In the business field, there is a concept called the "flywheel effect", which refers to the sustainable and virtuous business operation model that a company finds. For innovative drug companies, the rotation of this flywheel is obviously built on the continuous construction of high-quality innovative products.

In other words, once the product flywheel of an innovative drug company starts to rotate, it can continuously generate new profit growth points and achieve sustainable development.

Among the many pharmaceutical companies, I believe that 3sbio (01530.HK) is a typical example.

Recently, the company released its performance report for the first half of the year, showing steady and robust performance. Let's take a look at what makes it unique.

Recently, the company released its performance report for the first half of the year, showing steady and robust performance. Let's take a look at what makes it unique.

1. Continuous consolidation of core products, diverse revenue structure supports steady and far-reaching development

From the overall financial report data, the company's revenue and profit growth performance is steady.

In the first half of the year, 3sbio achieved operating income of approximately 4.389 billion yuan, a year-on-year increase of 16.0%; gross profit of approximately 3.797 billion yuan, a year-on-year increase of 18.6%; net profit attributable to shareholders of 1.09 billion yuan, a year-on-year increase of 11.1%; adjusted operating net profit attributable to shareholders of 1.112 billion yuan, a year-on-year increase of 1.5%; adjusted EBITDA of approximately 1.664 billion yuan, a year-on-year increase of 17.0%.

Focusing on specific revenue sources, the revenue growth of the company's main products is stable and solid.

In the first half of the year, Tebiao achieved sales of 2.48 billion yuan, a year-on-year increase of 22.6%, accounting for approximately 56.4% of the company's total revenue.

Yibiao achieved sales of 0.393 billion yuan, a year-on-year increase of 7.4%; Saiboer achieved sales of 0.123 billion yuan, a year-on-year increase of 25.9%. The total sales of Yibiao and Saiboer accounted for approximately 11.7% of the company's total revenue.

The hair loss field achieved sales of 0.557 billion yuan, a year-on-year increase of 9.5%, accounting for approximately 12.7% of the company's total revenue. Among them, Mandi's sales were 0.55 billion yuan, a year-on-year increase of 10.0%.

Yisaipu achieved sales of 0.329 billion yuan, a year-on-year increase of 9.5%, accounting for approximately 7.5% of the company's total revenue.

From the income structure, it is not difficult to see that 3sbio has formed a diversified revenue growth curve. Among them, Tebiao as the flagship product of the company contributes the most to the revenue, while other products such as Yibiao, Saiboer, Mandi, and Yisaipu also show growth potential in their respective treatment areas.

Clearly, the diversified income structure built by the company helps 3sbio maintain stability in the face of market fluctuations and provides multiple sources of power for future growth.

It is worth noting that while the revenue steadily grows, the overall gross margin of 3sbio has further improved, rising from 84.6% in the same period last year to 86.5%. This indirectly reflects the optimization of the company's product portfolio, cost control, and operational efficiency.

In summary, through this operating performance, we can see that 3sbio has a relatively solid foundation and continues to deliver performance growth. Under the solid market position, it demonstrates strong market competitiveness.

Looking ahead, the highlights of the company's research and development cannot be ignored, as this directly determines its bigger growth opportunities in the future.

Serious medical and consumer medical fields resonate, and the differentiated pipeline enters an intensive realization period.

3sbio has built a differentiated product pipeline, formed a rich product gradient through self-research and collaboration, and ushered in an intensive realization period.

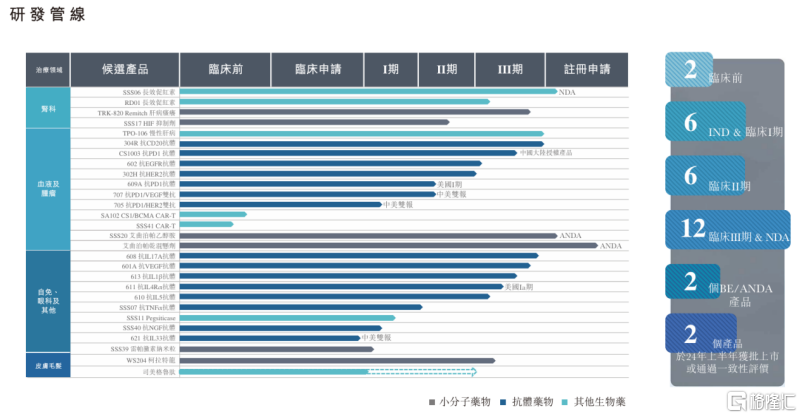

As of the first half of 2024, out of 28 products in research by 3sbio, 25 are being developed as innovative drugs in mainland China, covering antibodies (15 items), other biological products (7 items), and small molecule drugs (6 items), demonstrating the company's research and development strength in multiple therapeutic areas.

Among them, the company has 12 products in research in the hematology/oncology field; 10 products in research target self-immune diseases (including RA), and other diseases such as refractory gout and ophthalmic diseases (such as BRVO); 4 products in research in nephrology; 1 product in research in dermatology, and 1 product in research in endocrinology.

