①多只中证1000指数和券商相关ETF成交额环比昨日大增,其中1000ETF(159629)成交额环比增长199%。②网约车人气股大众交通今日遭国盛证券宁波桑田路营业部卖出1.16亿。

沪深股通今日合计成交1677.9亿,其中贵州茅台和宁德时代分居沪股通和深股通成交额个股首位。板块主力资金方面,电子板块净流入居首。ETF成交方面,沪深300ETF(510300)成交额位居首位。期指持仓方面,IF合约多头加仓数量大于空头。龙虎榜方面,星辉娱乐获机构买入近3000万;力源信息获机构买入超2000万;山金国际遭机构卖出1.95亿;东山精密遭机构卖出超8000万;天利科技获两家一线游资席位买入;国科天成获一家量化席位卖出超3000万

一、沪深股通前十大成交

今日沪股通总成交金额为902.29亿,深股通总成交金额为775.61亿。

今日沪股通总成交金额为902.29亿,深股通总成交金额为775.61亿。

从沪股通前十大成交个股来看,贵州茅台位居首位,招商银行、工商银行成交金额分居二、三位。

从沪股通前十大成交个股来看,贵州茅台位居首位,招商银行、工商银行成交金额分居二、三位。从深股通前十大成交个股来看,宁德时代位居首位,大涨的迈瑞医疗成交额居次席。

二、板块个股主力大单资金

从板块表现来看,保险、华为海思、游戏、房地产等板块涨幅居前,银行、贵金属、高速公路等板块跌幅居前。

从主力板块资金监控数据来看,电子板块主力资金连续净流入居首。

从主力板块资金监控数据来看,电子板块主力资金连续净流入居首。板块资金流出方面,银行板块主力资金净流出居首。

从个股主力资金监控数据来看,主力资金净流入前十的个股所属板块较为杂乱,江淮汽车净流入居首。

从个股主力资金监控数据来看,主力资金净流入前十的个股所属板块较为杂乱,江淮汽车净流入居首。主力资金流出前十的个股中银行股较多,工商银行净流出居首。

三、ETF成交

从成交额前十的ETF来看,沪深300ETF(510300)成交额位居首位,中证500ETF(510500)成交额位居次席,三只恒指相关ETF位居前十行列。

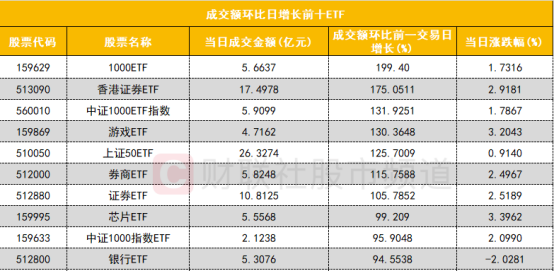

从成交额前十的ETF来看,沪深300ETF(510300)成交额位居首位,中证500ETF(510500)成交额位居次席,三只恒指相关ETF位居前十行列。 从成交额环比增长前十的ETF来看,三只中证1000指数ETF和三只券商相关ETF位居前十行列,其中1000ETF(159629)成交额环比增长199%位居首位,香港证券ETF(513090)成交额环比增长175%位居次席。

从成交额环比增长前十的ETF来看,三只中证1000指数ETF和三只券商相关ETF位居前十行列,其中1000ETF(159629)成交额环比增长199%位居首位,香港证券ETF(513090)成交额环比增长175%位居次席。四、期指持仓

四大期指主力合约中,IH、IF多空双方均大幅加仓,IH合约空头加仓数量较多,IF合约多头加仓数量较多;IC合约多空双方均减仓,空头减仓数量较多;IM合约空头加仓数量大于多头。

四大期指主力合约中,IH、IF多空双方均大幅加仓,IH合约空头加仓数量较多,IF合约多头加仓数量较多;IC合约多空双方均减仓,空头减仓数量较多;IM合约空头加仓数量大于多头。五、龙虎榜

1、机构

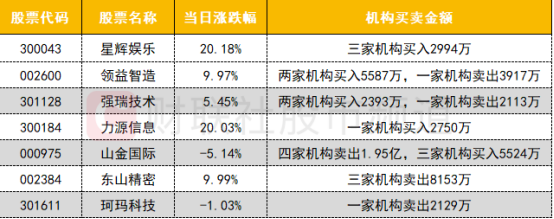

龙虎榜机构活跃度有所提升,买入方面,游戏股星辉娱乐获机构买入近3000万;华为海思概念股力源信息获机构买入超2000万。

龙虎榜机构活跃度有所提升,买入方面,游戏股星辉娱乐获机构买入近3000万;华为海思概念股力源信息获机构买入超2000万。卖出方面,黄金股山金国际遭机构卖出1.95亿;消费电子概念股东山精密遭机构卖出超8000万。

2、游资

一线游资活跃度一般,保险概念股天利科技获两家一线游资席位买入;大众交通遭国盛证券宁波桑田路营业部卖出1.16亿。

一线游资活跃度一般,保险概念股天利科技获两家一线游资席位买入;大众交通遭国盛证券宁波桑田路营业部卖出1.16亿。量化资金活跃度有所提升,次新股国科天成获一家量化席位卖出超3000万。