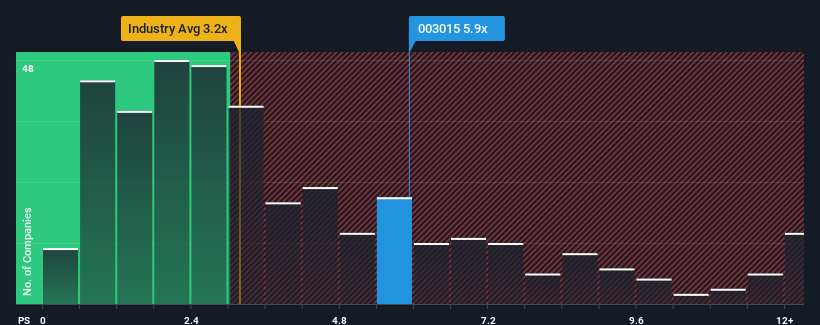

When close to half the companies in the Electronic industry in China have price-to-sales ratios (or "P/S") below 3.2x, you may consider Jiangsu Rijiu Optoelectronics Jointstock Co., Ltd (SZSE:003015) as a stock to avoid entirely with its 5.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Jiangsu Rijiu Optoelectronics' Recent Performance Look Like?

The revenue growth achieved at Jiangsu Rijiu Optoelectronics over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Jiangsu Rijiu Optoelectronics, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Jiangsu Rijiu Optoelectronics' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 24% gain to the company's top line. As a result, it also grew revenue by 9.2% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Retrospectively, the last year delivered an exceptional 24% gain to the company's top line. As a result, it also grew revenue by 9.2% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 26% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's alarming that Jiangsu Rijiu Optoelectronics' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Jiangsu Rijiu Optoelectronics currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Plus, you should also learn about these 3 warning signs we've spotted with Jiangsu Rijiu Optoelectronics (including 1 which shouldn't be ignored).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.