The chip giant will announce its quarterly earnings after the US stock market on Wednesday; investors are closely watching the forward-looking guidance and the expected delivery of Blackwell architecture AI chips.

Since OpenAI launched the stunning ChatGPT, the undisputed leader in the field of AI chips.$NVIDIA (NVDA.US)$The total market value has skyrocketed by nearly 3 trillion US dollars in about two years. It is no exaggeration to say that NVIDIA has almost single-handedly reshaped the core framework of the entire US stock market. The theme of "artificial intelligence" has driven the entire US stock market to reach new highs, resulting in this AI chip giant having an immense influence on a series of stock benchmark indexes or industry indexes.

Wall Street's top investment institutions witnessed this turbulence in the US stock market earlier this month, as well as the subsequent wave of "super rebound", in which the major US stock market benchmark -$S&P 500 Index (.SPX.US)$Expanded by as much as 4 trillion US dollars in market value from August 5th to August 23rd, while NVIDIA's stock price soared by more than 28% in just three weeks.

NVIDIA's financial report undoubtedly concerns global technology stock investors' faith in AI. Its financial data and outlook for the next quarter's performance will likely directly determine the short- to medium-term momentum of global technology stocks. Data shows that the stock has risen by approximately 150% year-to-date, accounting for about one-quarter of the 18% increase in the S&P 500 index this year. NVIDIA's performance can be said to have a tremendously significant impact on the entire US stock market.

NVIDIA's financial report undoubtedly concerns global technology stock investors' faith in AI. Its financial data and outlook for the next quarter's performance will likely directly determine the short- to medium-term momentum of global technology stocks. Data shows that the stock has risen by approximately 150% year-to-date, accounting for about one-quarter of the 18% increase in the S&P 500 index this year. NVIDIA's performance can be said to have a tremendously significant impact on the entire US stock market.

In addition, investors behind the surge in electric power stocks, data center REITs, and some renewable energy stocks this year are also focusing on NVIDIA's financial report. These sectors all directly benefit from this unprecedented wave of AI investment, and NVIDIA's performance will determine whether this AI frenzy can successfully continue. Therefore, almost all AI-related stocks or sectors will be greatly affected by NVIDIA's performance.

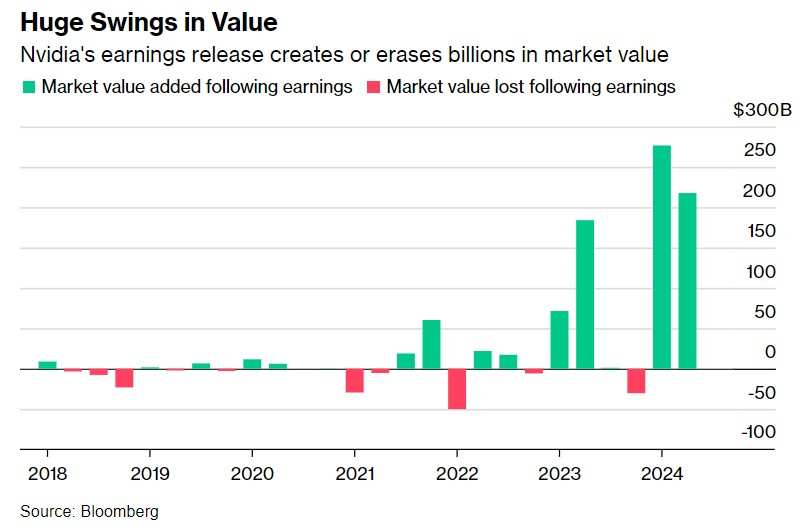

Now, with the highly anticipated NVIDIA quarterly earnings set to be released after the closing of the US stock market on Wednesday, traders will be closely watching their screens and preparing for any significant fluctuations. The general consensus among Wall Street investment firms is that after the release of NVIDIA's fiscal Q2 2025 performance report in July, it is expected to create or erase a market cap of up to several hundred billion USD.

Some analysts believe that considering Nvidia's market cap of approximately $3.15 trillion, the stock's close to 10% volatility could translate into a volatility of approximately $310 billion, which could be the largest expected volatility of any company in history after announcing earnings.

