$Gold Futures(DEC4) (GCmain.US)$ reached a new closing high this Tuesday as expectations of a September interest rate cut from the U.S. Federal Reserve continued to gather momentum. So far this year, gold prices have risen over 23%, outperforming the three major U.S. stock indices.

"Analysts foresee long-term gains for the precious metal, driven by the Federal Reserve's preparations to cut rates, believing inflation is under control," said Russell Shor, senior market specialist at Tradu.

Chicago and NY Fed directors favored discount rate cut in July

Members of the boards of directors overseeing the Chicago and New York Federal Reserve banks voted in favor of lowering by a quarter percentage point the central bank’s discount rate during July, according to meeting minutes released on Tuesday.

Members of the boards of directors overseeing the Chicago and New York Federal Reserve banks voted in favor of lowering by a quarter percentage point the central bank’s discount rate during July, according to meeting minutes released on Tuesday.

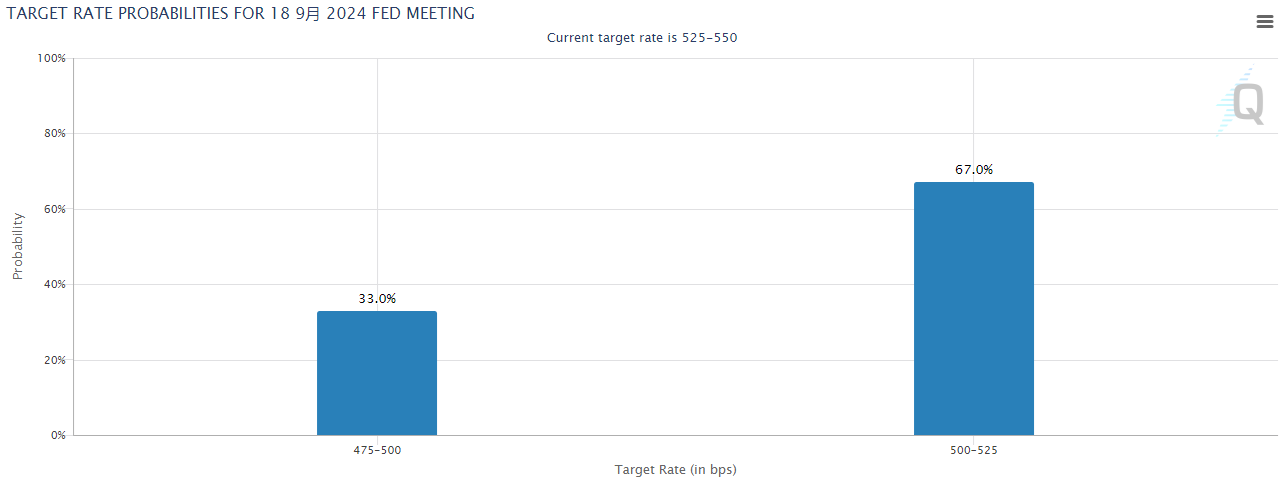

The discount window meeting minutes offer an insight into the likely direction of monetary policy. With inflation pressures easing and risks around the job market rising, the Fed is almost certain to cut its rate target at the September policy meeting. According to the CME Group's FedWatch tool, the probability of a rate cut of 25 basis points is 67%, while the probability of a 50 basis points cut is 33%.

Source: CME Group

What experts are saying about gold prices

In a recent note, UBS analysts stated: “Dovish Fed expectations – with UBS economists now forecasting three 25bp rate cuts this year – the move lower in real rates, and a weaker US dollar have all been positive for the gold price.”

They also added that they don’t believe gold is currently overvalued and cite macroeconomic factors, investor positioning, and market dynamics as factors that show there is potential for further price increases.

Meanwhile, Citi analysts said in July that gold prices might surge to $3,000 per ounce as financial flows show potential for significant expansion. The bank said at the time that a dovish pivot by the Federal Reserve "should be bullish for gold and silver into year-end," with positive effects also expected for base metals like copper.

That bullish sentiment is shared by Alamos Gold CEO John McCluskey. “I’ve been on record myself predicting a target of $2,650 by the end of the year,” stated McCluskey, who has been in the gold mining industry for over 35 years.

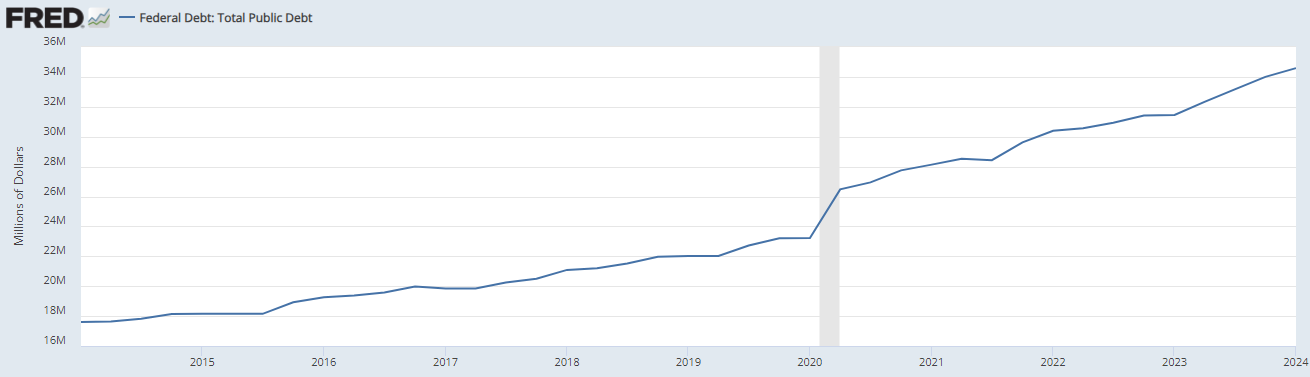

McCluskey cited political upheaval and unrest internationally, as well as the issue of U.S. debt and the strength of the economy, as long-term factors that should continue driving the price of gold to new heights.

“The U.S. debt has grown exponentially in recent months, reaching its current level of over $35T,” he adds. “Combined with anticipated rate cuts coming from the Fed and the upcoming U.S. election, as well as the growing concerns around the U.S. economy — these are all factors that can further increase the potential for gold.”

How to seize the opportunity of rising gold prices?

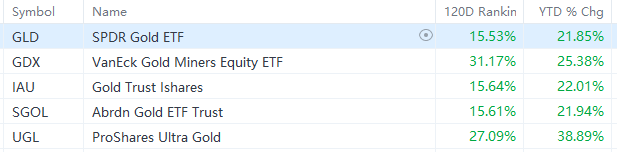

Due to the convenience and high liquidity of gold ETFs, and the ability to trade them online during trading hours, investors can seize the opportunity of rising gold prices by investing in ETFs.

As of the year-to-date performance, mainstream gold ETFs such as $SPDR Gold ETF (GLD.US)$ and $Gold Trust Ishares (IAU.US)$ have risen over 21%, outperforming the S&P 500 Index which has increased by 17.24%. Meanwhile, the leveraged ETF, $ProShares Ultra Gold (UGL.US)$, has seen a rise of more than 37%.

Source: moomoo. As of August 29, 2024

Investors should buy gold even as the metal hovers around record-high prices, according to Bank of America investment strategist Michael Hartnett.

Potential gold ETFs to consider are $ISHARES GOLD TRUST MICRO (IAUM.US)$ and $Spdr Gold Minishares Trust (GLDM.US)$, which Hartnett called "top-rated."

Source: Yahoo Finance, Reuters, CME Group