(Source: Company Announcement)

Currently, the company is accelerating the research and development progress of its projects, with upcoming commercialized products including SSS06, Tabalumab CLDT indications, and 608 (IL-17A antibody).

Among them, the new drug SSS06 for the indication of anemia in chronic kidney disease (CKD) has been accepted for new drug application (NDA), which is expected to be an important growth driver for the company in the near future and is expected to bring about a certain performance growth.

At the same time, the indication for Type B Australia CLDT is expected to apply for NDA in the second half of this year. With the expansion of indications and the improvement of penetration rate in the field of oncology, the future growth of the core product Type B Australia will also have highlights.

608 (IL-17A antibody) targets moderate to severe psoriasis indications and is also expected to apply for NDA in the second half of this year, which will bring new growth opportunities for the company in the field of dermatology treatment.

In the first half of this year, 3sbio also cooperated with international pharmaceutical companies to introduce the topical acne drug Winlevi, which is currently undergoing Phase III bridging clinical trials and is expected to apply for NDA in 2025.

At the same time, in May of this year, the company also reached a collaboration agreement with Han Yu Pharmaceutical for the weight reduction indication of semaglutide injection, which is expected to tap into the vast market of weight reduction therapy.

From the pipeline layout of 3sbio, it can be seen that it not only insists on differentiated innovation research and development, but also achieves the organic combination and balance of serious medical treatment and consumer medical treatment. Among them, in the consumer medical market, the layout in areas such as hair loss, acne, weight loss, and dermatology disease makes it particularly promising.

Just looking at the hair loss market, it is estimated that by 2025, the global hair loss treatment market will reach about $20 billion, showing huge market potential. The current industrial scale of the domestic hair loss prevention and hair growth industry is about 11.4 billion yuan, and it is expected that the market scale of the domestic hair medical service industry will reach 138.1 billion yuan by 2030.

In the acne market, it is estimated that by 2027, the scale of the domestic acne treatment market will increase from 4.2 billion yuan in 2024 to 8.1 billion yuan, showing a rapid growth trend.

In the field of drug weight loss, it is also a race track with a market value of more than 100 billion yuan, and it is maintaining high-speed growth.

It is not difficult to see that 3sbio, through continuous research and development investment, continues to launch innovative drugs to meet the demand for efficient and innovative treatment methods in the serious medical field. At the same time, it actively lays out to meet the needs of consumers for health and beauty in the consumer medical field. This balanced strategy between serious medical and consumer medical not only enables it to serve a broader market demand, but also brings diversified sources of income and growth opportunities. Through continuous efforts in products, brands, and channels, 3sbio has also built a sustainable revolving product wheel and achieved rapid development.

In conclusion, the results achieved in the first quarter demonstrate that AI capabilities have brought new opportunities to the company. With the continuous increase in the penetration rate of large models, continuous enhancement of product performance, diversification of landing scenarios, and further expansion of overseas business, Cheetah Mobile is expected to welcome a broader development space.

It is undeniable that the financing environment of the entire pharmaceutical industry is still under pressure. In this context, companies with commercial achievements and abundant cash flow will be able to achieve more stable development. At the same time, pharmaceutical companies with mature innovative research and development systems, international development capabilities, differentiated innovation pipeline research and development, and international commercialization cooperation capabilities will also have more growth prospects.

Clearly, 3sbio is a company that meets the above characteristics. With the intensive realization of the company's follow-up pipeline, coupled with a solid performance base, especially in the consumer medical field, with the performance boost brought by economic recovery, the company may have a more optimistic performance growth outlook.

With the release of this financial report, 3sbio has also gained recognition from institutions, especially mentioning the outstanding performance of the company in shareholder returns. Pacific Securities research reports show that 3sbio insists on shareholder returns, combining dividends and repurchases. In the first half of 2024, the company distributed a total of 0.86 billion Hong Kong dollars in dividends and repurchases, accounting for more than 40% of the operating surplus of 23. Among them, the dividend distribution is 0.6 billion Hong Kong dollars, and the dividend yield calculated based on the closing price on the dividend payment date reaches 4.1%; repurchase is 0.27 billion Hong Kong dollars. The research report also believes that considering the stable growth of 3sbio's main business and the formation of a research product pipeline, gradually entering the realization stage, it maintains its "buy" investment rating.

Currently, under the background of the Federal Reserve entering an interest rate cut cycle, the rebound of the Hong Kong stock market and the recovery of financing in the biomedical industry will drive the pharmaceutical sector to usher in a new window of opportunity. This financial report of 3sbio is not only a surprise to the market, but also holds opportunities.

近期,该公司交出了上半年成绩单,表现持续稳健,不妨就此来看看其有何独特之处?

近期,该公司交出了上半年成绩单,表现持续稳健,不妨就此来看看其有何独特之处?