On August 23rd, Federal Reserve Chairman Powell stated at the Jackson Hole Central Bank Meeting: the timing for policy adjustment has arrived. The market generally believes that this is the most explicit interest rate cut signal released by the Fed so far.

The report from China International Capital Corporation (CICC) points out that Powell's speech basically confirms the September interest rate cut, which is in line with expectations. Guotai Junan Securities believes that there is a high probability of a 25 basis point rate cut by the Fed in September, and there is a greater possibility of three rate cuts throughout the year. According to CME interest rate futures, the market believes that the probability of a rate cut in September has reached 100%, with a 76% probability of a 25 basis point rate cut and a 24% probability of a 50 basis point rate cut.

Overall, the direction of the Fed's interest rate cut is already clear. The only uncertainty is the magnitude and pace, but this has already provided strong support for the future trend of copper.

At the current stage, enterprises that have sufficient high-quality copper resources should pay attention. On August 26th, Jinchuan International released its latest interim report, which may provide some clues.

At the current stage, enterprises that have sufficient high-quality copper resources should pay attention. On August 26th, Jinchuan International released its latest interim report, which may provide some clues.

1. The long-term outlook for copper prices is bullish, strengthening profitability.

In the first half of the year, Jinchuan International achieved a revenue of 0.283 billion US dollars, a slight decline compared to the previous year, mainly due to unstable power supply from the national grid in the Democratic Republic of Congo, resulting in a decrease in cathode copper production at the Ruashi mine, which affected terminal sales. These occasional events do not affect the company's long-term operations.

It is worth noting that the company's profitability has significantly improved, achieving a turnaround to profit in the current period, with a net profit of 12.78 million US dollars.

From another perspective, Jinchuan International's business involves a large amount of fixed asset investment and long-term asset depreciation. Using EBITDA can better evaluate the company's core profitability without being affected by non-cash items such as depreciation and amortization. In the first half of the year, the company's EBITDA was $74.987 million, a significant increase of 86.55% compared to the previous year.

The recovery of profit cannot be separated from the continuous rise in the price of copper.

In March this year, with the dovish remarks of Powell, the market began to trade the rate cut logic, and LME copper started a unilateral upward trend, reaching a historical high of $11,104.5 per ton on May 20. Subsequently, along with profit-taking and the hawkish tone of the Fed, copper prices adjusted continuously, falling back to around $9300.

(Source: Wind)

Now standing at the most clear expectation of the Fed rate cut, the support for copper prices has strengthened, which is beneficial for the continuous improvement of the company's profitability.

In addition to financial impacts, the price of copper is also strongly related to the supply and demand side.

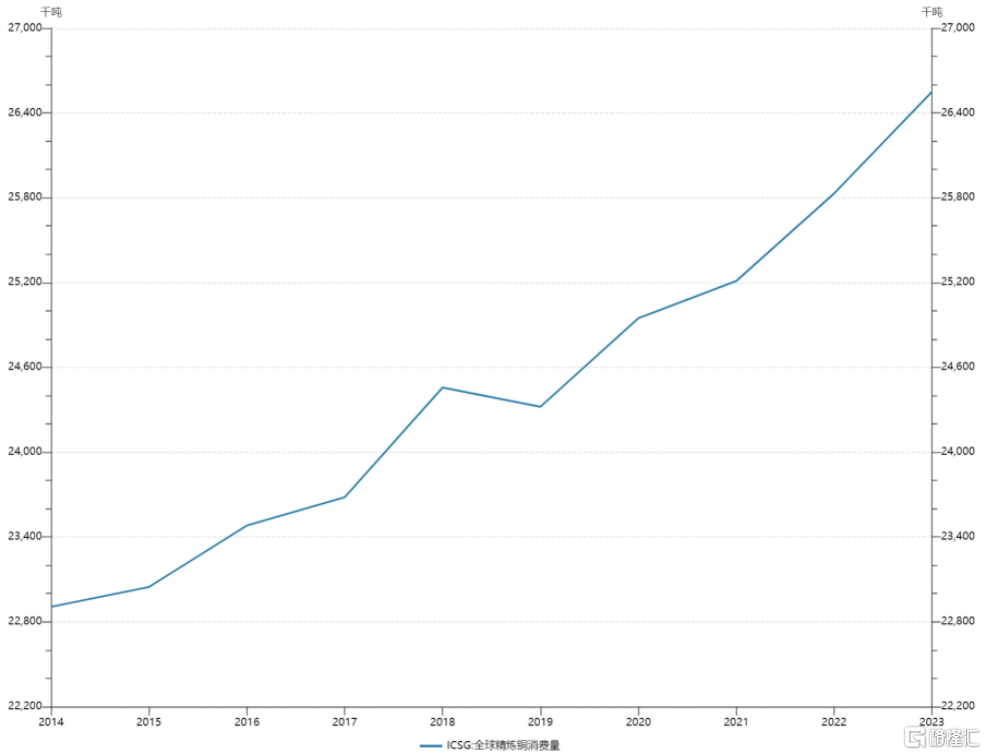

In terms of demand, due to copper's excellent thermal and electrical conductivity, as well as its easy processing and corrosion resistance characteristics, it is widely used in various industrial fields, and its demand has been increasing for a long time. According to the International Copper Study Group (ICSG) statistics, from 2014 to 2023, global copper consumption increased from 22.906 million tons to 26.549 million tons.

