The consumption time of Bitcoin is increasing rapidly, indicating a shift in activity and trend among long-term holders.

After a sharp rise in BTC price, it increased by 1%, but continuous currency transfers may lead to a price decline.

If BTC breaks through its 20-day EMA, it may exceed $60,000; otherwise, it may fall to $58,790.

The Bitcoin (BTC) market has recently witnessed significant changes in the activity of its long-term holders.

The Bitcoin (BTC) market has recently witnessed significant changes in the activity of its long-term holders.

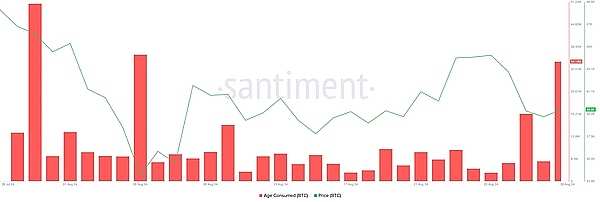

On Thursday morning, the "consumed age" indicator showed a significant surge, indicating that investors who hold tokens for the long term are now becoming active again.

Bitcoin long-term holders are taking action.

According to data, Bitcoin's "consumed age" indicator soared to 34.16 million on Thursday morning, reaching the highest single-day level since August 5, when the broader market slump led to liquidation of over $1 billion. The consumed age indicator tracks the movement of dormant coins by calculating the time they were held before being moved multiplied by the number of coins moved.

In general, long-term holders do not frequently transfer their coins, so the surge in this indicator often indicates an upcoming change in market trends.

After the surge in age consumption, bitcoin has risen by 1% in the past 24 hours. When price surges accompany the surge in age consumption, it may indicate the emergence of a local bottom. However, the recent 1% growth is not enough to confirm this argument.

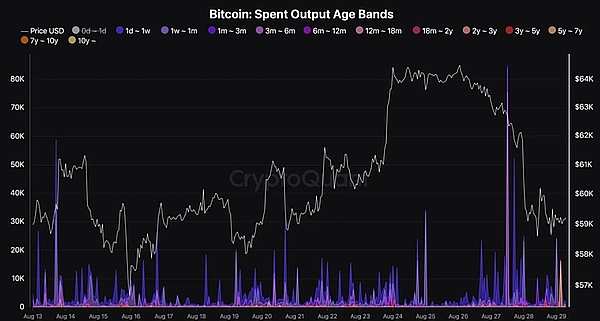

Further analysis of bitcoin with output age distribution shows that different holders have widely allocated bitcoin in the past few days.

On the second day, there were 19,067 coins aged one week to one month on the market, and some coins aged less than 2 years. Today, traders have transferred 23,345 coins aged one week to one month, 1,220 coins aged 6 to 12 months, and 16,003 coins aged 5 to 7 years.

These transfers must cease; otherwise, they will continue to contribute to the decline of bitcoin. When long-dormant bitcoins are transferred, it is usually in preparation for something and you may see them being sold. Transfers that occur at the right time and place often have a negative impact on bitcoin.

BTC Price Prediction: Possible Breakout Above $60,000

As of press time, the bitcoin trading price is below its 20-day Exponential Moving Average (EMA), at $59,640. The moving average tracks the average price of bitcoin over the past 20 days and is a key indicator of market sentiment.

When the asset price falls below its 20-day EMA, it usually indicates increased selling pressure.

If this selling pressure intensifies, bitcoin may lose the gains of the past 24 hours and potentially fall to $58,790. However, if the token successfully breaks above its 20-day moving average, new buying momentum may push its price back above $60,000.

比特币(BTC)市场最近发现其长期持有者的活动发生了显著变化。

比特币(BTC)市场最近发现其长期持有者的活动发生了显著变化。