The simplest way to benefit from a rising market is to buy an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. For example, the Jinling Pharmaceutical Company Limited (SZSE:000919) share price is down 25% in the last year. That contrasts poorly with the market decline of 16%. However, the longer term returns haven't been so bad, with the stock down 13% in the last three years. Furthermore, it's down 16% in about a quarter. That's not much fun for holders. However, one could argue that the price has been influenced by the general market, which is down 12% in the same timeframe.

After losing 9.0% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

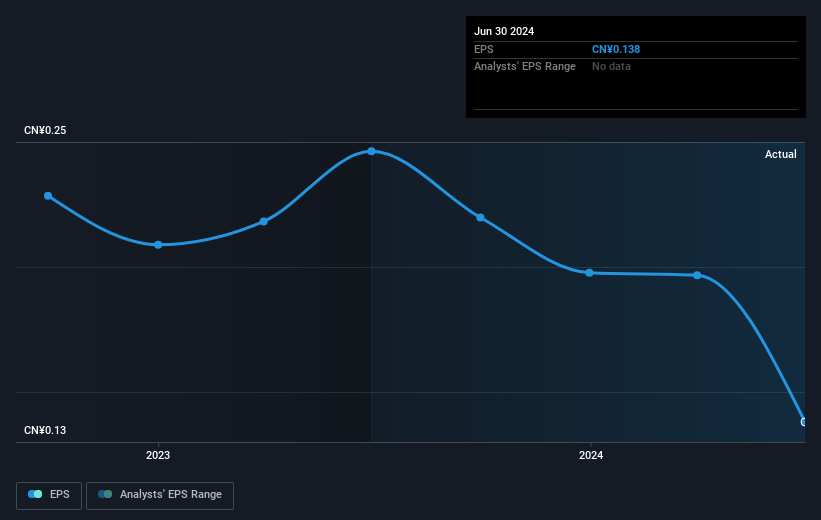

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unhappily, Jinling Pharmaceutical had to report a 44% decline in EPS over the last year. This fall in the EPS is significantly worse than the 25% the share price fall. It may have been that the weak EPS was not as bad as some had feared. With a P/E ratio of 50.10, it's fair to say the market sees an EPS rebound on the cards.

Unhappily, Jinling Pharmaceutical had to report a 44% decline in EPS over the last year. This fall in the EPS is significantly worse than the 25% the share price fall. It may have been that the weak EPS was not as bad as some had feared. With a P/E ratio of 50.10, it's fair to say the market sees an EPS rebound on the cards.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Jinling Pharmaceutical's key metrics by checking this interactive graph of Jinling Pharmaceutical's earnings, revenue and cash flow.

A Different Perspective

While the broader market lost about 16% in the twelve months, Jinling Pharmaceutical shareholders did even worse, losing 24% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 3% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Jinling Pharmaceutical better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Jinling Pharmaceutical (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.