(Source: Wind)

Currently, as the global embrace of new energy intensifies, copper, as an indispensable metal raw material in emerging industries such as new energy vehicles and AI data centers, has further opened up long-term demand space.

On the supply side, there is relatively weak supply. Fangzheng Securities pointed out that factors such as the decrease in the discovery of large copper mines, the uncertainty of long-term mine development, the decrease in ore grades, and the decline in capital expenditures of major global copper enterprises will constrain the release of new copper mines, and the increase in mine supply from 2023 to 2025 will gradually decline.

At the same time, copper inventories are continuing to decline. According to wind data, as of August 23rd, COMEX copper inventories were 0.029 million tons, the lowest level in nearly ten years.

(Source: Wind)

Overall, the divergence between supply and demand is favorable for the sustained strength of copper prices in the medium to long term, and it is beneficial to enterprises with abundant mining resources like Jinchuan International to continuously improve their profitability.

Second, we wait for the release of the value of the mines, and there are more points to look forward to in the future.

Currently, the focus on Jinchuan International should be on its several mines.

Firstly, there is the Ruashi copper-cobalt mine, which has been operating steadily for many years. Currently, the construction of a 0.6 million ton flotation and magnetic separation plant has been completed at the mine, aimed at improving the mine's lifespan through flotation and magnetic separation of low-grade mixed ores.

Secondly, the Kinsenda copper mine is one of the highest-grade copper deposits in the world, with a copper grade of 5.8%.

As of now, the mine has copper reserves of 0.18 million tons and resources of 0.935 million tons. It is expected to have a lifespan of 12 years, but given its massive resource reserves, the lifespan can be extended to 20 years. The mining license has also been extended to 2036, providing certainty for the company's continued development. It is reported that a second decline has been constructed at the mine, which will be used to mine the resources in the eastern part of the deposit and facilitate future increase in copper production.

In the first half of this year, the two mines produced approximately 0.0286 million tons of copper, corresponding to an annual average production capacity of about 0.06 million tons.

Meanwhile, the Musonoi copper-cobalt project, which Jinchuan International is currently developing, has copper resources of 1.085 million tons and copper reserves of 0.606 million tons. It is expected to have an annual production capacity of 0.0438 million tons of electrolytic copper. According to public information, the project is scheduled to start production in early 2025, which means that excluding fluctuations in copper prices and the increase in production from existing mines, the copper mining business will have at least 60% or more growth potential next year.

In addition, Jinchuan International has the Lubembe copper project, which reportedly has copper resources of 1.9 million tons, making it the largest mine in terms of resource reserves for the company. If successfully put into production in the future, it will greatly increase Jinchuan International's copper production and become a new growth driver in the coming years after the Musonoi project.

If we look at a longer time frame, Jinchuan International's potential goes beyond its current visible mine resources.

Backed by Jinchuan Group, Jinchuan International's stock price has been hovering below 1 Hong Kong dollar for a long time. Under the current policy guidance of "strengthening the market value management of state-owned listed companies," this situation urgently needs to be changed.

For a mining enterprise, the most direct and effective way to enhance its recognition in the capital market is undoubtedly to inject more mining resources into it.

And Jinchuan Group's assets under its subsidiaries, such as Xiongcun Copper and Gold Mine in Tibet, copper mine projects in Mexico, South Africa's Siwe Platinum Mine, Zambia's Munali Nickel Mine, Indonesia's WP&RKA Nickel Iron Project, Koala Sea Nickel Iron Project, and Universal Gao Ice Nickel Project, need a listed company as a carrier in order to fully realize their value.

As the only overseas listing platform of Jinchuan Group, Jinchuan International is undoubtedly the most suitable carrier. According to Jinchuan International's roadshow materials, it is expected to increase copper production to 4 to 5 times the current level in the future through mergers and acquisitions and other measures.

(Source: Jinchuan International public information)

This is still considering only the value generated by the copper mining. Jinchuan International currently also has cobalt mining resources and will inject nickel resources, platinum group metals, and gold resources in the future. Both nickel and cobalt, the two major non-ferrous metal prices, have entered a historical range after long-term adjustments, and there is little room for further downward exploration. With the vigorous development of new energy and other emerging industries, both nickel and cobalt are expected to become new growth drivers for Jinchuan International's performance.

III. Conclusion

Overall, in the face of global economic fluctuations and changes in market expectations, Jinchuan International has achieved significant improvement in profitability by optimizing operations and cost control.

More importantly, the Federal Reserve's interest rate cut policy has provided support for the rise in copper prices, coupled with Jinchuan International's rich mining resources and expectations of a substantial increase in future copper production, the growth certainty of Jinchuan International is becoming higher and higher.

在当前节点,对于拥有足够优质铜矿资源的企业理应重视起来。8月26日,金川国际发布了最新中报,从中或许能找到些许线索。

在当前节点,对于拥有足够优质铜矿资源的企业理应重视起来。8月26日,金川国际发布了最新中报,从中或许能找到些许线索。