Twin Vee Powercats Co. (NASDAQ:VEEE) shareholders that were waiting for something to happen have been dealt a blow with a 33% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 76% share price decline.

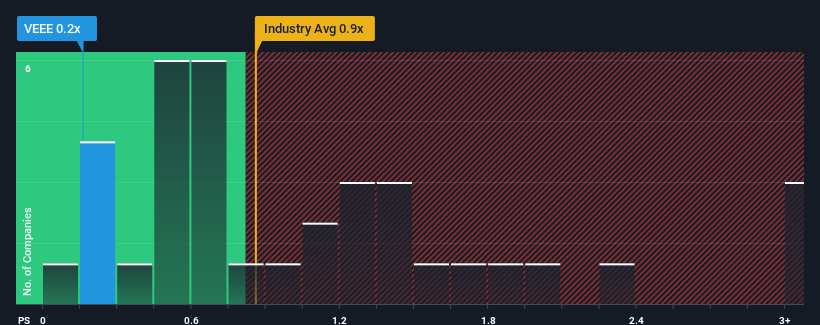

Following the heavy fall in price, when close to half the companies operating in the United States' Leisure industry have price-to-sales ratios (or "P/S") above 0.9x, you may consider Twin Vee Powercats as an enticing stock to check out with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

What Does Twin Vee Powercats' P/S Mean For Shareholders?

For example, consider that Twin Vee Powercats' financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Twin Vee Powercats, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Twin Vee Powercats would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Twin Vee Powercats would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 25%. Still, the latest three year period has seen an excellent 97% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 1.8% shows it's a great look while it lasts.

In light of this, it's quite peculiar that Twin Vee Powercats' P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Twin Vee Powercats' P/S?

Twin Vee Powercats' recently weak share price has pulled its P/S back below other Leisure companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Twin Vee Powercats revealed that despite growing revenue over the medium-term in a shrinking industry, the P/S doesn't reflect this as it's lower than the industry average. There could be some major unobserved threats to revenue preventing the P/S ratio from matching this positive performance. The most obvious risk is that its revenue trajectory may not keep outperforming under these tough industry conditions. It appears many are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Twin Vee Powercats, and understanding these should be part of your investment process.

If you're unsure about the strength of Twin Vee Powercats' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.