During the reporting period, the company's sales revenue from micro inverters and monitoring equipment amounted to 0.749 billion yuan, with the sales volume of micro inverters reaching approximately 0.6142 million units and the sales volume of monitoring equipment reaching approximately 0.1444 million units. Including Sungrow Power Supply, Goodee Technology, and Ginlong Technologies, the net income of inverter manufacturers improved in the second quarter.

On August 28th, HEMAI Corporation released its 2024 interim report, according to The Science and Technology Innovation Board Daily.

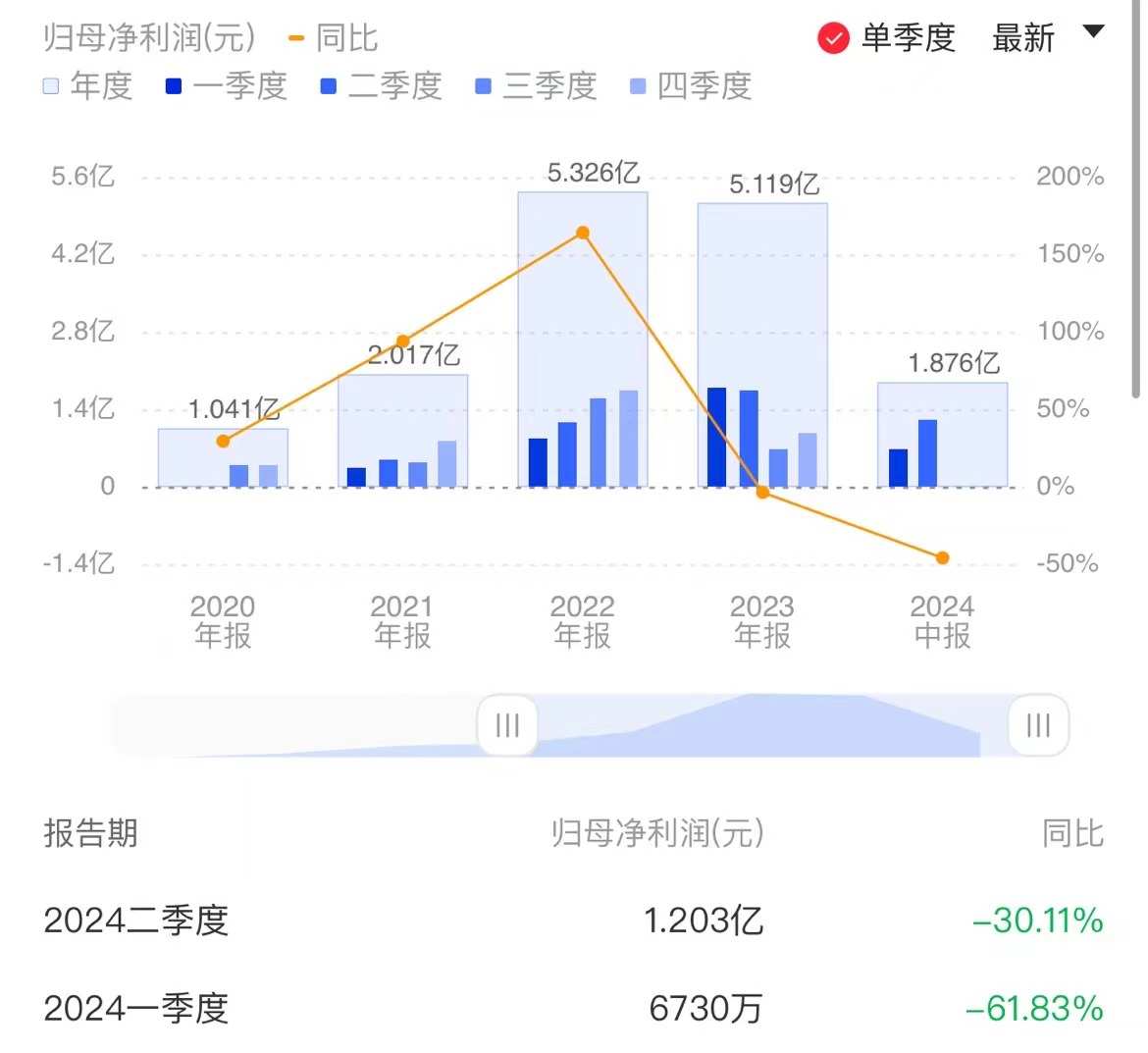

During the reporting period, the company achieved operating revenue of 0.908 billion yuan, a year-on-year decrease of 14.78%; a net income attributable to shareholders of 0.188 billion yuan, a year-on-year decrease of 46.16%; and a non-GAAP net income of 0.185 billion yuan, a year-on-year decrease of 44.37%.

