The truth is that if you invest for long enough, you're going to end up with some losing stocks. Long term Nine Dragons Paper (Holdings) Limited (HKG:2689) shareholders know that all too well, since the share price is down considerably over three years. So they might be feeling emotional about the 72% share price collapse, in that time. And more recent buyers are having a tough time too, with a drop of 32% in the last year. Shareholders have had an even rougher run lately, with the share price down 28% in the last 90 days.

The recent uptick of 3.1% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Nine Dragons Paper (Holdings) isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, Nine Dragons Paper (Holdings)'s revenue dropped 1.1% per year. That's not what investors generally want to see. The share price fall of 20% (per year, over three years) is a stern reminder that money-losing companies are expected to grow revenue. We're generally averse to companies with declining revenues, but we're not alone in that. There's no more than a snowball's chance in hell that share price will head back to its old highs, in the short term.

Over the last three years, Nine Dragons Paper (Holdings)'s revenue dropped 1.1% per year. That's not what investors generally want to see. The share price fall of 20% (per year, over three years) is a stern reminder that money-losing companies are expected to grow revenue. We're generally averse to companies with declining revenues, but we're not alone in that. There's no more than a snowball's chance in hell that share price will head back to its old highs, in the short term.

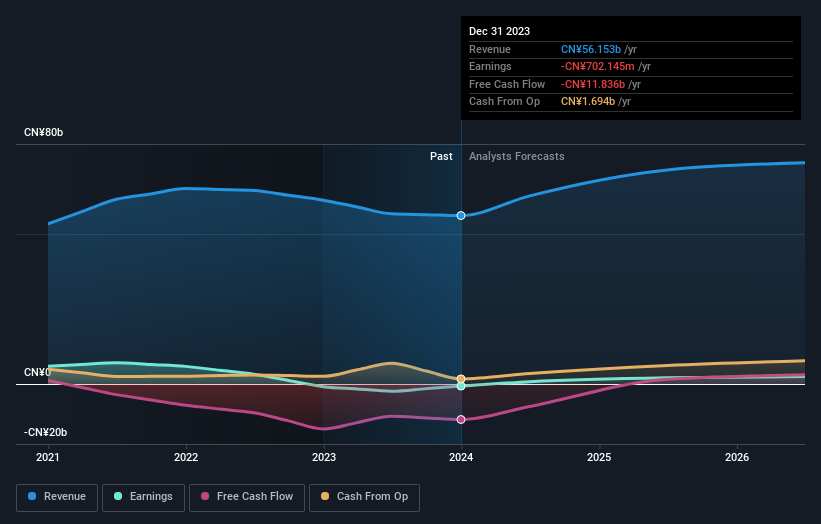

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Nine Dragons Paper (Holdings) is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

Investors in Nine Dragons Paper (Holdings) had a tough year, with a total loss of 32%, against a market gain of about 9.1%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for Nine Dragons Paper (Holdings) you should be aware of.

Of course Nine Dragons Paper (Holdings) may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.