On August 26th, China Minsheng Bank, the "Guangfa Industry Value Discovery 3-year Hold Mixed Type Securities Investment Fund", which was open for redemption, announced on its official website the preferential transaction fee for some securities investment funds. Some industry insiders said that based on the current net value performance, it may not be enough to attract mature investors to continue buying related products of Guangfa Fund solely relying on measures such as preferential transaction fees.

On August 26th, Liu Gesong, the manager of Guangfa Fund, saw the opening redemption of the "Guangfa Industry Value Discovery 3-year Hold Mixed Type Securities Investment Fund" with a volume of over 10 billion.

According to public reports, since its establishment, the net value of the fund has fallen by more than 56%, with a loss of over 8 billion. In the investment discussion area of the fund, many investors said that they would apply for redemption at the first time, and some investors said it is difficult to decide whether to stay or leave. Due to the unimaginable amount of losses, Liu Gesong has also become a hot topic of online discussion recently.

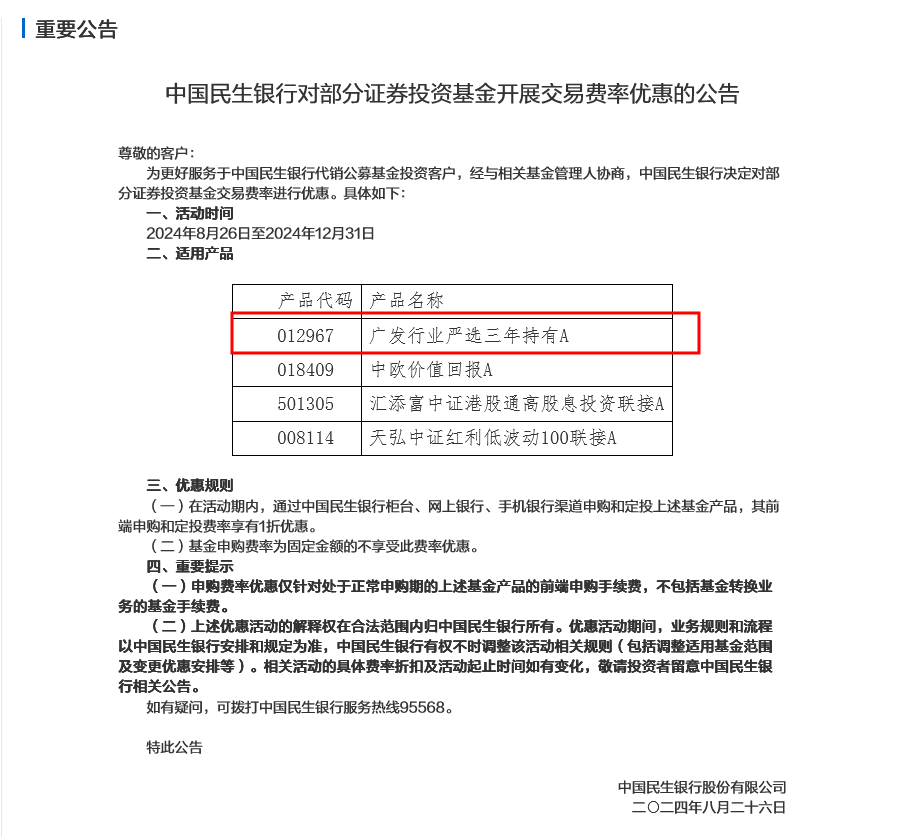

On August 26th, China Minsheng Bank issued a document stating that a 90% discount would be given to some securities investment funds. Among them, the first to be addressed is the "Guangfa Industry Value Discovery 3-year Hold A" with the code 012967.

On August 26th, China Minsheng Bank issued a document stating that a 90% discount would be given to some securities investment funds. Among them, the first to be addressed is the "Guangfa Industry Value Discovery 3-year Hold A" with the code 012967.

Yu Zhi, a researcher at the Yuyi Trust Research Institute, told reporters from Cailian News that it is not surprising that banks provide fee discounts for public offerings considering the current situation in the capital market. Specifically, in the case of Liu Gesong's products of Guangfa Fund, the performance of a net value drop of over 56% in the past three years is obviously unsatisfactory for investors. The opportunity cost of a large number of investors has already been sunk, and relying solely on measures such as preferential transaction fees may not be enough to attract mature investors to continue buying related products of Guangfa Fund.

Appearing to attract Liu Gesong? Minsheng Bank offers a 90% discount on multiple funds again

Public data shows that the Guangfa Industry Value Discovery 3-year Hold Mixed Type A and C were established on August 26, 2021, with a lock-up period of 3 years after purchase, during which they cannot be sold. According to the fund's second quarter report, as of June 30, 2024, the total amount of fund shares is 16.638 billion.

