① Southbound capital traded around HK$622.5 billion this month. Which individual stocks continued to flow in? ② Tencent Holdings' capital inflow of about HK$8.6 billion in the month. How was the stock price performing?

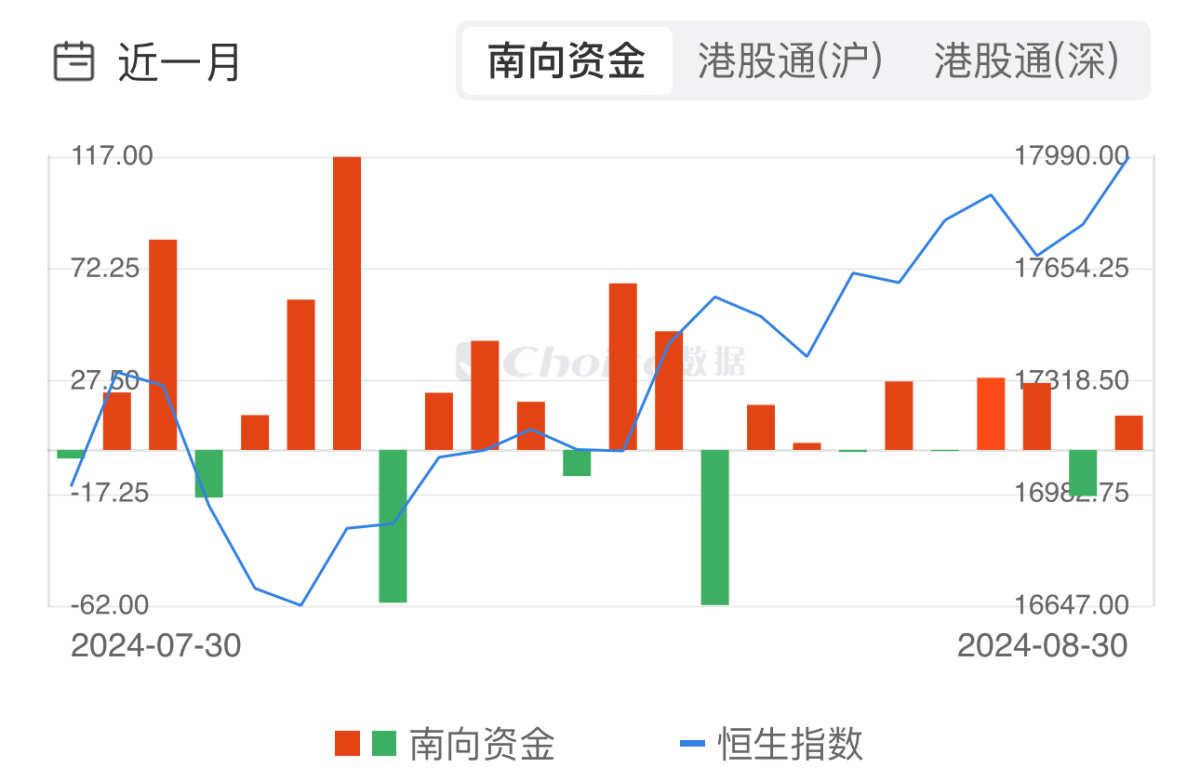

Financial Services Association, August 30 (Editor: Feng Yi) Southbound Capital sold a total of HK$622.476 billion in August, a decrease of about 16% compared to July.

This month, the cumulative net inflow of capital to the south was HK$41.876 billion, a decrease of about HK$6 billion compared to July, and lower than the average for the previous eight months.

In terms of trend, southbound capital inflows remained continuous in the first 8 months of this year, with a cumulative inflow of HK$461.2 billion, which is more than double the total inflow for the same period last year.

In the long run, the net inflow of capital to the south has been maintained for nearly 14 months, with a cumulative net purchase of HK$656.548 billion during this period.

On a short-term level, due to the contraction and rebound of the Hang Seng Index in August, the desire to increase southbound capital positions was generally not strong, and there was even a sharp outflow when market fluctuations intensified.

