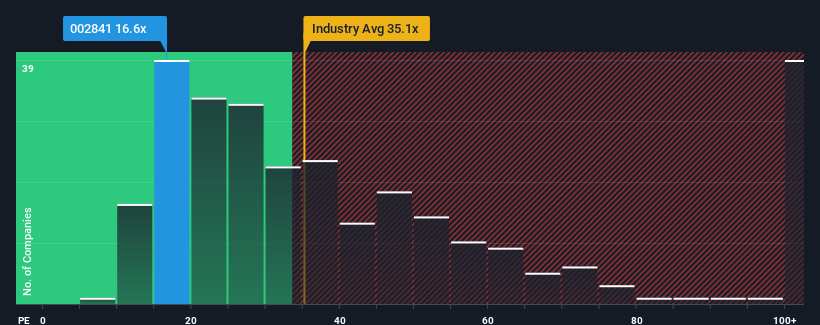

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 26x, you may consider Guangzhou Shiyuan Electronic Technology Company Limited (SZSE:002841) as an attractive investment with its 16.6x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Guangzhou Shiyuan Electronic Technology hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

What Are Growth Metrics Telling Us About The Low P/E?

Guangzhou Shiyuan Electronic Technology's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 36% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 34% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 14% each year over the next three years. With the market predicted to deliver 23% growth per annum, the company is positioned for a weaker earnings result.

In light of this, it's understandable that Guangzhou Shiyuan Electronic Technology's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Guangzhou Shiyuan Electronic Technology's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Guangzhou Shiyuan Electronic Technology maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Guangzhou Shiyuan Electronic Technology has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If these risks are making you reconsider your opinion on Guangzhou Shiyuan Electronic Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.