Based on the latest options market bets, NVIDIA's performance is expected to cause its stock price to soar or plummet by nearly 10% in either direction - a move that could reshuffle approximately 300 billion USD in market cap. And this is just its own market cap change, with substantial volatility expected for all AI-related stocks. Therefore, NVIDIA's performance directly determines whether the '4 trillion dollar rebound' wave in the US stock market can continue to surge forward. According to Wall Street analysts' expectations, NVIDIA's performance is expected to lead the way for the '4 trillion-dollar rebound' to continue its conquest.

Data shows that this AI chip giant holds a staggering 6.7% weight in the S&P 500 index, making it the second largest global market-cap company in this widely recognized stock benchmark, second only to Apple Inc. Nvidia's weight in the index, also known as the "global technology stock barometer", is over 8%.$NASDAQ 100 Index (.NDX.US)$...$PHLX Semiconductor Index (.SOX.US)$With a weight of up to 14%.

"For investors, Nvidia is obviously the purest and cleanest way to assess the health and development process of the core infrastructure of artificial intelligence," said John Belton, portfolio manager at Gabelli Funds. "Therefore, Nvidia's performance is closely watched by global investors because they have the most direct interpretation of many companies in the AI value chain."

Investors are seeking continued revenue growth.

In the performance reports of Google parent company Alphabet Inc. and companies like the AI darling, the revenue growth pace will be the focus of Nvidia's performance, and the market expects Nvidia's revenue, especially the revenue of the datacenter business, to continue to grow rapidly.$Amazon (AMZN.US)$After the performance reports of Google parent company Alphabet Inc. and companies like the AI darling showed that the huge AI-related capital expenditure had a relatively insignificant impact on their revenue data, the revenue growth pace became the focus of Nvidia's performance, and the market expects Nvidia's revenue, especially the revenue of the datacenter business, to continue to grow rapidly.

So far this year, this AI chip giant has consistently exceeded market expectations for five consecutive quarters and has promised even greater scale of returns in the future. Nvidia has become the main beneficiary of billions of dollars in AI spending, so any slight deviation from this trend will trigger investors' comprehensive doubts about the prospects of this technology.

At the same time, this crucial role has effectively transformed once unknown chip companies into an important indicator of the overall economic strength of the United States.

"Actually, it (Nvidia) shouldn't be an economic bellwether," said Sana Siegel, founder and president of Banríon Capital Management. "But it has indeed become a center, mainly because its scale and stock trend have an impact on the entire market."

Wall Street analysts generally expect Nvidia's quarterly revenue to reach around $29 billion, more than double last year's performance report. They expect future sales guidance to be raised again, but there is a new challenge - the company must provide the latest progress in the case of reports of possible delivery delays and design flaws in its highly anticipated Blackwell architecture AI chip, and this progress must convince AI enthusiasts to continue buying Nvidia stocks or call options. The company announced in early August that it expects Blackwell architecture AI chip production to increase according to the established target in the second half of the year.

On Wall Street, top investment bank Goldman Sachs recently backed Nvidia's financial report and gave revenue forecasts higher than the market's general expectations. The bank predicts that Nvidia's Q2 revenue will reach $29.769 billion and earnings per share of $0.68, exceeding market expectations by 4.1% and 5.9% respectively. Goldman Sachs believes that the Q2 financial report will show strong demand from major global companies for Nvidia's Hopper architecture H100 GPU, and the upgraded H200 is expected to be mass-produced driven by strong demand.

Another top investment bank, Morgan Stanley, expressed extreme optimism about Nvidia's performance in their research report on August 25, stating, 'We expect this to be a strong quarter and may well exceed high market expectations.' The Morgan Stanley analysis team also pointed out that if Nvidia's revenue exceeds expectations, AI-related stocks may have a potential upside of 3-15%. Conversely, if it falls short of expectations, the entire AI-related stock market may experience a potential downside of 5-10%.