Looking at the second quarter alone, HEMAI Corporation achieved a net income attributable to shareholders of 0.12 billion yuan, a year-on-year decrease of 30.11%, with a significant improvement compared to the previous quarter.

Regarding the reasons for the decrease in revenue and net income, HEMAI Corporation explained that it was primarily due to the impact of the industry environment and the slowdown in sales growth. The decline in revenue, coupled with increased expenses and a decrease in foreign currency project translation gains, resulted in a year-on-year decline in net income and non-GAAP net income.

HEMAI Corporation's main business is the research and development, manufacturing, and sales of photovoltaic inverters, energy storage inverters, and other power conversion equipment, electrical complete sets of equipment, and related products. The photovoltaic inverters and related products mainly include micro inverters and monitoring equipment, isolation systems, and photovoltaic power generation systems. The energy storage-related products mainly include energy storage inverters and energy storage systems.

During the reporting period, the company's sales revenue from micro inverters and monitoring equipment amounted to 0.749 billion yuan, with the sales volume of micro inverters reaching approximately 0.6142 million units and the sales volume of monitoring equipment reaching approximately 0.1444 million units. Among them, the company launched the world's first micro inverter, MiT, with a power of 5000W. In the field of energy storage applications, the company launched the world's first AC-coupled micro energy storage product.

Overseas revenue accounts for a relatively high proportion at Jiangsu Goodwe Power Supply Technology Co.,Ltd. In terms of overseas markets, it is reported that the product certification of the company's micro inverters and their monitoring equipment has obtained more than 1400 certifications worldwide; energy storage products have passed grid-connected certifications in nearly 30 important countries such as Germany, France, the United Kingdom, Australia, and the United States.

During the reporting period, the total R&D investment of the company was 12.1 billion yuan, an increase of 39.47% year-on-year. In terms of research projects, the development and application of power semiconductor chip module design, packaging testing equipment, AC component micro-inverters, and other related projects are in the development stage; key technological research for the second generation of four-input single-phase micro-inverter systems and photovoltaic energy storage systems has entered the trial production stage.

Multiple manufacturers improve Q2 net income, and power inverters may usher in an industry turning point.

After the 'consolidation' competition in the photovoltaic industry from last year to the first quarter of this year, the performance of manufacturers in various segments of the industry chain collectively declined, but the performance of inverter manufacturers improved significantly in the second quarter.

Specifically, leading inverter manufacturer Sungrow Power Supply achieved a net income attributable to the parent company of 28.63 billion yuan in the second quarter, a 37% increase from the previous quarter; Delixi Group achieved a net income attributable to the parent company of 8.028 billion yuan in the second quarter, an 85.45% increase from the previous quarter.

On the same day (August 28th), Ginlong Technologies, which disclosed its semi-annual report, achieved a net profit of 3.319 billion yuan in the second quarter, a significant improvement compared to 202.9 million yuan in the first quarter. The company stated in its financial report that the second quarter saw a continuous improvement in the overseas order volume for grid-connected and energy storage inverters, with an increased proportion of overseas shipments. A person from its securities department further explained to the 'STAR Market Daily' reporter, 'The second quarter was mainly favorable in the Asia, Africa, and Latin America markets, and India and Brazil were also performing well.'

An official from the securities department of Jiangsu Goodwe Power Supply Technology Co.,Ltd. also told the 'STAR Market Daily' reporter earlier that the operating situation improved somewhat in the second quarter, including in the photovoltaic and energy storage products. 'On one hand, Europe's destocking has reached a relatively stable level, and on the other hand, there is a significant increase in the emerging markets, particularly in the Asia, Africa, and Latin America markets.'

Deng Yongkang, an analyst at Minsheng Securities, believes that with signs of high growth in demand for grid connections and household energy storage in emerging markets such as Southeast Asia and the Middle East, as well as the near completion of destocking in Europe, the continuous recovery of inverter exports may indicate an industry turning point.