Looking At Eaton Corp's Recent Unusual Options Activity

Looking At Eaton Corp's Recent Unusual Options Activity

Financial giants have made a conspicuous bullish move on Eaton Corp. Our analysis of options history for Eaton Corp (NYSE:ETN) revealed 9 unusual trades.

金融巨頭對伊頓公司採取了明顯的看好行動。我們對伊頓公司(NYSE:ETN)的期權歷史進行了分析,發現了9筆異常交易。

Delving into the details, we found 55% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $190,916, and 3 were calls, valued at $297,946.

進一步探究後,我們發現55%的交易者持看漲態度,而33%的交易者顯示出了看跌傾向。在我們發現的所有交易中,有6筆看跌期權交易,價值$190,916,還有3筆看漲期權交易,價值$297,946。

Expected Price Movements

預期價格波動

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $240.0 to $350.0 for Eaton Corp over the recent three months.

根據交易活動,最近三個月來,重要的投資者似乎將伊頓公司的價格區間定在$240.0到$350.0之間。

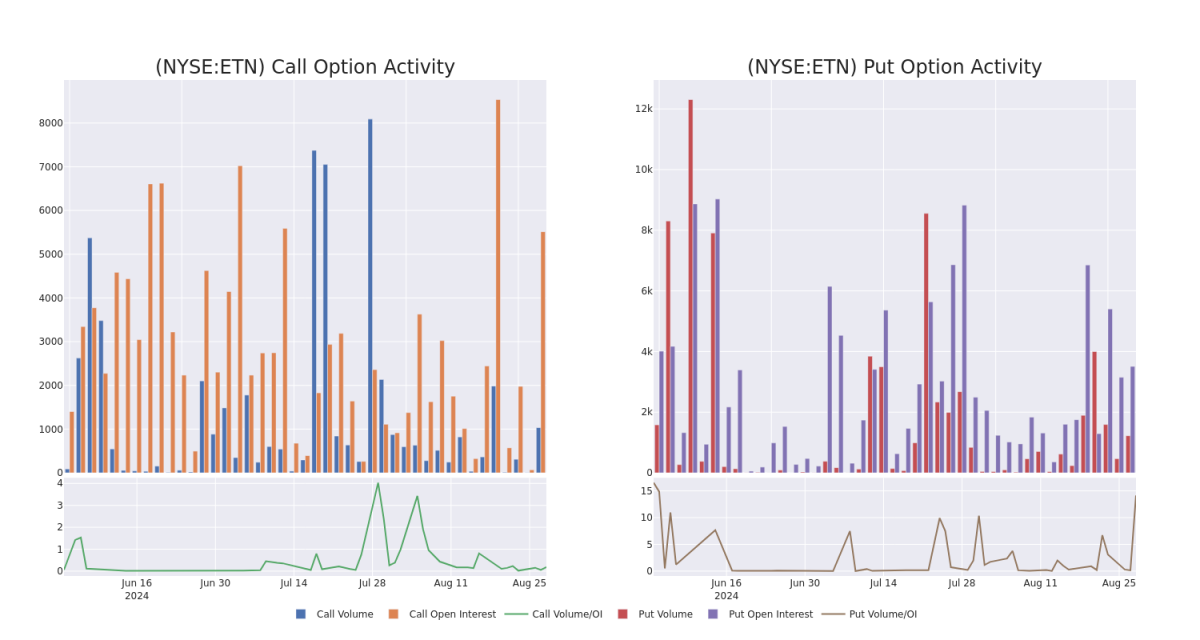

Analyzing Volume & Open Interest

分析成交量和未平倉合約

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Eaton Corp's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Eaton Corp's significant trades, within a strike price range of $240.0 to $350.0, over the past month.

