① In the first half of 2024, Liyang Chip achieved operating income of 0.231 billion yuan, a year-on-year decrease of 5.51%, and net profit changed from profit to loss; ② Liyang Chip said in the financial report that demand for consumer terminals has improved, but testing demand for high computing power, industrial control, and communication has decreased. On the cost side, fixed costs continued to rise due to the gradual release of production capacity from the previous layout.

“Science and Technology Innovation Board Daily”, August 28 (Reporter Guo Hui) Liyang Chip, a third-party chip testing service company, released its financial report for the first half of 2024.

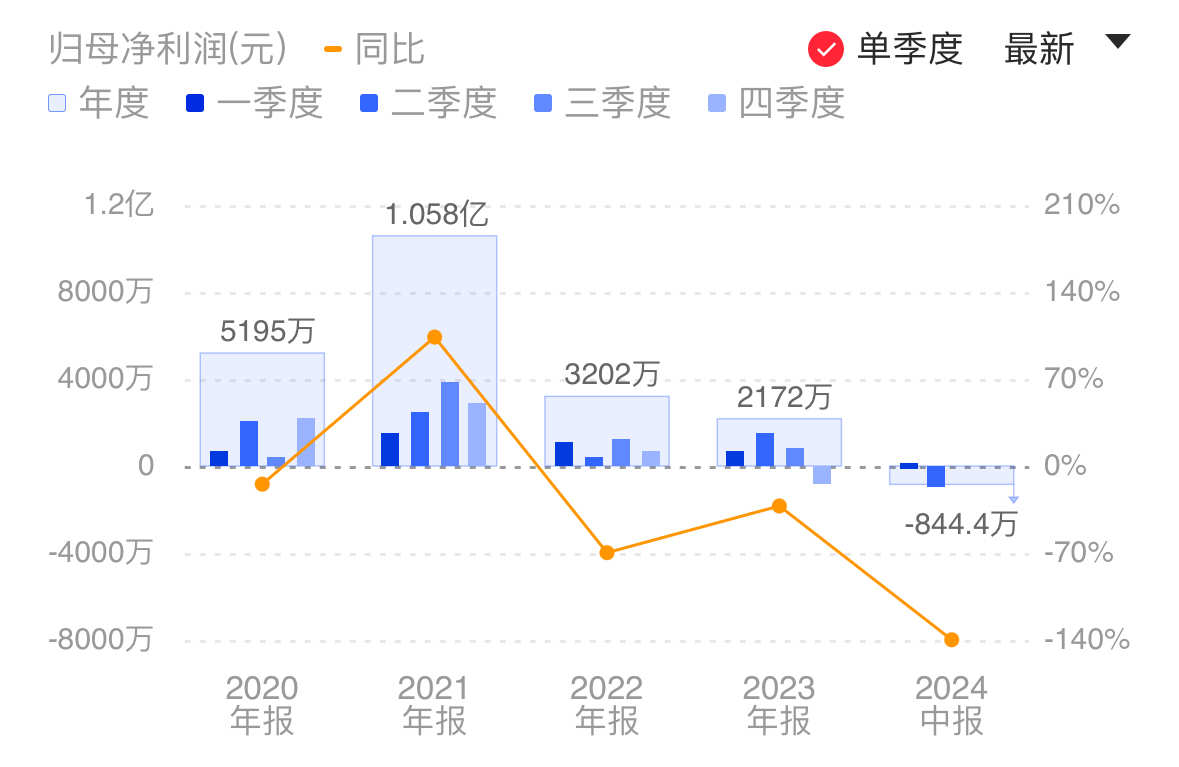

According to the data, in the first half of 2024, Liyang Chip achieved operating income of 0.231 billion yuan, a year-on-year decrease of 5.51%; realized net profit to mother of 8.4442 million yuan, a year-on-year decrease of 139.81%.

The “Science and Technology Innovation Board Daily” reporter combed through and compared A-share semiconductor packaging and testing sector companies and noticed that under the pace of recovery in the semiconductor industry, most companies achieved positive growth in the first half of the year. Among them, only the performance of Liyang Chip, Blue Rocket Electronics, Dagang Co., Ltd., and Hualing Co., Ltd. declined year on year.

Liyang Chip said in its financial report that demand for consumer terminals has indeed improved, driving an increase in customer testing demand for some categories of consumer products — such as AIoT, smart phones, storage, satellite communications, etc., and related chip testing revenue has increased dramatically over the same period last year.

However, Liyang Chip also said that demand for tests such as high computing power, industrial control, and communication has declined. Affected by this, revenue from this type of test has declined to varying degrees.

In the first half of the year, Liyang Chip's net profit changed from profit to loss. In response, the company said that its revenue fell short of expectations in the first half of the year, but on the cost side, fixed costs such as depreciation, amortization, labor, electricity, plant costs, and maintenance costs continued to rise due to the gradual release of production capacity from the previous layout; on the other hand, due to a sharp increase in consumer chip shipments compared to the same period last year, costs increased due to the corresponding increase in the amount of accessories used.

Financial reports show that in the first half of this year, the company's operating costs were 0.174 billion yuan, an increase of 12.0079 million yuan over the same period of the previous year, an increase of 7.40% over the previous year, accounting for 75.50% of revenue, while revenue decreased by 13.4541 million yuan compared to the same period last year.

The gross margin of Liyang Chip in the first half of the year was 24.50%, down 9.08 percentage points from the same period last year.

In July 2024, Liyang Chip officially issued convertible bonds and raised 0.52 billion yuan, of which 0.49 billion will be invested to expand chip testing capacity. After construction is completed, it will add about 1 million hours of CP testing service and about 1.14 million hours of FT testing service production capacity. The project has pre-invested capital prior to the official issuance of convertible bonds.

According to financial reports, Liyang Chip's fixed asset depreciation accrued 81.916 million yuan in the first half of the year, compared to 69.91 million yuan in the same period last year.

In the risk alert section, Liyang Chip said that with continuous investment in test production capacity, the continuous increase in fixed asset size will lead to a continuous increase in fixed costs such as average annual depreciation and amortization expenses, but since production capacity climbing requires a certain period of time, if future market demand growth is lower than expected or market development is poor, it may cause the initial production capacity investment to not generate benefits quickly to make up for additional fixed costs, and there is a risk of decline or loss in performance.

At present, Liyang Chip has developed a total of 44 types of chip testing solutions, and has completed mass production tests for nearly 6,000 chip models, which can be applied to the testing needs of different terminal application scenarios.

Liyang Chip is using its subsidiary Liyang Core to lay out businesses such as wafer thinning. According to the company's announcement, Liyangxin has signed a contract for wafer thinning and related supporting services. The estimated amount is 65 million. Currently, the contract is being executed normally with the customer.

In addition, Liyang Chip also recently announced that its wholly-owned subsidiary Shanghai Optoelectronics Co., Ltd. signed an agreement with Shanghai Diecheng Optoelectronics Technology Co., Ltd. to exclusively provide process technology services such as heterogeneous wafer lamination and testing of ultra-wide spectral laminated image sensing chips.