Hive Digital Technologies Ltd (NASDAQ:HIVE) has been buzzing in the financial markets, despite the stock being down 23.69% year-to-date and slipping 2.62% over the past year. In the last month alone, HIVE has dipped 9.21%.

But wait—there's more to the story. On Aug. 13, HIVE reported a surprise earnings beat that has investors taking a second look. The company posted quarterly earnings of 3 cents per share, a whopping 400% above the analyst consensus estimate of a negative 1 cent per share. This impressive turnaround is highlighted by a 115.79% increase from the negative 19 cents loss per share reported in the same quarter last year.

Sales also surged, reaching $32.20 million, outpacing the analyst consensus estimate of $24.32 million by 32.40%. This marks a 36.64% increase over the $23.57 million in sales recorded during the same period last year.

With these strong financial results, Hive stock seems to be buzzing back to life—but does the technical outlook support this newfound optimism?

Golden Cross Alert: Is HIVE Stock Ready To Soar?

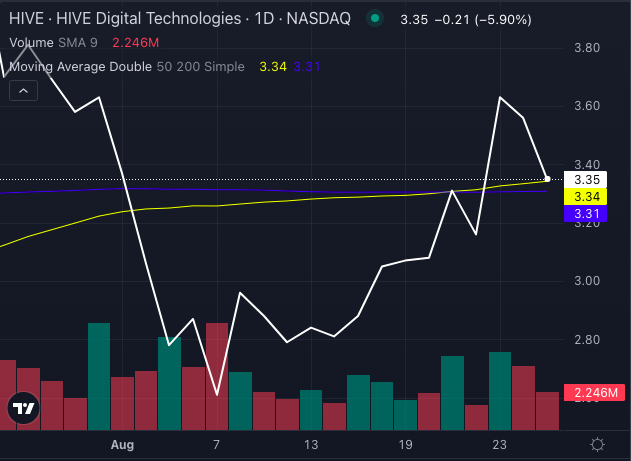

On the technical front, Hive stock has just triggered a Golden Cross, a bullish signal that occurs when the 50-day moving average crosses above the 200-day moving average.

Chart created using Benzinga Pro

This pattern suggests potential upward momentum, which could spark a rally if sustained.

Currently trading at $3.35, Hive stock's price sits above several key moving averages, indicating a bullish stance.

Chart created using Benzinga Pro

Hive stock is showing a bullish signal, as its current price is above key moving averages, including the 8-day SMA at $3.28, 20-day SMA at $3.08, 50-day SMA at $3.34, and 200-day SMA at $3.31.

Read Also: HIVE Digital Technologies Q1 EPS $0.03 Beats $(0.01) Estimate, Sales $32.20M Beat $24.32M Estimate

Moderately Bullish, But Watch For Overbought Signals

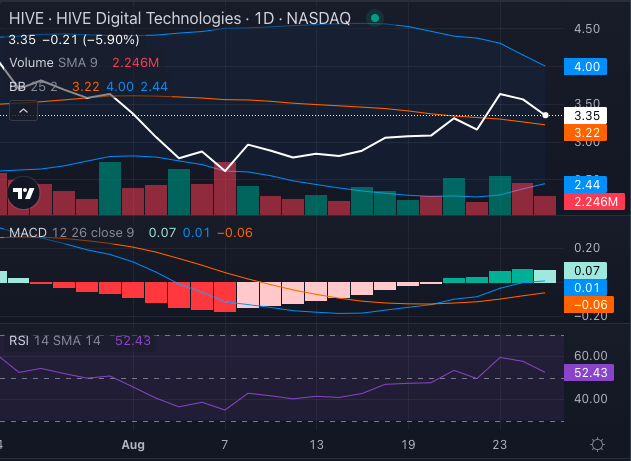

While the golden cross has lit up bullish indicators, the current trend is only moderately bullish, with some slight selling pressure evident.

Chart created using Benzinga Pro

The MACD indicator reads at 0.01, a neutral yet positive signal hinting at potential bullish movement. However, caution is warranted as the Relative Strength Index (RSI) is at 52.43, indicating a moderate momentum that is rising, but still comfortably within the neutral range, suggesting that the stock is not yet approaching overbought territory.

The Bollinger Bands also suggest a possible squeeze with a range between $2.44 and $4.00, signaling potential volatility ahead.

Cautious Optimism For HIVE Stock Investors

Despite the recent dip in Hive's stock price, the earnings beat and the formation of a golden cross suggest there could be more upside ahead.

However, investors should be mindful of the overbought signals and prepare for possible short-term volatility.

For now, Hive stock seems to be in a cautiously bullish position—let's see if it can sustain the buzz!

- PVH, nCino, Marathon Digital And Other Big Stocks Moving Lower In Wednesday's Pre-Market Session

Photo: rafapress/Shutterstock.com