However, Morgan Stanley advises investors who are fond of technology stocks not to give up on AI-related stocks even if Nvidia's financial report or next quarter's performance guidance disappoints. Morgan Stanley believes that the stock prices of AI-related companies have already adjusted after the August sell-off and are still far from reaching the extreme valuation levels seen during the bursting of the internet bubble.

Global investors may dissect Huang Renxun's remarks word by word.

According to Morgan Stanley's report, whether Nvidia's Q3 performance guidance meets market expectations may not have a significant impact on the stock's trend. The real influence on the stock's trend will be whether the management can alleviate any concerns among investors regarding potential delivery delays of Blackwell due to chip design adjustments.

Nvidia CEO Huang Renxun previously stated in May that the Blackwell architecture chip would be shipped in the second quarter of this year. However, earlier this month, The Information reported that the company is facing delivery delays of Blackwell caused by design issues, which could postpone a large amount of shipments to the first quarter of 2025.

'Concerns about any delays in the shipment of Blackwell architecture AI chips may affect the market's performance expectations for Nvidia's fiscal year 2025, making management comments under Huang Renxun's leadership - especially optimistic forecasts of the 2025 outlook and delivery and demand expectations for Blackwell architecture AI chips - crucial.' wrote the Bloomberg Intelligence analyst team led by Kunjan Sobhani in a report on August 21.

Howard Chen, CEO of Kurv Investment Management, stated that any comments on the progress of Blackwell during the earnings call will be closely analyzed by the market, just like the announcements from the Federal Reserve. 'Everyone will carefully consider every word,' he emphasized.

HSBC's analysis team wrote in a report in August: "We expect Nvidia to reduce its focus on the Blackwell architecture B100/B200 AI GPU in the second half of the year and instead increase its focus on the H200 capacity based on the Hopper architecture."

Analysts and investors will also focus on Nvidia's upgraded version of the H100 AI chip, the H200, which may offset the revenue impact of Blackwell architecture chip delivery delays. If the chip products currently launched by Nvidia can achieve performance that is not inferior to expectations, it is likely to indicate a promising future for the next-generation performance-upgraded Blackwell chip products.

"If they achieve very good results here, this could be a good sign, and these results are due to strong global demand for the H200," said Bellton from Gabelli. "This may paint an encouraging picture for incremental demand expectations for Blackwell next year."

Of course, it is undeniable that Wall Street is still very optimistic about the prospects of Nvidia's stock. According to data collected by institutions, the stock has 66 "buy" ratings, 8 "hold" ratings, and 0 "sell" ratings. The target stock price within 12 months is approximately $145, which means that the potential increase from the current trading price is about 13%.

Nvidia's valuation has also suffered a significant collapse due to the August tech stock plunge, with a harmonized forward P/E ratio of about 38x, lower than June's 44x and over 60x last year. The forward P/E ratio of the S&P 500 index is about 21x.

Concerns about how long the market's massive spending on artificial intelligence will continue and when AI will be monetized, as well as concerns about demand for the Blackwell chip and its delivery schedule, weighed down Nvidia's stock during the lows of August. However, the rebound since then suggests that investors are still willing to buy the stock on dips, as the frenzy of large tech companies' AI infrastructure layout shows no sign of stopping.

Bellton said, "I think the bar for beating expectations has been raised in the past few quarters." "If you think about the situation of all the large tech stocks in this earnings reporting cycle, I think the market is definitely hoping to see healthy outperformance data and significantly better-than-expected outlook."

Editor/Emily

英伟达这份财报无疑关乎着全球科技股投资者对于AI的信仰,其财报数据以及对于下一财季的业绩展望大概率直接决定全球科技股至少短中期内的股价势头。数据显示,今年以来,该股上涨了约150%,贡献了标普500指数今年以来18%涨幅中的约四分之一,可以说英伟达业绩对整个美股市场有无比重大的影响。

英伟达这份财报无疑关乎着全球科技股投资者对于AI的信仰,其财报数据以及对于下一财季的业绩展望大概率直接决定全球科技股至少短中期内的股价势头。数据显示,今年以来,该股上涨了约150%,贡献了标普500指数今年以来18%涨幅中的约四分之一,可以说英伟达业绩对整个美股市场有无比重大的影响。