The China Minsheng Bank released a notice on its official website on August 26th, the day when the "GF Selected Industries Three-Year Holding Period Diversified Bond Fund" started open redemption, announcing transaction fee discounts for certain securities investment funds.

In the announcement, Minsheng Bank stated that in order to better serve the clients investing in public funds through China Minsheng Bank, it has reached an agreement with the relevant fund managers to offer discounts on transaction fees for certain securities investment funds. The promotion period is from August 26th, 2024 to December 31st, 2024, and the applicable products include GF Selected Industries Three-Year Holding A (Product Code: 012967), LC Value Discovery A (Product Code: 018409), HTF CSI Hong Kong Stock Connect High Dividend A (Product Code: 501305), and Tianhong CSI Dividend Low Volatility 100 A (Product Code: 008114).

According to data from the Huitian Fund Network, the "GF Selected Industries Three-Year Holding Period Diversified Bond A", which has started open redemption, has the product code 012967, which is consistent with the GF Selected Industries Three-Year Holding A that Minsheng Bank is offering discounts for.

Minsheng Bank has recently implemented channel discounts, as has Hua Xia Bank.

According to information on the Minsheng Bank official website, in less than two months, Minsheng Bank has already released three sets of information about discounted fund fees, primarily for securities-based public funds targeting equity markets. Additionally, multiple products belong to the "GF Series".

On July 1st, Minsheng Bank announced transaction fee discounts for a total of 54 securities investment funds. In the announcement, Minsheng Bank stated that, after consultation with the relevant fund managers, it has decided to offer transaction fee discounts for certain securities investment funds from July 1st, 2024 to December 31st, 2024. Participating products include Rich Country Quality Development, Hua An Media Internet A, and 52 other products. During the promotion period, the front-end sales (申购) and regular savings (定投) fees for these products will enjoy a 10% discount when purchased through the bank's counters, online banking, and mobile banking channels.

On July 29th, Minsheng Bank announced that, in order to better serve the clients investing in public funds through China Minsheng Bank, it has reached an agreement with the relevant fund managers to offer transaction fee discounts for certain securities investment funds. The promotion period is from August 1st, 2024 to December 31st, 2024. During the promotion period, front-end sales (申购) and regular savings (定投) fees for the mentioned funds will enjoy a 10% discount when purchased through Minsheng Bank's counters, online banking, and mobile banking channels. Fixed amount subscription fees will not enjoy this discount.

This time, Minsheng Bank released 9 public fund products, mainly from GF series, including GF Diversified Emerging (Product Code: 003745.OF), and GF Balanced Growth A (Product Code: 010534.OF), among others.

In addition, the reporter also noticed that since August, Hua Xia Bank has also released similar fund rate discount information, but it involves bond-type products. On August 22, Hua Xia Bank issued an announcement about the rate discount activity for E Fund Enhanced Return Bond A.

In the announcement, Hua Xia Bank stated that in order to better serve institutional customers, and after consultation with E Fund Management Co., Ltd., starting from August 23, 2024, the bank will launch a 10% discount rate for the purchase of E Fund Enhanced Return Bond A (fund code: 110017) sold by Hua Xia Bank. The discount activity period will be from August 23, 2024, and the end time will be subject to the specific announcement from Hua Xia Bank. During the discount activity period, institutional customers can enjoy a 10% discount on the fund purchase handling fee when purchasing E Fund Enhanced Return Bond A (fund code: 110017) through Hua Xia Bank's "Hua Xia e-house" institutional platform. The original fund purchase rate is based on a fixed fee per transaction, which will continue to be charged at the original fixed fee.

A macro analyst from a certain brokerage told Caixin that public funds have collected a large amount of management fees, which are often criticized after losses. However, these fees are objectively allocated in various ways and are not solely for the benefit of fund managers. The fees obtained by banks and other distribution channels are also considerable.

There is a debate in the market about whether investors should redeem Liu Gesong's products, and some people believe that they should continue to hold on and wait for a break-even. In response, Yu Zhi believes that whether to continue holding or choose to redeem is the investor's own right and choice. Based on the current market situation, no one can guarantee that funds that are currently losing will definitely recover or be profitable in the future. Both choices involve uncertainties, and investors need to make rational decisions.

财联社记者注意到,就在8月26日,中国民生银行发文称,对部分证券投资基金开展交易费率1折优惠。其中,首当其冲的就是代码012967的“广发行业严选三年持有A”。

财联社记者注意到,就在8月26日,中国民生银行发文称,对部分证券投资基金开展交易费率1折优惠。其中,首当其冲的就是代码012967的“广发行业严选三年持有A”。