Financial giants have made a conspicuous bearish move on Moderna. Our analysis of options history for Moderna (NASDAQ:MRNA) revealed 19 unusual trades.

Delving into the details, we found 42% of traders were bullish, while 47% showed bearish tendencies. Out of all the trades we spotted, 12 were puts, with a value of $856,535, and 7 were calls, valued at $481,149.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $60.0 and $150.0 for Moderna, spanning the last three months.

Analyzing Volume & Open Interest

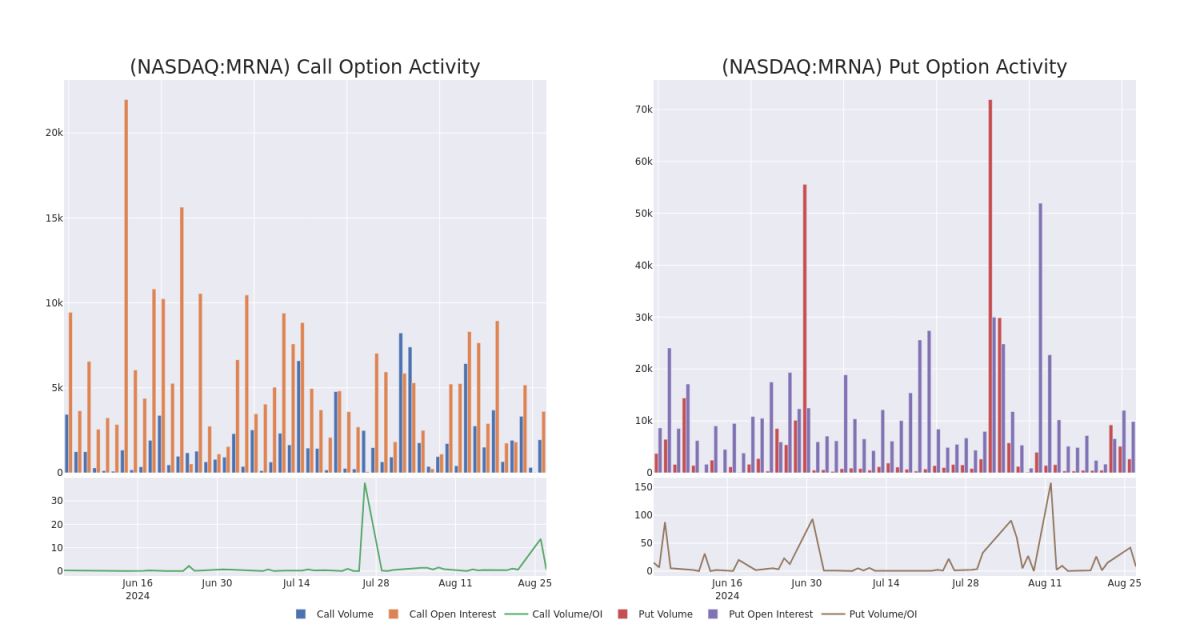

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Moderna's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Moderna's whale trades within a strike price range from $60.0 to $150.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Moderna's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Moderna's whale trades within a strike price range from $60.0 to $150.0 in the last 30 days.

Moderna 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRNA | PUT | SWEEP | BEARISH | 06/20/25 | $6.05 | $5.95 | $6.02 | $60.00 | $362.0K | 668 | 600 |

| MRNA | CALL | TRADE | BEARISH | 09/06/24 | $1.28 | $1.2 | $1.21 | $83.00 | $180.8K | 151 | 1.5K |

| MRNA | CALL | TRADE | BEARISH | 09/06/24 | $1.15 | $0.93 | $1.01 | $84.00 | $136.3K | 167 | 27 |

| MRNA | PUT | SWEEP | BULLISH | 01/17/25 | $14.1 | $13.95 | $13.95 | $85.00 | $100.4K | 3.3K | 72 |

| MRNA | PUT | SWEEP | BULLISH | 09/13/24 | $2.39 | $2.15 | $2.21 | $77.00 | $70.0K | 69 | 317 |

About Moderna

Moderna is a commercial-stage biotech that was founded in 2010 and had its initial public offering in December 2018. The firm's mRNA technology was rapidly validated with its COVID-19 vaccine, which was authorized in the United States in December 2020. Moderna had 39 mRNA development candidates in clinical trials as of mid-2023. Programs span a wide range of therapeutic areas, including infectious disease, oncology, cardiovascular disease, and rare genetic diseases.

In light of the recent options history for Moderna, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Moderna

- With a volume of 2,549,863, the price of MRNA is down -3.43% at $78.86.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 65 days.

Professional Analyst Ratings for Moderna

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $127.2.

- Reflecting concerns, an analyst from RBC Capital lowers its rating to Sector Perform with a new price target of $90.

- Maintaining their stance, an analyst from Goldman Sachs continues to hold a Buy rating for Moderna, targeting a price of $178.

- An analyst from RBC Capital persists with their Outperform rating on Moderna, maintaining a target price of $125.

- Maintaining their stance, an analyst from JP Morgan continues to hold a Neutral rating for Moderna, targeting a price of $88.

- An analyst from Barclays has decided to maintain their Overweight rating on Moderna, which currently sits at a price target of $155.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Moderna with Benzinga Pro for real-time alerts.