The market fell Wednesday ahead of Nvidia earnings tonight. We will work as fast as possible in the News Room to bring you Nvidia's results as soon as they drop; tune in live for the earnings call tonight. Analysts tracked by Bloomberg expect adjusted earnings of $0.65/share on revenue of $28.86B; we will update you on the estimates and numbers throughout the day.

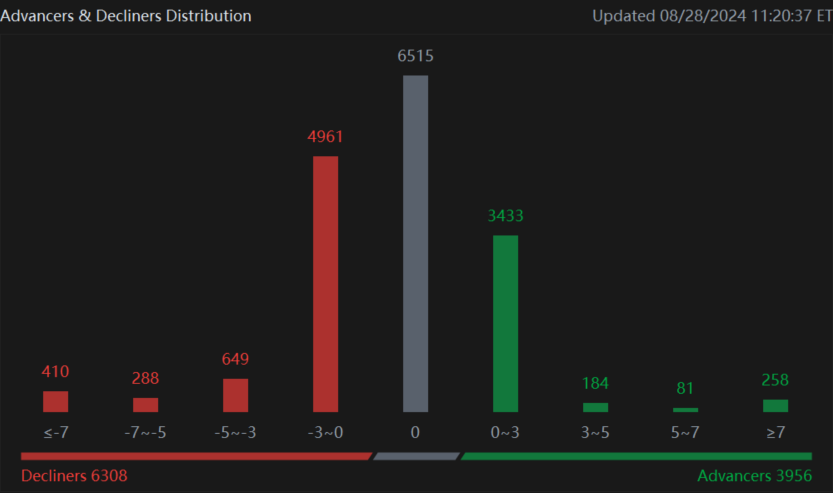

Index prices reflected traders holding their breath. Just before 4 pm ET, the $S&P 500 Index (.SPX.US)$ traded -0.60%, the $Dow Jones Industrial Average (.DJI.US)$ fell 0.39%, and the $Nasdaq Composite Index (.IXIC.US)$ shed 1.12%.

Every sector on the S&P 500 was in the green Friday after the Federal Reserve rate cut news, but since reaching a hair length of records, prices have stayed put in the past two trading sessions. Fed President Jerome Powell did not specify the timeline of these rate cuts, but he said he was confident the economy was on the way to 2% inflation. "The time has come to adjust, and the direction is clear," Powell said.

This week in macro, investors can look forward to more macroeconomic data that might inform how the FOMC will decide on rate cuts. CB Consumer Confidence came out Tuesday morning, showing a jump in expectations. Crude Oil Inventories came out Wednesday morning, showing a cut of 800,000 barrels compared to last week's drop of 4 million.

This week in macro, investors can look forward to more macroeconomic data that might inform how the FOMC will decide on rate cuts. CB Consumer Confidence came out Tuesday morning, showing a jump in expectations. Crude Oil Inventories came out Wednesday morning, showing a cut of 800,000 barrels compared to last week's drop of 4 million.

Investors are awaiting a speech from Atlanta Fed President Raphael Bostic after 6 p.m. ET. Continuing and Initial Jobless claims will drop on Thursday alongside updated GDP numbers for the second quarter.

Friday will see the release of the July person Consumption Expenditure index (PCE), the Fed's favorite inflation measure. Last time, the PCE came in at 2.6% year over year, the lowest since 2021. Michigan consumer expectations and confidence will also drop on Friday.

Interested in Options? To see these stocks and more on the options page, click here. Want to learn more about options, check out moomoo education with this link. Click here to join our exclusive options chat with personal callouts from our resident expert, Invest with Sarge.

Yesterday, users were commenting on PDD, and how hard they were hit by this season earning reacitons.

Traders, what do you think, is the market in 2024 about following the herd? What you watching on the stock market today? What is the herd following? Let me know in the comments below!

Disclaimer: This content is for informational use only and is not a recommendation or endorsement of any particular investment or strategy. Indexes are unmanaged and cannot be directly invested into. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors' financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances, before making any investment decisions. Past performance does not indicate or guarantee future success. Moomoo makes no representation or warranty as to its adequacy, or timeliness for any particular purpose of the above content. The data and information provided has been obtained from sources considered to be reliable, but moomoo does not guarantee that the foregoing material is accurate or complete. See the link in the Moovers Community post for more information.