How is the revenue and net income growth of Great Wall Motor in the first half of the year? How are the institutions predicting its future performance?

According to Caixin Finance on August 30th, benefiting from positive mid-term performance, Great Wall Motor (02333.HK) surged more than 7% in early trading. As of the time of writing, it rose by 4.02%, at 10.88 Hong Kong dollars.

Note: Performance of Great Wall Motor

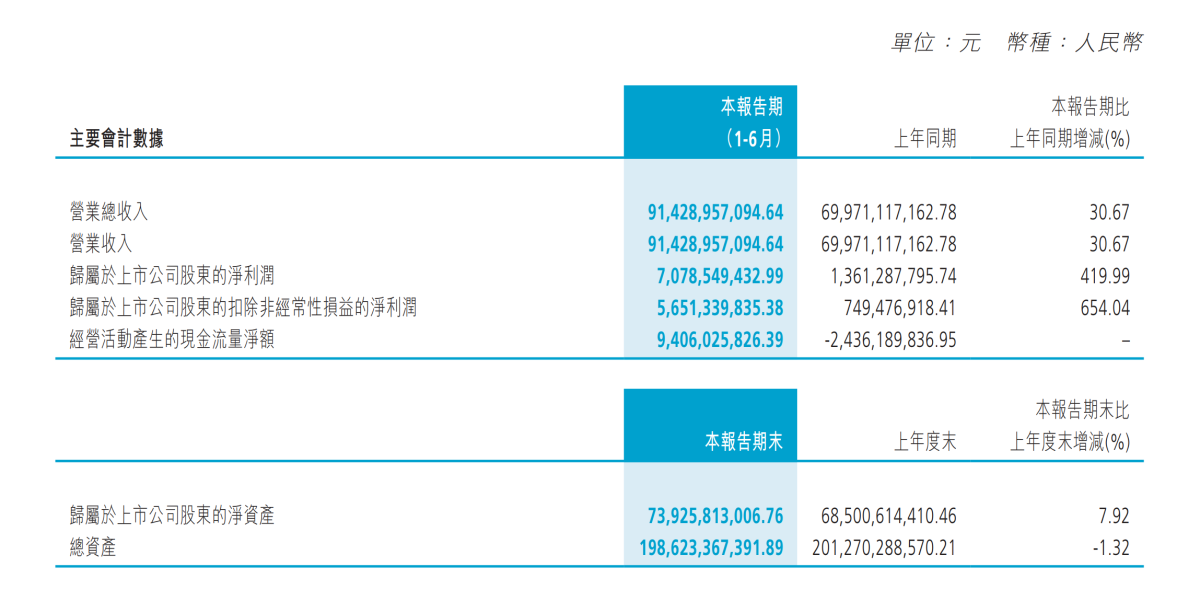

In terms of news, Great Wall Motor released its first-half performance yesterday. During the period, it achieved a total revenue of 91.429 billion yuan, which increased by 30.67% year-on-year; its net income attributable to shareholders reached 7.079 billion yuan, a year-on-year increase of 419.99%.

In terms of news, Great Wall Motor released its first-half performance yesterday. During the period, it achieved a total revenue of 91.429 billion yuan, which increased by 30.67% year-on-year; its net income attributable to shareholders reached 7.079 billion yuan, a year-on-year increase of 419.99%.

The growth in the first-half revenue of Great Wall Motor is mainly attributed to the increase in vehicle sales volume and the improvement in the proportion of overseas market and mid-to-high-end product sales volume, which resulted in an increase in revenue per vehicle. At the same time, the year-on-year growth in net income also benefited from the expansion of the overseas market.

Based on the first-half sales volume, the export sales volume of pickups and SUVs reached 23,624 and 168,607 units, representing year-on-year growth of 14.10% and 81.79% respectively compared to the same period last year.

Note: Product sales volume

Institutions believe that the overseas market performance will further enhance the company's profitability.

It is worth noting that Great Wall Motor pointed out in the first quarter report of this year that the expansion of the overseas market is a key factor driving the company's performance growth. As indicated by gtja's analysis, Great Wall Motor's proactive layout in the overseas market has begun to show results, achieving a significant year-on-year and quarter-on-quarter increase in gross margin in this quarter.

Specifically, the gross margin in the first quarter of 2024 reached 20.0%, and this growth is mainly due to the optimization of the product structure and the increase in overseas exports. During this period, the company's export sales volume reached 0.0928 million vehicles, an increase of 78.5% year-on-year. Due to the profitability of overseas models surpassing the domestic market, Great Wall Motor's expansion and sales growth in the overseas market have both shown an accelerating trend.

Gtja expects that with the continuation of this trend, the company's overall profitability will be further enhanced.

消息方面,长城汽车在昨日发布上半年业绩,期内实现营业总收入914.29亿元,同比增加30.67%;归母净利润70.79亿元,同比增加419.99%。

消息方面,长城汽车在昨日发布上半年业绩,期内实现营业总收入914.29亿元,同比增加30.67%;归母净利润70.79亿元,同比增加419.99%。