In 2024, the live e-commerce industry is not without challenges and changes, such as intense competition, the ebb of super influencers, and a growing significance of industry restructuring. At this time, Be Friends Hldg has released its best semi-annual report.

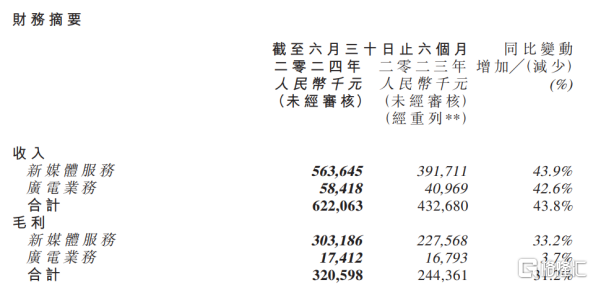

According to the financial report, Be Friends Hldg achieved a revenue of 0.62 billion yuan in the first half of the year, a year-on-year increase of 43.8%; the net income was 83.81 million yuan, a year-on-year increase of 93.8%, and it has achieved profitability for three consecutive half years.

In terms of business segments, the revenue of new media services was 0.56 billion yuan, a year-on-year increase of 43.9%, accounting for 90.6% of the total revenue; the revenue of radio and television business was 58.42 million yuan, a year-on-year increase of 42.6%, accounting for 9.4% of the total revenue. At the same time, the new media services sector completed a total of 5.96 billion yuan in transaction value (GMV), a year-on-year increase of 18.2%, and the growth rate of revenue was significantly faster. The corresponding revenue conversion ratio continued to improve, indicating an increase in monetization ability and operational efficiency.

Source: Company Announcement

Source: Company Announcement

What's more important is that with the restructuring of the industry, it will also bring opportunities for the gradual increase in industry concentration, and the top-tier enterprises with strong operating capabilities will benefit. This performance reflects that Be Friends Hldg's business model has stronger market adaptability and competitiveness. Therefore, the strong growth of Be Friends Hldg may have just begun.

The stable operation of Be Friends Hldg comes from several aspects:

1) Further moving towards channel IP

From a visual perspective, Be Friends Holding successfully implements a standardized and replicable "matrix live broadcast room" model, which meets the diverse and segmented needs of consumers, achieves more accurate user engagement and more efficient user conversion, and is still in the expansion dividend period, able to unleash more total transaction value, and solidify a stable and steady growth foundation.

As of the first half of the year, Be Friends Holding independently owns and broadcasts more than 50 live broadcast rooms, making it one of the institutions with the highest number of live broadcast rooms in the new media field, a significant increase compared to the data at the end of last year.

As a result, Be Friends Holding further transitions from individual IP to channel IP, achieving decentralization, and shifts the value anchor to precisely match the demands of the vast consumer base, rather than a simple traffic logic, significantly reducing operational volatility risks.

In this process, a key point is the advancement of cross-platform strategy, allowing it to cover more fields and customer groups, and gain more traffic and retention from various circles. Nowadays, in the context of saturated competition in the e-commerce industry, the trend of e-commerce platforms focusing on their core business is becoming more prominent, emphasizing the need to strengthen the core business, while the trend of decentralized consumption is also becoming more distinct, such as buying digital appliances on JD.com and buying daily necessities on Taobao and Tmall.

At the same time, Be Friends Holding has accelerated its expansion into various segmented markets this year, leveraging more specialized accounts to cover a full range of products and provide more accurate products for a more precise customer base. This further aligns with the trend of decentralized consumption, and a service system focused on category building can better guarantee user experience.

In addition, Be Friends Holding has an experienced anchor team that ensures talent reserves through standardized operational SOPs, reducing the requirement for individual anchor capabilities, and building a long-term reservoir for account matrix expansion, making the entire model sustainable.

2) High-quality experience and efficiency improvement.

This year, Be Friends Holding has also proposed a repositioning of its long-term vision to become a technology-driven new retail company, emphasizing that the company's essence is a new retail company. This strategic framework positions live broadcasting more as a tool to connect brand merchants/production factories with consumers, and high-quality consumer experience and technology-driven efficiency improvement are the core of its business model, generating more stable growth momentum.

Therefore, Be Friends Hldg has proposed the goal of "accurate, fast, good, and cost-saving", which hides the first principle of the new retail era, finding people for goods.

In the context of general surplus of goods and excess production capacity, the core is to actively seek and identify customers through efficient and low-cost means, and to accurately satisfy the consumption experience of specific customer groups. Whoever has the ability to achieve more accurate matching has a greater chance of becoming an invincible channel.

In terms of specific layout, Be Friends Hldg continues to deepen the selection of products, strives to discover and promote high-quality commodities; continues to deepen the supply chain, uses the self-developed "Friend Cloud" big data platform and AI technology to empower live streaming retail business, improves operational efficiency and standardization level, and enhances customer service experience. In the first half of the year, Be Friends Hldg also formed a team to launch the development of AI live streaming project, with the goal of achieving full-scenario decision-making of AI system in the field of live streaming e-commerce, which is expected to continue to promote efficiency and experience upgrades, and accelerate the release of strategic upgrade dividends.

3) Expanding the second growth curve.

In addition, Be Friends Hldg is actively exploring industrial belt resources and overseas business, actively expanding the second growth curve.

On the day when the financial report was released, Be Friends Hldg announced that its subsidiary engaged in overseas e-commerce business had officially settled in Hengqin, making arrangements for the next step of high-quality development. It is reported that the subsidiary will be committed to the construction and optimization of overseas e-commerce ecosystem, covering core areas such as localized operation of cross-border e-commerce platforms, intelligent supply chain management, and international market expansion.

These areas are precisely the key to the success of cross-border e-commerce, and the core is still the improvement of high-quality consumer experience and efficiency driven by technology. From this perspective, Be Friends Hldg still has a certain degree of certainty and is likely to enhance its global market competitiveness, thereby achieving diversification of performance sources.

Taking into account the overall improvement in the fundamentals of Be Friends Hldg, the replicable growth curve has been fully verified. With its continued promotion of multiple platforms, multiple vertical categories, and development at home and abroad, the potential for performance will continue to be released. This kind of steady operation is particularly valuable in an uncertain market, and it will also enhance investment value at the same time.

In addition, be friends hldg announced a share buyback plan in July to boost market confidence and shareholder returns. Currently, the PE (TTM) is only around 10 times, and these factors together determine its considerable valuation repair space in the future, with the hope of achieving a double hit of performance and valuation.

来源:公司公告

来源:公司公告