Financial giants have made a conspicuous bullish move on Caterpillar. Our analysis of options history for Caterpillar (NYSE:CAT) revealed 10 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 20% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $166,668, and 8 were calls, valued at $268,932.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $310.0 to $370.0 for Caterpillar over the last 3 months.

Volume & Open Interest Trends

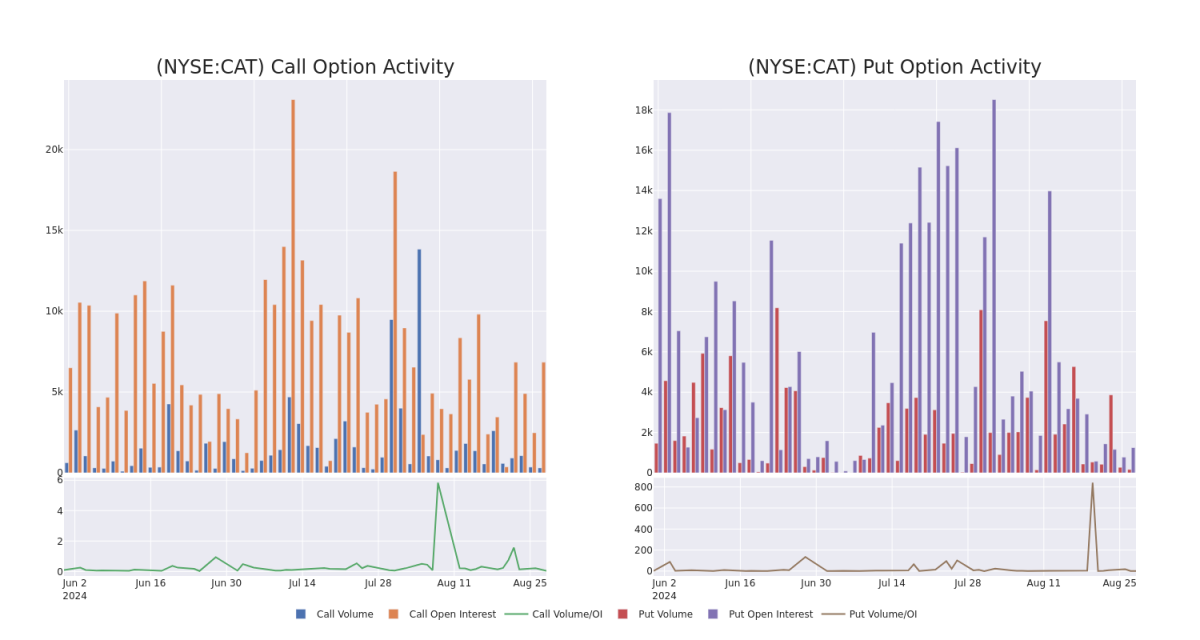

In today's trading context, the average open interest for options of Caterpillar stands at 1156.0, with a total volume reaching 469.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Caterpillar, situated within the strike price corridor from $310.0 to $370.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Caterpillar stands at 1156.0, with a total volume reaching 469.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Caterpillar, situated within the strike price corridor from $310.0 to $370.0, throughout the last 30 days.

Caterpillar Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CAT | PUT | TRADE | BULLISH | 11/15/24 | $13.35 | $13.05 | $13.16 | $340.00 | $131.6K | 698 | 121 |

| CAT | CALL | TRADE | NEUTRAL | 11/15/24 | $19.5 | $19.15 | $19.31 | $350.00 | $48.2K | 649 | 30 |

| CAT | CALL | SWEEP | BEARISH | 11/15/24 | $10.7 | $10.4 | $10.49 | $370.00 | $40.9K | 1.1K | 40 |

| CAT | CALL | TRADE | BULLISH | 01/17/25 | $38.5 | $37.75 | $38.5 | $330.00 | $38.5K | 807 | 10 |

| CAT | CALL | TRADE | BEARISH | 09/20/24 | $9.25 | $8.8 | $8.95 | $350.00 | $35.8K | 2.4K | 60 |

About Caterpillar

Caterpillar is the top manufacturer of heavy equipment, power solutions, and locomotives. It is currently the world's largest manufacturer of heavy equipment. The company is divided into four reportable segments: construction industries, resource industries, energy and transportation, and Cat Financial. Its products are available through a dealer network that covers the globe with about 2,700 branches maintained by 160 dealers. Cat Financial provides retail financing for machinery and engines to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Caterpillar product sales.

In light of the recent options history for Caterpillar, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Caterpillar's Current Market Status

- With a trading volume of 681,572, the price of CAT is down by -1.19%, reaching $346.94.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 62 days from now.

What The Experts Say On Caterpillar

5 market experts have recently issued ratings for this stock, with a consensus target price of $343.2.

- An analyst from Truist Securities downgraded its action to Buy with a price target of $399.

- Consistent in their evaluation, an analyst from UBS keeps a Sell rating on Caterpillar with a target price of $285.

- An analyst from Barclays persists with their Equal-Weight rating on Caterpillar, maintaining a target price of $335.

- Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for Caterpillar, targeting a price of $376.

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a In-Line rating on Caterpillar with a target price of $321.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.