①上半年廈門銀行營收、歸母淨利潤分別下滑2.21%、15.03%,淨息差收窄至1.14%,在已披露中報的23家上市銀行中墊底;②今日收盤,廈門銀行報4.96元/股,當日跌幅達6.94%,領跌銀行股。

財聯社8月29日訊(記者 史思同)8月29日,半年報披露後首個交易日,廈門銀行出現了近7%的跌幅。從業績來看,上半年該行營收及歸母淨利潤分別同比下降2.21%、15.03%,同時其淨息差水平也進一步收窄0.2個百分點至1.14%,在已披露中報的23家上市銀行中墊底。

對此,廈門銀行表示,淨息差同比收窄,主要受LPR利率持續下行、年初集中重定價、及公司加大對實體經濟減費讓利的力度等因素影響,貸款平均利率下降明顯。同時,該行上半年信用減值損失計提金額同比增加較大,也進一步導致淨利潤出現下滑。

不過就在這一業績公佈後,資本市場上的投資者也當即做出反應。8月29日收盤,銀行板塊除青島銀行平盤外,其餘41家銀行股全部下跌。其中,廈門銀行以6.94%的跌幅領跌銀行股。

不過就在這一業績公佈後,資本市場上的投資者也當即做出反應。8月29日收盤,銀行板塊除青島銀行平盤外,其餘41家銀行股全部下跌。其中,廈門銀行以6.94%的跌幅領跌銀行股。

業績雙降,淨息差進一步收窄至1.14%

具體來看,今年以來,廈門銀行業務規模增長較少,存款規模更是有所縮減。截至今年6月末,該行總資產3984.55億元,較上年末上升1.99%。貸款及墊款總額爲2132.87億元,較上年末增長1.71%;存款總額2052.87億元,較上年末下降1.10%。

業績方面,廈門銀行營收、利潤也雙雙出現明顯下滑。其中,上半年該行實現營業收入28.92億元,同比下降2.21%;歸母淨利潤12.14億元,同比下降15.03%。

對此,甬興證券研究所固收首席分析師鄭嘉偉分析認爲,廈門銀行業績表現不佳主要是其息差進一步收窄導致營收下滑,同時信用減值損失計提金額同比大幅增加導致利潤下滑超預期。

從收入構成來看,上半年廈門銀行實現利息淨收入20.01億元,同比下降10.58%。「在LPR持續下調、市場利率持續走低、存款定期化趨勢未見改善等的環境下,公司息差較同期收窄,影響淨利息收入的實現。」廈門銀行稱。

不過受投資收益帶動,該行上半年非利息淨收入8.91億元,同比增長23.83%。其中,投資收益5.57億元,同比大增283.26%;相比之下,其手續費及佣金淨收入則較上年同期減少8.09%降至1.80億元。

具體到息差而言,上半年廈門銀行淨利差爲1.06%,淨息差爲1.14%,同比分別下降0.22個百分點和0.20個百分點。

「主要受LPR利率持續下行、年初集中重定價、及公司加大對實體經濟減費讓利的力度等因素影響,貸款平均利率下降明顯。」在廈門銀行看來,2024年上半年,該行淨息差結構優化措施的效果逐步顯現,自1月份探底後,上半年淨息差呈現回升態勢。

