The Price Is Right For BAIC BluePark New Energy Technology Co.,Ltd. (SHSE:600733) Even After Diving 29%

The Price Is Right For BAIC BluePark New Energy Technology Co.,Ltd. (SHSE:600733) Even After Diving 29%

BAIC BluePark New Energy Technology Co.,Ltd. (SHSE:600733) shareholders won't be pleased to see that the share price has had a very rough month, dropping 29% and undoing the prior period's positive performance. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 24%.

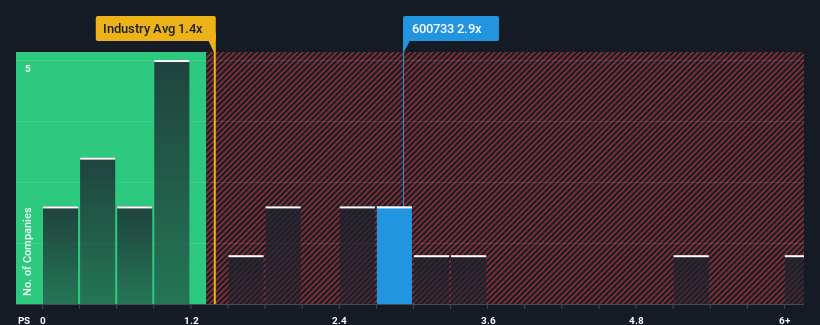

Even after such a large drop in price, when almost half of the companies in China's Auto industry have price-to-sales ratios (or "P/S") below 1.4x, you may still consider BAIC BluePark New Energy TechnologyLtd as a stock probably not worth researching with its 2.9x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

What Does BAIC BluePark New Energy TechnologyLtd's P/S Mean For Shareholders?

Recent times haven't been great for BAIC BluePark New Energy TechnologyLtd as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on BAIC BluePark New Energy TechnologyLtd will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For BAIC BluePark New Energy TechnologyLtd?

In order to justify its P/S ratio, BAIC BluePark New Energy TechnologyLtd would need to produce impressive growth in excess of the industry.

In order to justify its P/S ratio, BAIC BluePark New Energy TechnologyLtd would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.1% last year. The latest three year period has also seen an excellent 167% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 79% per year during the coming three years according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 26% per annum, which is noticeably less attractive.

In light of this, it's understandable that BAIC BluePark New Energy TechnologyLtd's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Despite the recent share price weakness, BAIC BluePark New Energy TechnologyLtd's P/S remains higher than most other companies in the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into BAIC BluePark New Energy TechnologyLtd shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for BAIC BluePark New Energy TechnologyLtd you should know about.

If you're unsure about the strength of BAIC BluePark New Energy TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.