Jointly produced by China Thailand International and Finance Association

Market reviews

In the primary market, Ganzhou City Investment Holding Group Co., Ltd. and BOC Aviation Leasing Co., Ltd. participated in the new issuance of US dollar bonds;

In the secondary market, the investment grade of Chinese dollar bonds strengthened slightly. In the state-owned enterprise sector, China Shipbuilding narrowed by 2 bps; in the technology sector, Meituan narrowed by about 2 bps; in the financial sector, the Industrial and Commercial Bank of China narrowed by 4 bps. The high-yield market for Chinese dollar bonds was relatively lackluster. COSCO rose 0.1 pt, and Country Garden fell 0.1 pt.

Performance of the bond market

New message

• Ganzhou Urban Control issues senior unsecured sustainable notes for a period of 3 years, with an interest rate of 5.95% and a scale of 0.15 billion US dollars. Debt rating: BBB-Fitch.

• Bank of China Aviation Leasing issues senior unsecured notes with a term of 7 years, issued at T+105 bps, a scale of 0.5 billion dollars, and a debt rating of A-/A-.

Global bond market performance data

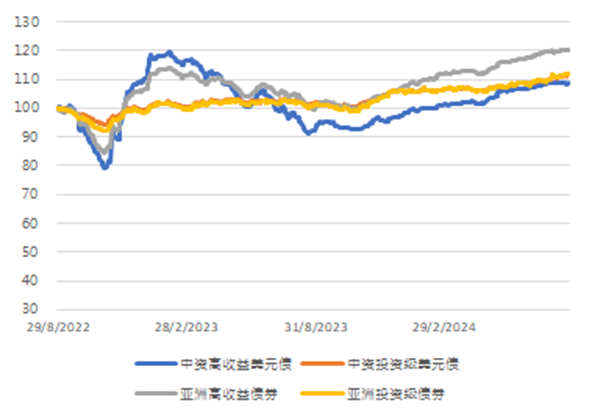

Figure 1. Trends in the Chinese and Asian dollar debt indices (benchmark=100)

Figure 2. Trend of the US dollar debt index in the Chinese real estate and urban investment sector (benchmark = 100)

Figure 3. Interest rate trend on US Treasury bonds (%)

Company rating adjustments

Market news summary

• Shimao Co., Ltd.: On August 27, Shanghai Shimao Co., Ltd. (“Shimao Shares” for short) issued a response notice to the “Shareholder Question Request Letter” from the China Securities Small and Medium Investors Service Center. Recently, Shanghai Shimao Co., Ltd. (hereinafter referred to as the “Company”) received a “Shareholders' Question Request” (Submission Center Letter (2024) No. 427, hereinafter referred to as the “Question Letter”) from the China Securities Small and Medium Investors Service Center to raise questions about the company's disclosure or matters. After receiving the letter, the company attached great importance to it and immediately organized relevant personnel to respond to the issues involved in the letter.

• Greentown China: On August 27, Greentown China issued an announcement stating that the company offered a cash purchase offer to any and all of its issued and unredeemed 2.3% credit enhancement bonds (ISIN: XS2434935875) due in 2025. The takeover offer will expire on September 10, 2024 at 4:00 p.m. (London time), but the company made an extension or early termination. At the date of this announcement, the total outstanding principal amount of the bonds issued was USD 0.1 billion.

• Enlightenment Holdings: On August 26, Tus-Holdings Co., Ltd. (“Enlightenment Holdings Co., Ltd.”) announced the termination of consent requests and offers relating to THSCPA 7.95 05/13/24 and THSCPA 6.95 05/13/24. Since the issuer announced the launch of the offer repurchase and consent solicitation on May 14, 2024, the issuer has actively and continuously communicated with relevant regulators and all shareholders in an effort to successfully complete the offer repurchase on the delivery day and agree to solicit payment of the delivery fee and the signing of related transaction documents.

• Far East Development: On August 26, Far East Development Co., Ltd. (“Far East Development”) announced a request for consent for the $0.36 billion USD 7.375% perpetual bond (ISIN: XS2050584866) issued by its subsidiary FEC Finance Limited. This perpetual bond is provided by Far East Development with an unconditional and irrevocable guarantee. As of the date of this announcement, one of the sponsor's subsidiaries held a total of $4,000,000 in principal uncancelled notes.

New bond issuance

(Jointly produced by China and Thailand Finance Association. Data sources are Bloomberg, bond trading platform summaries, and corporate announcements)