William Blair said that Tesla's stock is worth buying because it has built an 'Apple-like' energy ecosystem. The company believes that the energy business of this electric car manufacturer is 'undervalued'.

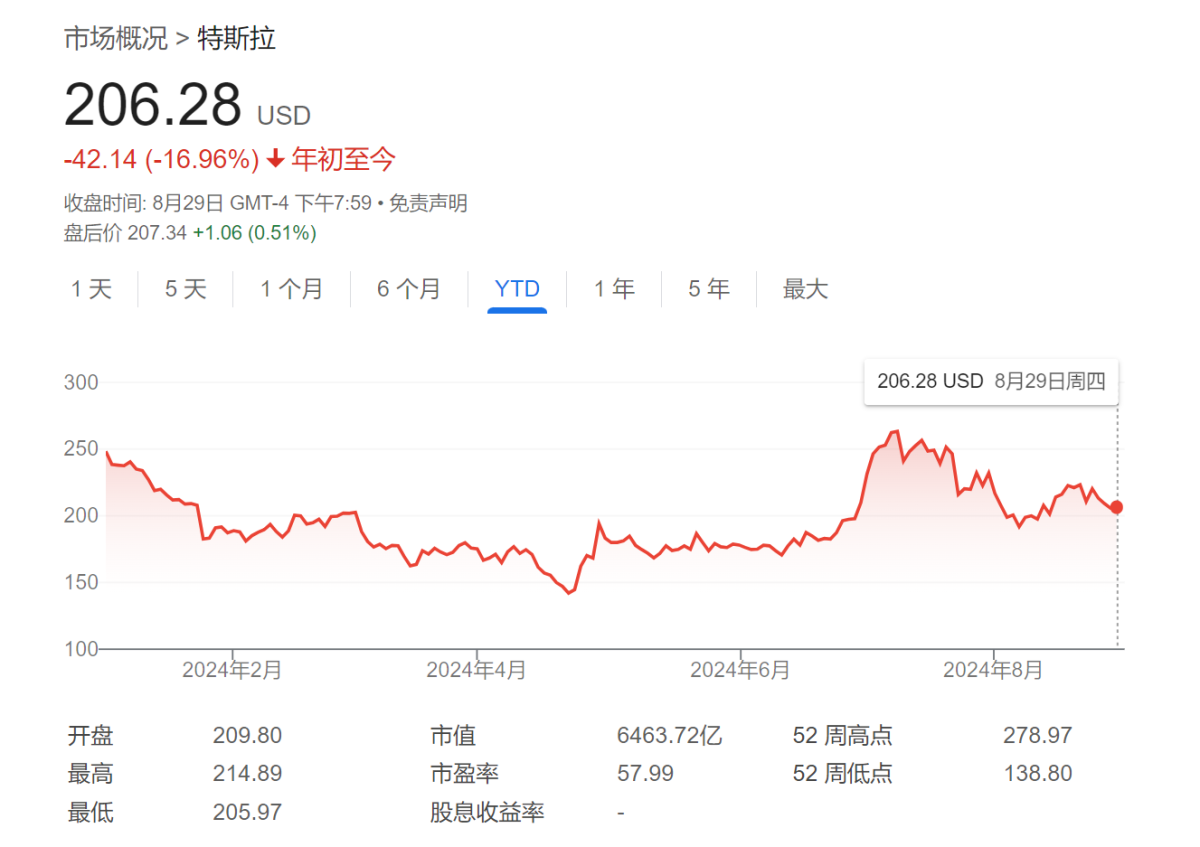

On August 30, the American multinational independent investment bank and financial services company, William Blair, stated that Tesla's stock is worth buying because it has built an 'Apple-like' energy ecosystem. With the decline in sales volume and a series of questions surrounding Musk, Tesla's stock price has plummeted by about 17% this year.

On Thursday (August 29th), Jed Dorsheimer, an analyst at William Blair, rated Tesla as 'outperforming the market' and said that the energy business of this electric car manufacturer is 'undervalued' amidst the continuous growth in power demand driven by data centers and the rise of renewable energy.

'We believe that Tesla Energy is the most underestimated part of the Tesla story, given the recent moderation in expectations for electric vehicles, we expect the narrative to shift towards energy storage business,' he explained.

The three key drivers of Tesla's energy storage business include data center construction, efforts to stabilize the US power grid, and the integration of renewable energy.

Dorsheimer stated, 'Combining the automotive business with long-term opportunities such as artificial intelligence, autonomous taxis, and robots, we believe Tesla is a technological leader in the future energy field with an 'Apple-like' ecosystem.'

For a long time, Tesla's products have been compared to Apple's products, and its cars are sometimes referred to as 'iPhones on wheels'.

However, William Blair's focus on Tesla's research is its energy business, which includes solar panels, charging stations, and battery packs for residences and utility companies.

Dorsheimer estimates that by 2028, the compound annual growth rate of Tesla's energy business could reach 50%, increasing its revenue contribution from 6% to 25%, doubling it.

"We believe Tesla's Megapack is an independent leader in the energy storage field and we believe it will gain significant market share in these areas," he added.

According to the report, Tesla's Megapack could become the company's fastest-growing business, with higher profit margins compared to the electric vehicle business. Megapack is a large rechargeable battery network that provides energy storage capacity for utilities and large commercial projects.

Dorsheimer said, "Our analysis predicts that Megapack will be Tesla's fastest-growing product and will significantly increase earnings per share from $0.14 in 2024 to $2.35 in 2028."

However, not everyone is as confident in Tesla. For example, Ross Gerber, CEO of Gerber Kawasaki Wealth Investment Management and a well-known Tesla investor, recently said that he had sold about half of his stake in the automaker because no one was interested in buying the company's cars or robots.

"I'm concerned that Tesla's prime time is over. Over time, I've been reducing my position because I have no confidence in Tesla's ability to achieve its goals of selling more cars set a few years ago or even recently," he said.

Overall, William Blair has not set a target price for Tesla, but it believes its premium valuation is reasonable.

"We believe that Musk's halo effect, the company's first principle culture, and the technological advantage it has established ensure its significant valuation premium," Dorsheimer said.