23家已披露中報上市銀行中息差墊底、歸母淨利潤降幅最高

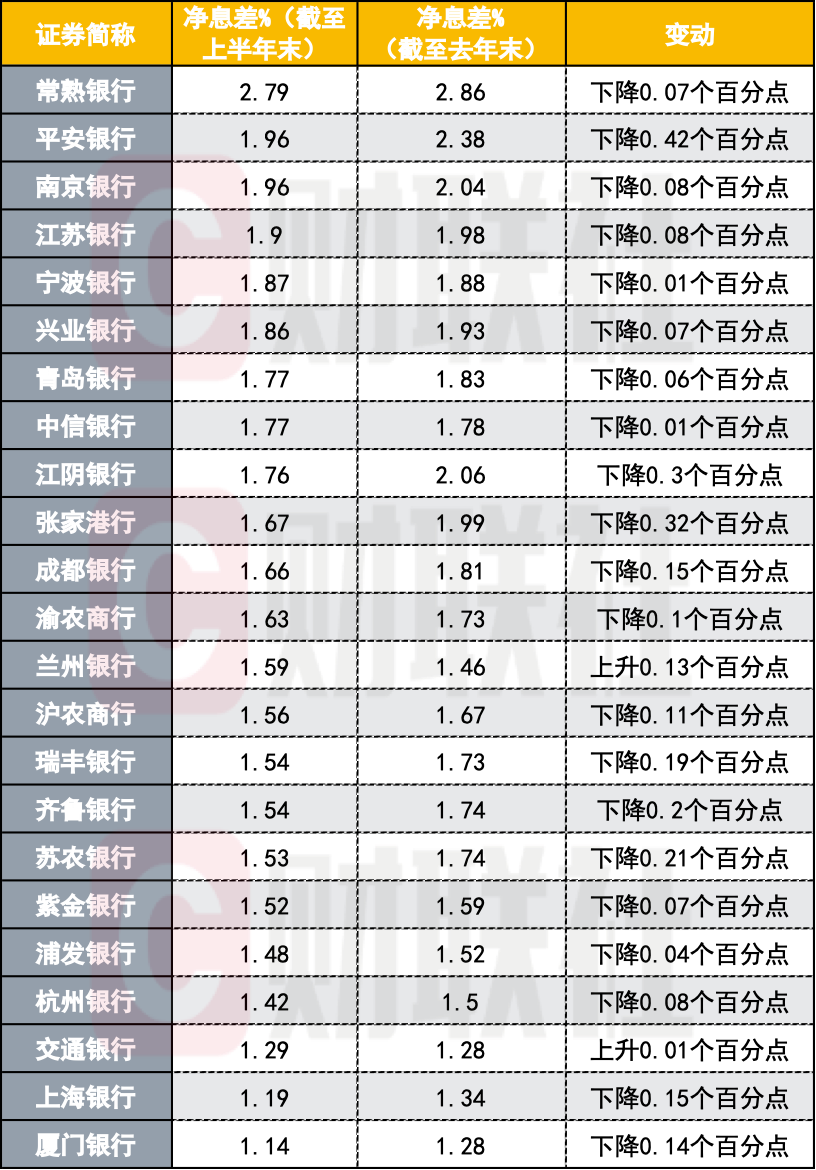

實際上,近年來銀行業息差收窄已不是新鮮事。然而相比同業而言,今年上半年末,廈門銀行1.14%的息差水平在目前披露中報的A股上市銀行中已然墊底。

財聯社記者梳理發現,截至發稿,當前已有23家A股上市銀行披露半年報。其中,僅有常熟銀行淨息差在2%以上,達2.79%。其餘銀行中,有17家淨息差在1.5%以上,而在淨息差在1.2%以下的銀行僅有上海銀行、廈門銀行兩家,分別爲1.19%、1.14%。

與此同時,受息差進一步收窄等因素影響,該行也成爲上述23家上市銀行中第三家營收、淨利雙降的銀行,並且是第一家歸母淨利潤降幅達兩位數的上市銀行。

據鄭嘉偉分析,當前廈門銀行面臨一定的經營壓力,隨着相對高收益資產到期以及新投放貸款利率較低,整體資產收益率可能進一步下行;同時,存款定期化趨勢仍在延續,可能進一步擠壓淨息差。

「經濟復甦進度、息差改善進程以及尾部不良風險等因素也可能對廈門銀行的未來業績產生一定影響。未來,廈門銀行仍需進一步優化業務結構、改善淨息差並加強風險管理以應對市場變化帶來的挑戰。」鄭嘉偉表示。

銀行板塊全線受挫,廈門銀行-6.94%領跌

進一步來看,相對於業績大幅下滑,廈門銀行資產質量及資本充足水平整體仍保持穩定。

資產質量方面,截至今年6月末,廈門銀行不良貸款餘額16.13億元,不良貸款率0.76%,與年初持平,資產質量保持平穩;撥備覆蓋率396.22%,風險抵補能力保持充足,不過相比年初仍下降了16.67個百分點。

其中值得關注的是,6月末該行關注類貸款金額爲48.30億元,較上年末增加18.26億元。對此,廈門銀行解釋稱,主要系針對部分基本面正常但受外部經濟環境變化影響出現風險信號的客戶,公司基於審慎原則將其分類下調爲關注。

與此同時,作爲體現銀行風險抵補能力的重要指標,廈門銀行資本充足水平也進一步提升。截至6月末,該行資本充足率爲15.44%,一級資本充足率爲12.38%,核心一級資本充足率爲9.91%,較年初分別提升0.04、0.04、0.05個百分點。

不過即便如此,似乎也難以抵擋業績下滑給投資者帶來的負面情緒。資本市場方面,截至8月29日收盤,廈門銀行報4.96元/股,當日跌幅達6.94%,領跌銀行股。

在業內分析人士看來,廈門銀行股價劇烈波動與該行業績不理想,以及此前銀行板塊累積較大漲幅有關。同時,從今天盤面看,短期部分資金轉向其他題材熱點,幾方面疊加影響下,該行股價出現較大跌幅。

實際上,今日股價下跌的不止廈門銀行。整體來看,8月29日,A股上市銀行全線受挫,除青島銀行平盤以外,其餘41家銀行股全部下跌,銀行板塊當日跌幅達2.87%。

對此,上述分析人士表示,市場波動是常態,從銀行基本面趨勢、估值及股息率方面看,銀行板塊後續估值修復仍有空間,但個股存在一定分化。

不过就在这一业绩公布后,资本市场上的投资者也当即做出反应。8月29日收盘,银行板块除青岛银行平盘外,其余41家银行股全部下跌。其中,厦门银行以6.94%的跌幅领跌银行股。

不过就在这一业绩公布后,资本市场上的投资者也当即做出反应。8月29日收盘,银行板块除青岛银行平盘外,其余41家银行股全部下跌。其中,厦门银行以6.94%的跌幅领跌银行股。