Investors with a lot of money to spend have taken a bullish stance on Altria Group (NYSE:MO).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MO, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MO, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 8 options trades for Altria Group.

This isn't normal.

The overall sentiment of these big-money traders is split between 75% bullish and 25%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $85,840, and 7, calls, for a total amount of $1,036,992.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $40.0 to $57.5 for Altria Group during the past quarter.

Volume & Open Interest Development

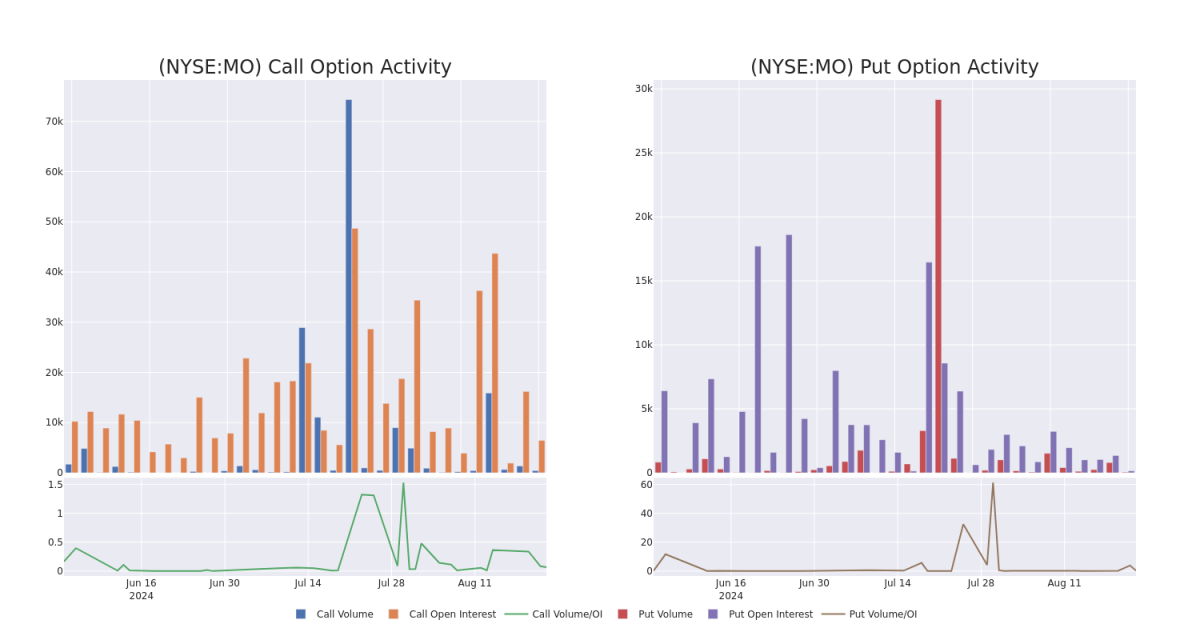

In terms of liquidity and interest, the mean open interest for Altria Group options trades today is 3401.25 with a total volume of 3,158.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Altria Group's big money trades within a strike price range of $40.0 to $57.5 over the last 30 days.

Altria Group Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MO | CALL | SWEEP | BULLISH | 06/20/25 | $13.35 | $13.25 | $13.35 | $40.00 | $385.8K | 2.2K | 290 |

| MO | CALL | SWEEP | BULLISH | 06/20/25 | $13.3 | $13.2 | $13.3 | $40.00 | $339.1K | 2.2K | 301 |

| MO | CALL | SWEEP | BULLISH | 06/20/25 | $13.3 | $13.2 | $13.3 | $40.00 | $164.9K | 2.2K | 726 |

| MO | PUT | TRADE | BEARISH | 01/17/25 | $6.0 | $5.5 | $5.8 | $57.50 | $85.8K | 372 | 0 |

| MO | CALL | SWEEP | BULLISH | 06/20/25 | $13.3 | $13.2 | $13.3 | $40.00 | $59.8K | 2.2K | 601 |

About Altria Group

Altria comprises Philip Morris USA, US Smokeless Tobacco, John Middleton, Horizon Innovations, and Helix Innovations. Through its tobacco subsidiaries, Altria maintains the leading position in cigarettes and smokeless tobacco in the United States and the number-two spot in machine-made cigars. The company's Marlboro brand is the leading cigarette brand in the US with 42% annual share in 2023. Beyond its core business, it holds an 8% interest in the world's largest brewer, Anheuser-Busch InBev, a 42% stake in cannabis manufacturer Cronos, acquired Njoy Holdings in 2023, and operates a joint venture with Japan Tobacco in the heated tobacco category. It also recently disposed of its investment in Juul Labs.

Where Is Altria Group Standing Right Now?

- Currently trading with a volume of 883,490, the MO's price is up by 0.24%, now at $53.35.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 56 days.

Professional Analyst Ratings for Altria Group

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $48.5.

- Consistent in their evaluation, an analyst from Stifel keeps a Buy rating on Altria Group with a target price of $54.

- Maintaining their stance, an analyst from Barclays continues to hold a Underweight rating for Altria Group, targeting a price of $43.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.