① Among Japanese stocks, semiconductor equipment manufacturer Tokyo Electronics closed down 1.76%, and SoftBank Group, which focuses on investing in AI startups, recently fell 2.4%; ② The two South Korean chip manufacturing giants both plummeted, Samsung Electronics closed down 3.14%, and SK Hynix fell 5.35%.

AFP, August 29 (Editor: Zhao Hao) The Japanese and South Korean stock markets both declined on Thursday (August 29) due to Nvidia's earnings report.

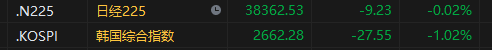

According to market conditions, the Nikkei 225 Index once fell more than 1% in early trading, and continued to narrow the decline rate and rose for a while, closing slightly down 0.02%; the Korea Composite Index remained weak, falling 1.02% to close at its lowest level in nearly half a month, with a maximum drop of nearly 1.5% in the intraday period.

After US stocks closed overnight, Nvidia released its financial results report for the second fiscal quarter of fiscal year 2025. The “artificial intelligence weather vane” recorded revenue of 30.04 billion US dollars during the quarter, an increase of 122% over the previous year; adjusted earnings per share of 0.67 US dollars exceeded market expectations.

Wong In-hoon wrote in the report that demand for Hopper chips is still strong, and expectations for Blackwell are unbelievable. He also mentioned on the call that Blackwell's demand will “far exceed supply” and “we're seeing momentum for generative AI accelerate.”

Nvidia expects revenue for the third fiscal quarter to reach 32.5 billion US dollars. Although it is already higher than the average forecast of 32 billion US dollars, Bernstein said the market has set this figure between 33 billion US dollars and 34 billion US dollars, and Nvidia did not meet this “higher standard.”

After the financial report was announced, Nvidia once fell more than 8% in after-market trading in the US stock market, dragging down related stocks in the Japanese and South Korean stock markets. Among Japanese stocks, semiconductor equipment manufacturer Tokyo Electronics closed down 1.76%, while SoftBank Group, which focuses on investing in AI startups, recently fell 2.4%.

Maki Sawada, a stock strategist at Nomura Securities, said that Nvidia's sales and revenue forecasts both exceeded expectations, but did not meet the high expectations of some market participants. “However, Nvidia's performance is still positive, and the sell-off phenomenon will not last long.”

IG analyst Tony Sycamore pointed out that Nvidia's revenue in 14 of the past 15 quarters exceeded expectations, and its stock price increased by more than 150% during the year, which also placed it under tremendous pressure. He believes that this may be an “perfect time for investors to switch from Nvidia to other chip vendors.”

Edwin Test, one of Nvidia's suppliers, once fell more than 3.6% in early trading, but closed up 0.3%. In the Nikkei Index, Nidec led the decline of more than 200 constituent stocks by 3.32%, as its water-cooling equipment research partner Ultramicrocomputer delayed filing of the 10-K document for the 2024 fiscal year.

In the Korean stock market, the two chip manufacturing giants both plummeted. Samsung Electronics closed down 3.14%, and SK Hynix fell 5.35%. Analysts pointed out that without the collapse of Samsung and SK Hynix, the Korea Composite Index should have remained stable.

TSMC (2330), which is an OEM for Nvidia, closed down 2.18%, falling nearly 1.9% before TSMC traded on the NYSE.