Goldman Sachs Gr Unusual Options Activity For August 28

Goldman Sachs Gr Unusual Options Activity For August 28

Deep-pocketed investors have adopted a bullish approach towards Goldman Sachs Gr (NYSE:GS), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in GS usually suggests something big is about to happen.

資金雄厚的投資者對高盛集團(NYSE:GS)採取了看好的策略,市場參與者不應忽視這一點。本質上,我們在彭博社跟蹤到的公開期權記錄揭示了今天的重大舉動。這些投資者的身份尚不明確,但是在GS股票中進行如此大規模的交易通常意味着即將發生重大事情。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 16 extraordinary options activities for Goldman Sachs Gr. This level of activity is out of the ordinary.

我們從彭博社的期權掃描器顯示的16項非凡的高盛集團期權活動中獲取了這些信息。這種活躍程度是離奇的。

The general mood among these heavyweight investors is divided, with 56% leaning bullish and 25% bearish. Among these notable options, 9 are puts, totaling $417,817, and 7 are calls, amounting to $254,993.

這些大手筆投資者中的普遍情緒存在分歧,56%看好,25%看淡。在這些引人注目的期權中,有9項看跌期權,總價值達417,817美元,還有7項看漲期權,總價值254,993美元。

What's The Price Target?

目標價是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $200.0 to $520.0 for Goldman Sachs Gr during the past quarter.

分析這些合約的成交量和未平倉合約數量,似乎大戶已經將高盛集團在過去一個季度的價格區間定爲200.0美元至520.0美元之間。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

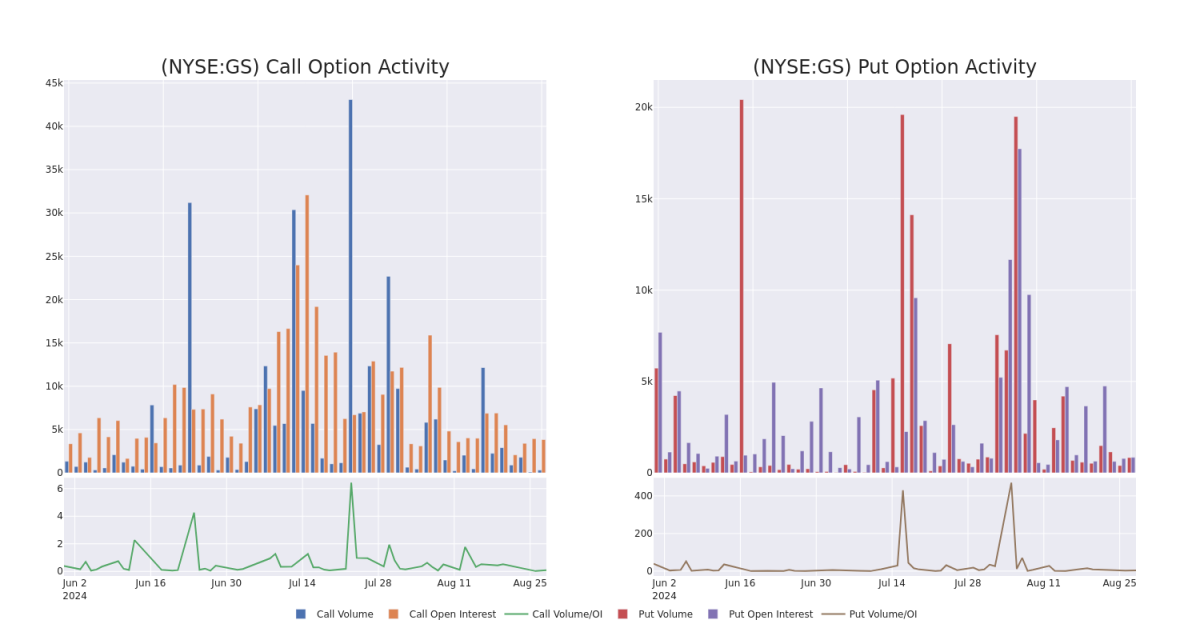

In today's trading context, the average open interest for options of Goldman Sachs Gr stands at 425.45, with a total volume reaching 1,101.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Goldman Sachs Gr, situated within the strike price corridor from $200.0 to $520.0, throughout the last 30 days.

