High-rolling investors have positioned themselves bullish on Citigroup (NYSE:C), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in C often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 14 options trades for Citigroup. This is not a typical pattern.

The sentiment among these major traders is split, with 64% bullish and 35% bearish. Among all the options we identified, there was one put, amounting to $57,600, and 13 calls, totaling $3,419,602.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $45.0 to $70.0 for Citigroup over the recent three months.

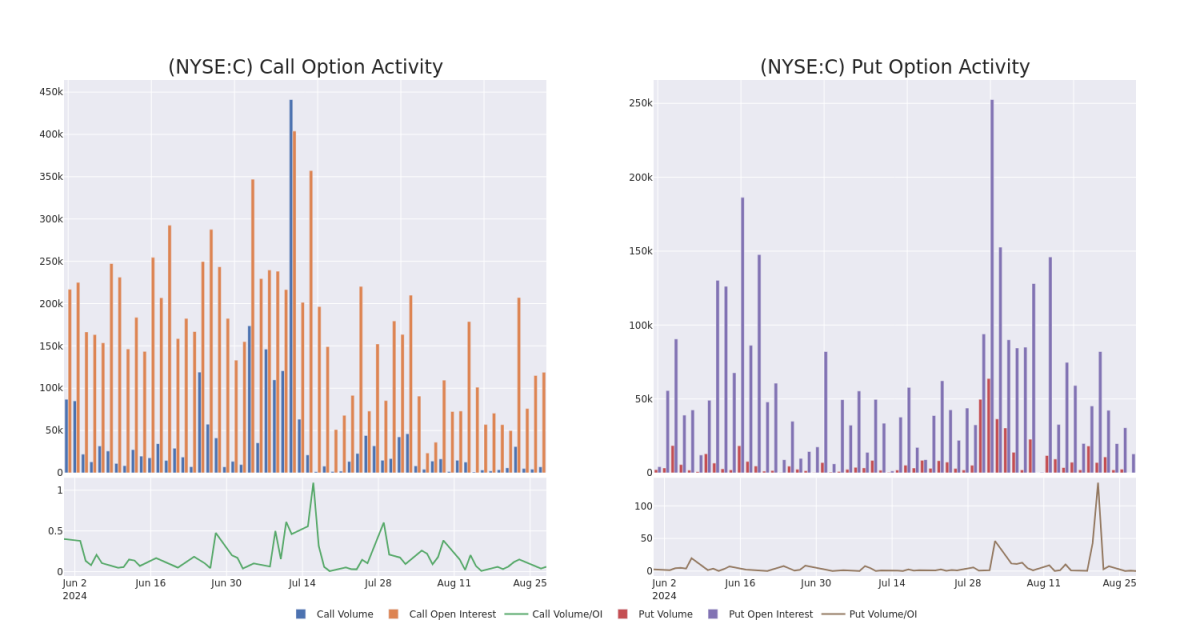

Volume & Open Interest Trends

In today's trading context, the average open interest for options of Citigroup stands at 16450.88, with a total volume reaching 7,045.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Citigroup, situated within the strike price corridor from $45.0 to $70.0, throughout the last 30 days.

Citigroup Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| C | CALL | TRADE | BEARISH | 01/17/25 | $7.2 | $7.1 | $7.11 | $57.50 | $2.4M | 13.0K | 3.5K |

| C | CALL | SWEEP | BEARISH | 09/20/24 | $9.5 | $9.45 | $9.45 | $52.50 | $141.7K | 8.2K | 552 |

| C | CALL | SWEEP | BEARISH | 09/20/24 | $9.55 | $9.5 | $9.5 | $52.50 | $123.5K | 8.2K | 702 |

| C | CALL | SWEEP | BULLISH | 09/20/24 | $9.5 | $9.45 | $9.5 | $52.50 | $114.0K | 8.2K | 392 |

| C | CALL | TRADE | BEARISH | 01/17/25 | $2.92 | $2.9 | $2.9 | $65.00 | $107.3K | 46.5K | 386 |

About Citigroup

Citigroup is a global financial-services company doing business in more than 100 countries and jurisdictions. Citigroup's operations are organized into five primary segments: services, markets, banking, US personal banking, and wealth management. The bank's primary services include cross-border banking needs for multinational corporates, investment banking and trading, and credit card services in the United States.

In light of the recent options history for Citigroup, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Citigroup

- Currently trading with a volume of 2,762,746, the C's price is down by -0.44%, now at $61.41.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 44 days.

What Analysts Are Saying About Citigroup

In the last month, 1 experts released ratings on this stock with an average target price of $79.0.

- An analyst from Morgan Stanley has decided to maintain their Overweight rating on Citigroup, which currently sits at a price target of $79.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.