Dell Technologies Inc (NYSE:DELL) is weighing a possible sale of cybersecurity company SecureWorks Corp (NASDAQ:SCWX), Reuters cites familiar sources.

In 2019, Dell explored selling the cybersecurity company to reduce its debt. It acquired SecureWorks for $612 million in 2011.

SecureWorks stock is trading lower, close to 4%, on Friday after gains of over 20% on Thursday. Dell is up over 6% at Friday premarket trading.

On Thursday, Dell reported second-quarter revenue growth of 9% to $25.03 billion, beating the analyst consensus of $24.14 billion. As of August 2, 2024, Dell held $17.8 billion in long-term debt.

On Thursday, Dell reported second-quarter revenue growth of 9% to $25.03 billion, beating the analyst consensus of $24.14 billion. As of August 2, 2024, Dell held $17.8 billion in long-term debt.

Dell has tapped investment bankers at Morgan Stanley and Piper Sandler to gauge takeover interest from potential acquirers, which include private equity firms.

SecureWorks is currently valued at $772 million. Dell owns 79.2% of SecureWorks and controls 97.4% of the company's voting stock.

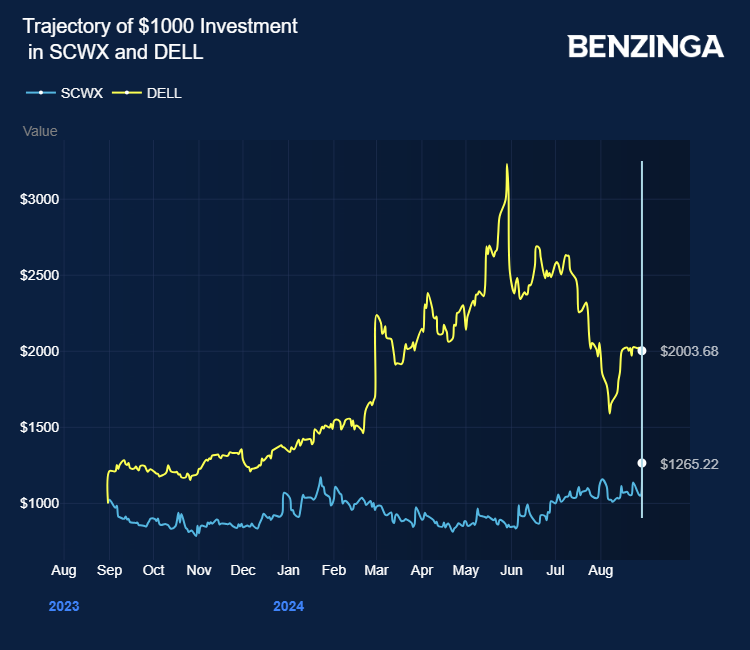

In June, SecureWorks beat first-quarter topline consensus by posting a revenue of $85.7 million. Taegis' revenue grew 10% to $69.1 million. It expects second-quarter revenue of $80 million-$82 million versus analyst consensus of $81.2 million. Secureworks stock is up over 31% in the last 12 months.

Price Actions: SCWX stock is down 3.67% at $8.41 premarket at the last check Friday. Dell is up 6.40% at $117.83.

Photo via Shutterstock