① Nvidia will release a performance report after closing; ② Berkshire's market capitalization is approaching the $1 trillion mark; ③ Ideal Auto's net profit fell 44.9% year on year; ④ BOSS Direct Hire Q2 revenue rose 28.8% year on year.

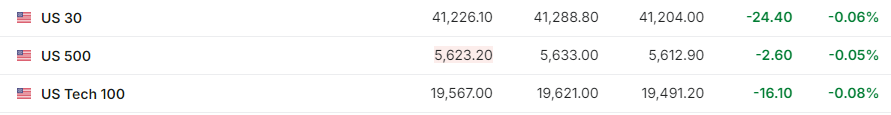

Financial Services, August 28 (Editor: Zhao Hao) Futures of the three major indices fell slightly before the US stock market on Wednesday (August 28). As of press release, Dow Jones futures were down 0.06%, S&P 500 futures were down 0.05%, and Nasdaq 100 futures were down 0.08%.

On the previous trading day, the three major indices collectively closed slightly higher, and the Dow Jones Industrial Average, which represents blue-chip stocks, continued to hit record highs. Looking ahead to the future market, traders are anxiously awaiting US chip giant Nvidia's results report for the second fiscal quarter of fiscal year 2025.

The analysis points out that Nvidia has become a barometer of artificial intelligence (AI) technology. Recently, there are some rumors that AI spending is suspected to be slowing down. Investors want to know if Nvidia will reflect this sign. Whether the company's performance is good or bad, it will probably cause a huge shock in US stocks.

The analysis points out that Nvidia has become a barometer of artificial intelligence (AI) technology. Recently, there are some rumors that AI spending is suspected to be slowing down. Investors want to know if Nvidia will reflect this sign. Whether the company's performance is good or bad, it will probably cause a huge shock in US stocks.

Earlier, the UBS analyst team reported that the shipment of the first batch of Blackwell chips was delayed by at most 4 to 6 weeks (that is, until the end of January 2025). In this earnings report, the impact of Blackwell's chip delays will receive special attention and may dampen the company's amazing growth story.

In terms of individual stocks, Berkshire Class B shares rose slightly by 0.1% before the market, and the company's total market value is approaching the $1 trillion mark. It is expected to become the ninth company in the world to join the “trillion dollar market capitalization club”; Bank of America, which continues to be sold off by Berkshire, fell nearly 0.6%.

Nordstrom, whose performance exceeded expectations, once rose more than 7%, but now the increase has narrowed to around 1.3%; semiconductor developer Ambarella (Ambarella), which raised its Q3 performance outlook, rose nearly 19%; CK's parent company PVH's outlook was disappointing, and its stock price fell more than 8%.

The European stock market, which is currently being traded, had mixed ups and downs. The German DAX30 index is now up 0.54%, the UK FTSE 100 index is down 0.29%, and the French CAC40 index is up 0.39%.

Company news

[Nasdaq says it is seeking regulatory approval to launch and trade Bitcoin Index options]

Nasdaq said it is seeking regulatory approval to launch and trade Bitcoin index options. The US Securities and Exchange Commission (SEC) has yet to approve any single Bitcoin exchange-traded fund (ETF) based options, including Nasdaq's application.

[Adjusted net profit attributable to shareholders of Ideal Auto in the second quarter was 1.5 billion yuan, down 44.9% year on year]

Ideal Auto's second-quarter revenue was RMB 31.7 billion, up 10.6% year on year, with market estimates of RMB 31.42 billion; adjusted net profit attributable to shareholders for the second quarter was RMB 1.5 billion, down 44.9% year on year; adjusted revenue per ADS was RMB 1.42, 2.58 yuan for the same period last year; gross margin was 19.5%, or 21.8% for the same period last year. Ideal Auto is expected to deliver 145,000 to 155,000 vehicles in the third quarter, with an estimated 13,7725 vehicles; total revenue for the third quarter is estimated to be 39.4-42.2 billion yuan, an increase of 13.7-21.6% over the previous year.

[BOSS direct employment in the second quarter of 2024: revenue of 1.917 billion yuan, up 28.8% year over year]

BOSS Direct Hiring released financial results for the second quarter of 2024. Under non-GAAP, net profit of 0.417 billion yuan was achieved, up 34.8% year on year. In the second quarter, the company achieved revenue of 1.917 billion yuan, up 28.8% year on year. In the same period, the number of paying corporate customers reached a new all-time high. In the 12 months ended June 30, 2024, the number of paying corporate customers reached 5.9 million, an increase of 31.1% over the previous year.

[Baozun E-commerce: Second quarter revenue of 2.39 billion yuan, net loss of 3.9 million yuan]

Baozun E-Commerce announced unaudited financial results for the second quarter of 2024. Total net revenue was 2.39 billion yuan, up 3.1% year over year; net loss attributable to shareholders under non-GAAP was 3.9 million yuan, compared to 4.4 million yuan for the same period in 2023. The net diluted loss per share of American Depositary Shares attributable to common shareholders of Baozun E-Commerce Co., Ltd. under non-GAAP was RMB 0.06 (US$0.01), compared to RMB 0.07 for the same period in 2023.

[Huanju Group's second-quarter revenue increased 3.3% year-on-year to 0.565 billion US dollars, higher than expected]

Huanju Group's net revenue for the second quarter was 0.5651 billion US dollars, up 3.3% year on year, and estimated at 0.5514 billion US dollars; of these, live streaming revenue was 0.4597 billion US dollars, a decrease of 3.6% year on year, and an estimated 0.4463 billion US dollars. The company's adjusted net income per ADS share for the second quarter was US$1.17, estimated at US$0.87. Net profit attributable to Huanju Group's controlling interests was US$52.1 million. The gross margin for the second quarter was 35.2%, compared to 36.1% in the same period last year, and is estimated at 34.6%.

[Trial production of BMW's “new generation” models will soon be domestically produced in 2026]

The BMW Group announced today that its “new generation” models will begin trial production at BMW's new plant in Debrecen, Hungary this fall. The factory's paint shop was first put into use on August 27. In China, trial production of sixth-generation power battery systems for new-generation models will begin before the end of this year, and the first new-generation model will be officially put into operation in Shenyang in 2026.

Notable events during the US stock market (Beijing time)

August 28

22:30 EIA commercial/strategic crude oil inventory for the week from the US to August 23

23:30 US to August 28 4-month treasury bond auction

August 29

01:00 US 5-year treasury bond auction until August 28

06:00 Atlanta Federal Reserve Chairman Bostic (2024 FOMC Voting Committee) delivered a speech on the economic outlook

分析指出,英伟达已经成为了人工智能(AI)技术的晴雨表,近期由于AI支出热潮疑似出现了一些放缓的流言,投资者想知道英伟达是否会反映这一迹象。该公司业绩可能无论好坏,都会引发美股的巨震。

分析指出,英伟达已经成为了人工智能(AI)技术的晴雨表,近期由于AI支出热潮疑似出现了一些放缓的流言,投资者想知道英伟达是否会反映这一迹象。该公司业绩可能无论好坏,都会引发美股的巨震。