通過對成交量和持倉量的研究,可以提供重要的股票研究見解。這些信息是衡量伊頓公司期權在特定行權價上的流動性和利益水平的關鍵因素。下面,我們提供了伊頓公司在過去一個月內,行權價區間爲$240.0到$350.0的重要交易中看漲和看跌期權的成交量和持倉量趨勢的快照。

Eaton Corp Option Activity Analysis: Last 30 Days

伊頓公司期權活動分析:最近30天

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ETN | CALL | SWEEP | BEARISH | 06/20/25 | $80.8 | $79.3 | $79.65 | $240.00 | $159.4K | 26 | 20 |

| ETN | CALL | TRADE | BEARISH | 10/18/24 | $41.9 | $39.7 | $40.1 | $270.00 | $76.1K | 44 | 19 |

| ETN | CALL | TRADE | NEUTRAL | 01/17/25 | $7.9 | $7.7 | $7.79 | $350.00 | $62.3K | 1.3K | 85 |

| ETN | PUT | SWEEP | BULLISH | 09/20/24 | $3.5 | $3.4 | $3.46 | $290.00 | $40.3K | 2.7K | 1.9K |

| ETN | PUT | SWEEP | BEARISH | 04/17/25 | $15.1 | $14.8 | $15.1 | $280.00 | $34.7K | 0 | 27 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 伊頓 | 看漲 | SWEEP | 看淡 | 06/20/25 | $80.8 | $79.3 | RBC Capital的一位分析師決定繼續維持他們對伊頓公司的跑贏市場評級,目前目標價爲371美元。 | $240.00 | $159.4K | 26 | 20 |

| 伊頓 | 看漲 | 交易 | 看淡 | 10/18/24 | $41.9 | $39.7 | $40.1 | $270.00 | $76.1K | 44 | 19 |

| 伊頓 | 看漲 | 交易 | 中立 | 01/17/25 | $7.9 | $7.7 | $7.79 | $350.00 | $62.3K | 1.3K | 85 |

| 伊頓 | 看跌 | SWEEP | 看好 | 09/20/24 | $3.5 | $3.4 | 3.46美元 | $290.00 | $40.3K | 2.7K | 1.9K |

| 伊頓 | 看跌 | SWEEP | 看淡 | 04/17/25 | $15.1 | $14.8 | $15.1 | $280.00 | $34.7K | 0 | 27 |

About Eaton Corp

關於伊頓公司

Founded in 1911 by Joseph Eaton, the eponymous company began by selling truck axles in New Jersey. Eaton has since become an industrial powerhouse largely through acquisitions in various end markets. Eaton's portfolio can broadly be divided into two parts: its electrical and industrial businesses. Its electrical portfolio (representing around 70% of company revenue) sells components within data centers, utilities, and commercial and residential buildings, while its industrial business (30% of revenue) sells components within commercial and passenger vehicles and aircraft. Eaton receives favorable tax treatment as a domiciliary of Ireland, but it generates over half of its revenue within the US.

Following our analysis of the options activities associated with Eaton Corp, we pivot to a closer look at the company's own performance.

在分析與伊頓公司有關的期權交易活動後,我們轉而更密切地關注公司自身的表現。

Eaton Corp's Current Market Status

- With a trading volume of 1,446,831, the price of ETN is up by 2.76%, reaching $301.69.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 61 days from now.

- 當前RSI值表明該股票可能接近超買狀態。

- 下一個收益報告將在61天后發佈。

Professional Analyst Ratings for Eaton Corp

伊頓公司的專業分析師評級

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $334.5.

- An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Eaton Corp, which currently sits at a price target of $333.

- An analyst from Barclays has decided to maintain their Equal-Weight rating on Eaton Corp, which currently sits at a price target of $319.

- An analyst from RBC Capital has decided to maintain their Outperform rating on Eaton Corp, which currently sits at a price target of $371.

- Maintaining their stance, an analyst from Wells Fargo continues to hold a Equal-Weight rating for Eaton Corp, targeting a price of $315.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Eaton Corp's options at certain strike prices. Below, we present a snapshot of the

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Eaton Corp's options at certain strike prices. Below, we present a snapshot of the