在當天的交易環境中,高盛集團期權的平均未平倉合約爲425.45,總成交量達到1,101.00。伴隨的圖表勾畫了過去30天內高盛集團高價交易的看漲和看跌期權成交量和未平倉合約的變化情況,位於200.0美元至520.0美元之間的行權價走廊內。

Goldman Sachs Gr 30-Day Option Volume & Interest Snapshot

高盛集團30天期權成交量和利息快照

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GS | PUT | SWEEP | BULLISH | 11/15/24 | $30.8 | $28.95 | $29.3 | $520.00 | $64.5K | 163 | 22 |

| GS | PUT | TRADE | BULLISH | 11/15/24 | $29.75 | $29.05 | $29.26 | $520.00 | $61.4K | 163 | 43 |

| GS | PUT | SWEEP | BULLISH | 11/15/24 | $29.7 | $29.05 | $29.25 | $520.00 | $58.4K | 163 | 63 |

| GS | PUT | TRADE | BULLISH | 11/15/24 | $29.7 | $29.05 | $29.21 | $520.00 | $58.4K | 163 | 83 |

| GS | PUT | SWEEP | BULLISH | 11/15/24 | $26.95 | $26.25 | $26.46 | $515.00 | $52.9K | 56 | 20 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 高盛公司所有板塊成交量 | 看跌 | SWEEP | 看好 | 11/15/24 | $30.8 | $28.95 | $29.3 | $520.00 | $64.5K | 163 | 22 |

| 高盛公司所有板塊成交量 | 看跌 | 交易 | 看好 | 11/15/24 | $29.75 | $29.05 | $29.26 | $520.00 | $61.4K | 163 | 43 |

| 高盛公司所有板塊成交量 | 看跌 | SWEEP | 看好 | 11/15/24 | $29.7 | $29.05 | 29.25美元 | $520.00 | 58.4K美元 | 163 | 63 |

| 高盛公司所有板塊成交量 | 看跌 | 交易 | 看好 | 11/15/24 | $29.7 | $29.05 | $520.00 | 58.4K美元 | 163 | 83 | |

| 高盛公司所有板塊成交量 | 看跌 | SWEEP | 看好 | 11/15/24 | $26.95 | $26.25 | $515.00 | $52.9K | 56 | 20 |

About Goldman Sachs Gr

高盛集團簡介

Goldman Sachs is a leading global investment banking and asset management firm. Approximately 20% of its revenue comes from investment banking, 45% from trading, 20% from asset management and 15% from wealth management and retail financial services. Around 60% of the company's net revenue is generated in the Americas, 15% in Asia, and 25% in Europe, the Middle East, and Africa.

高盛是一家領先的全球投資銀行和資產管理公司。約20%的營業收入來自投資銀行業務,45%來自交易業務,20%來自資產管理業務,15%來自财富管理和零售金融服務。公司約60%的淨營收來自美洲,15%來自亞洲,25%來自歐洲、中東和非洲。

Following our analysis of the options activities associated with Goldman Sachs Gr, we pivot to a closer look at the company's own performance.

在我們分析和關注高盛期權活動之後,我們轉向更近距離地關注公司的表現。

Goldman Sachs Gr's Current Market Status

高盛集團的當前市場狀況

- Currently trading with a volume of 586,376, the GS's price is down by -0.83%, now at $503.04.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 48 days.

- RSI讀數表明該股票目前處於中立狀態,處於超買和超賣之間。

- 預計發佈收益爲48天后。

Expert Opinions on Goldman Sachs Gr

高盛的專家意見

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $530.5.

- An analyst from Morgan Stanley persists with their Overweight rating on Goldman Sachs Gr, maintaining a target price of $561.

- In a cautious move, an analyst from RBC Capital downgraded its rating to Sector Perform, setting a price target of $500.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Goldman Sachs Gr with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供更高的利潤潛力。精明的交易者通過不斷學習、戰略性的交易調整、利用各種因子以及保持對市場動態的關注來減輕這些風險。通過Benzinga Pro即時提醒了解高盛集團的最新期權交易。

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $200.0 to $520.0 for Goldman Sachs Gr during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $200.0 to $520.0 for Goldman Sachs Gr during the past quarter.