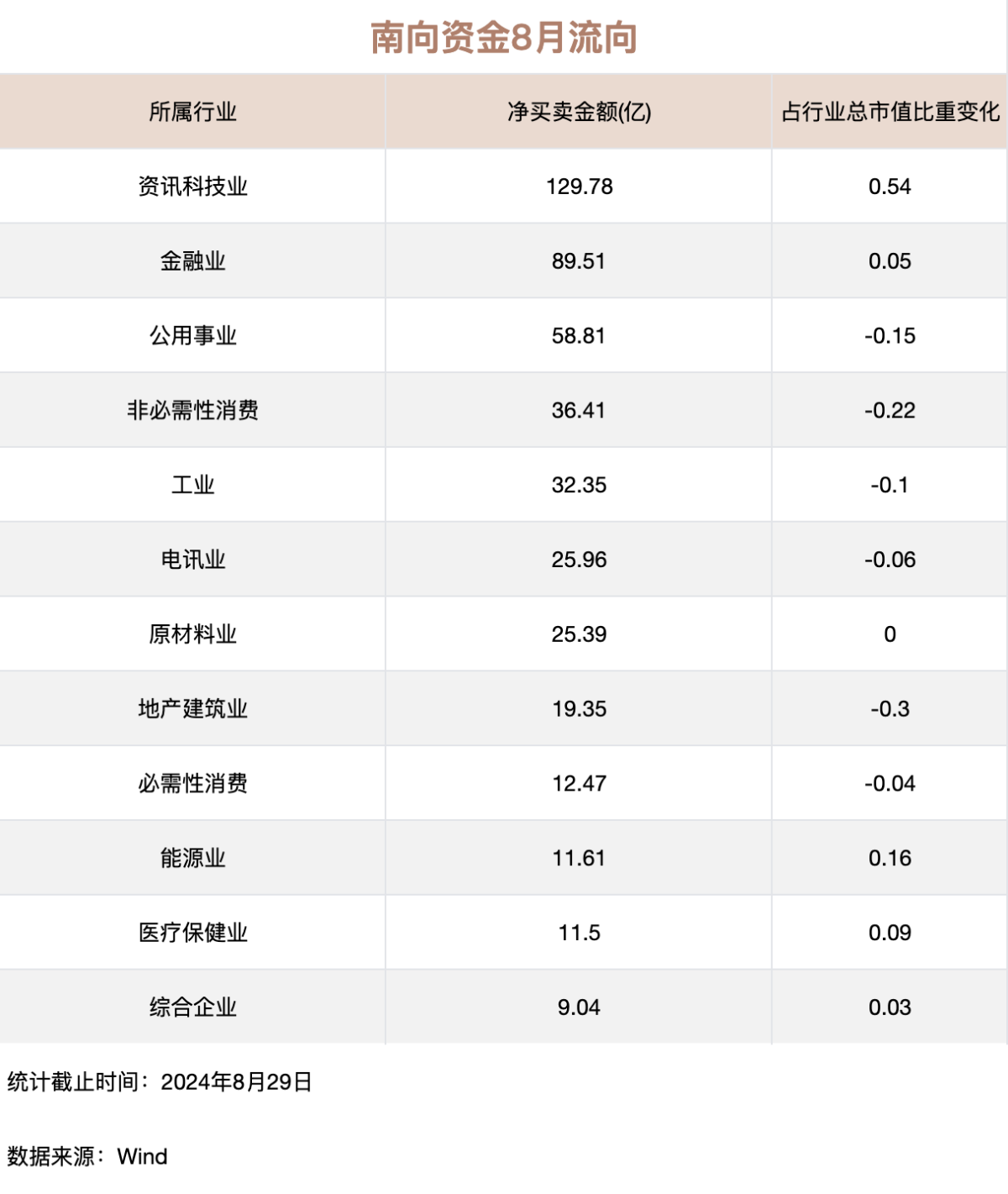

By industry, Southbound Capital mainly added positions in technology stocks in August. Although positions in financial stocks have been increased for the sixth month in a row, the net purchase scale has shrunk markedly. Furthermore, the utility sector continued to receive attention.

In terms of individual stocks, in the nearly one month ending August 30, southbound capital

Significant net inflows: Tencent Holdings (00700.HK) HK$8.528 billion; China Mobile (00941.HK) HK$3.123 billion; Xiaomi Group-W (01810.HK) HK$2.046 billion.

Significant net outflow: HSBC Holdings (00005.HK) HK$2.245 billion.

Key points of investment

Tencent Holdings surged 5.47% this month. Short-term capital outflows were frequent, and its share holdings were reduced by 2.3 million in the first 5 days.

China Mobile rose 4.96% this month. Short-term capital continued to flow in, adding 4.71 million shares in the first 5 days.

Xiaomi Group-W surged 15.80% this month. Short-term capital was mainly outflows, reducing its holdings by 61.56 million shares in the first 5 days.

HSBC Holdings declined by 0.82% this month. Short-term capital returned slightly, and positions increased by 2.15 million shares in the first 5 days.

Southbound capital traded HK$43.072 billion on August 30, with a net inflow of HK$1.367 billion on the same day. Among them, the net inflow from the Shanghai-Hong Kong Stock Connect was HK$1.428 billion, and the net outflow from the Shenzhen-Hong Kong Stock Connect was HK$0.061 billion.

According to exchange data, southbound capital on August 30:

Significant net inflows: Tencent Holdings (00700.HK) HK$0.681 billion; Ping An of China (02318.HK) HK$0.39 billion; Xiaomi Group-W (01810.HK) HK$0.205 billion.

Significant net outflows: ICBC (01398.HK) HK$0.479 billion; CCB (00939.HK) HK$0.419 billion; Ideal Automobile-W (02015.HK) HK$0.203 billion; CNOOC (00883.HK) HK$0.192 billion.

Ping An of China rose 3.60% today. Short-term capital inflows continued, adding 8.36 million shares in the first 5 days.

ICBC fell 2.81% today. Short-term capital inflows are still dominated by inflows, adding 40.59 million shares in the first 5 days.

CCB fell 1.95% today. Short-term capital inflows are still the main focus, adding 81.67 million shares in the first 5 days.

Ideal Automobile-W rose 7.79% today. Short-term capital outflows continued, reducing its holdings by 1.79 million shares in the first 5 days.

CNOOC rose 1.65% today. Short-term capital outflows continued, reducing its holdings by 3.47 million shares in the first 5 days.