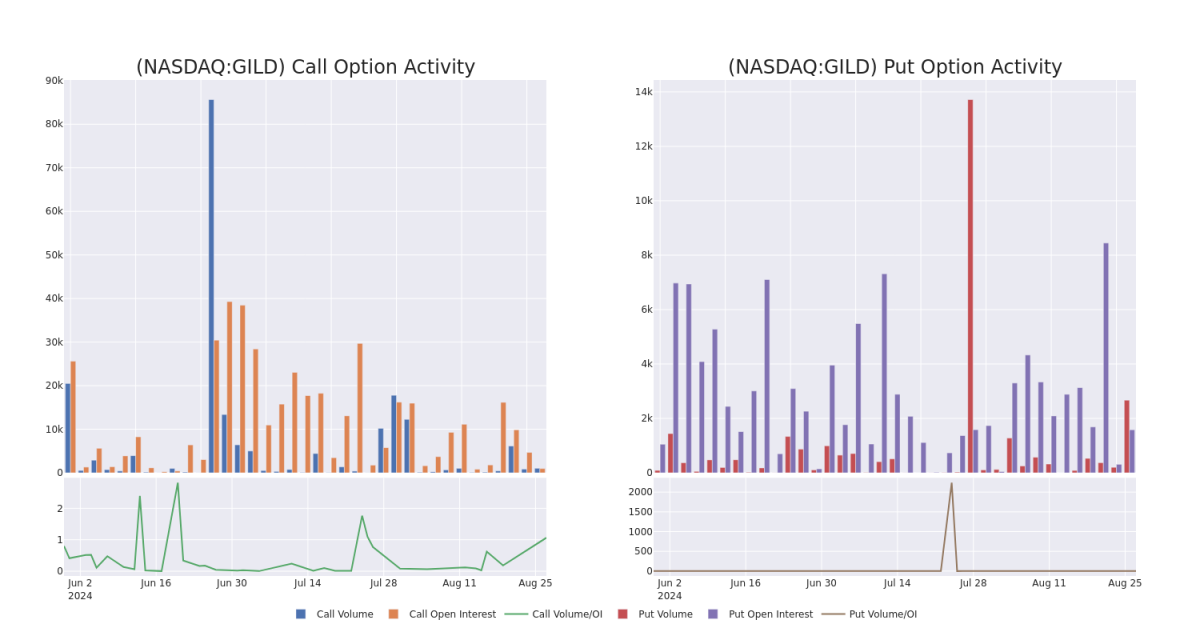

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Gilead Sciences's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Gilead Sciences's whale trades within a strike price range from $60.0 to $79.0 in the last 30 days.

Gilead Sciences Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GILD | CALL | TRADE | NEUTRAL | 09/20/24 | $0.73 | $0.65 | $0.69 | $79.00 | $69.0K | 86 | 1.0K |

| GILD | PUT | SWEEP | BEARISH | 01/16/26 | $5.8 | $4.8 | $5.72 | $70.00 | $59.6K | 1.2K | 500 |

| GILD | PUT | SWEEP | BEARISH | 01/16/26 | $5.8 | $5.6 | $5.73 | $70.00 | $44.7K | 1.2K | 370 |

| GILD | CALL | SWEEP | BULLISH | 01/17/25 | $17.5 | $17.4 | $17.46 | $60.00 | $43.7K | 889 | 25 |

| GILD | PUT | SWEEP | NEUTRAL | 01/16/26 | $6.0 | $5.65 | $5.75 | $70.00 | $40.2K | 1.2K | 640 |

About Gilead Sciences

Gilead Sciences develops and markets therapies to treat life-threatening infectious diseases, with the core of its portfolio focused on HIV and hepatitis B and C. Gilead's acquisition of Pharmasset brought rights to hepatitis C drug Sovaldi, which is also part of newer combination regimens that remain standards of care. Gilead is also growing its presence in the oncology market via acquisitions, led by CAR-T cell therapy Yescarta/Tecartus (from Kite) and breast and bladder cancer therapy Trodelvy (from Immunomedics).

In light of the recent options history for Gilead Sciences, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Gilead Sciences's Current Market Status

- Currently trading with a volume of 1,387,168, the GILD's price is down by -0.05%, now at $76.92.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 70 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Gilead Sciences options trades with real-time alerts from Benzinga Pro.