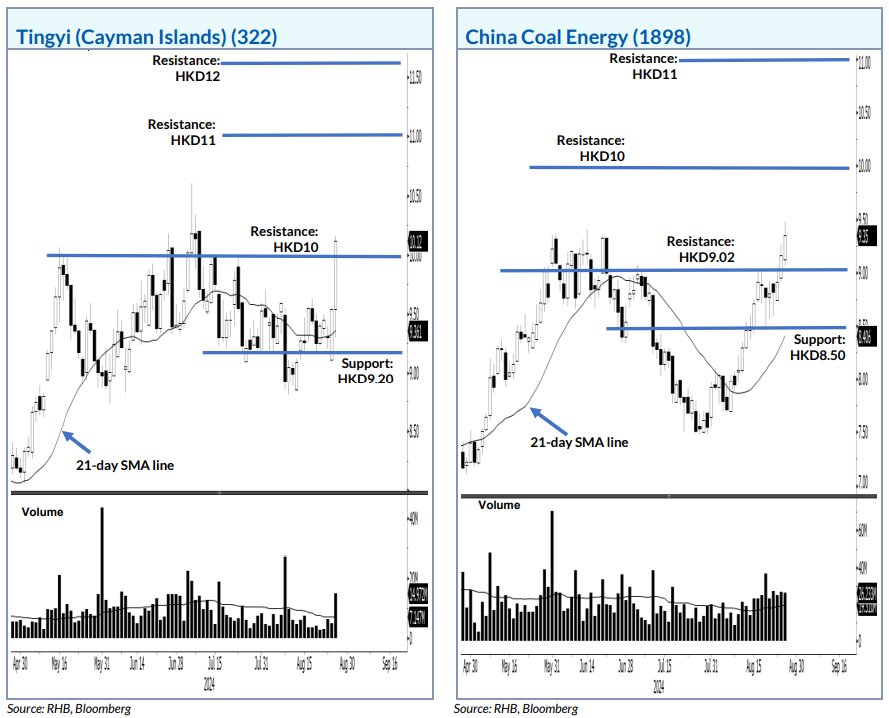

Hong Kong Viable Stocks – Tingyi (Cayman Islands), China Coal Energy (1898)

Hong Kong Viable Stocks – Tingyi (Cayman Islands), China Coal Energy (1898)

Tingyi (Cayman Islands) is poised to extend the upside movement after a bullish breakout on strong volume.

康師傅控股(開曼群島)有望在成交量大的看好突破後延續上行走勢。

RHB Retail Research (RHB) in a note today (Aug 28) said yesterday, the stock broke past the HKD10 mark with a long bullish candlestick, showing bullish momentum is underway now.

RHb零售研究(RHB)今日(8月28日)在一份報告中稱,昨日該股突破了10港元關口,出現了一根長陽k線,顯示目前正處於看好動能中。

The momentum may propel the stock towards the next resistance at HKD11, followed by HKD12.

該動能可能推動該股向上突破11港元的支撐位,隨後是12港元。

On the flipside, falling below the HKD9.20 support would resume the correction phase.

另一方面,跌破9.20港元的支撐位將重新啓動調整階段。

China Coal Energy is eyeing to stretch the bullish trajectory after breaking past the resistance on high volume.

中煤能源在成交量高的情況下突破了支撐位,有意延續看好的軌跡。

RHB noted that they observed the 21-day SMA line is moving upwards, showing the short-term trend is bullish.

RHb指出他們觀察到21日簡單移動平均線正在上升,顯示短期趨勢爲看好。

After breaking past the HKD9.02 resistance, the counter may climb towards the next resistance at HKD10, followed by HKD11.

在突破了9.02港元的支撐位後,該股可能上漲至接下來的10港元的阻力位,隨後是11港元。

If it breaches s the HKD8.50 support level, this will kick off a bearish phase.

如果突破小單8.50港元的支撐位,這將是一段看淡的階段。

On the flipside, falling below the HKD9.20 support would resume the correction phase.

On the flipside, falling below the HKD9.20 support would resume the correction phase.