Seize Investment Opportunities Amid a Record Gold Rally

Seize Investment Opportunities Amid a Record Gold Rally

$Gold Futures(DEC4) (GCmain.US)$ reached a new closing high this Tuesday as expectations of a September interest rate cut from the U.S. Federal Reserve continued to gather momentum. So far this year, gold prices have risen over 23%, outperforming the three major U.S. stock indices.

$黃金主連(2412) (GCmain.US)$ 本週二,由於市場普遍預期美國聯邦儲備系統將在9月份減息,黃金期貨價格再次達到新的收盤高位。今年以來,黃金價格已經上漲了23%以上,表現優於美國三大股指。

"Analysts foresee long-term gains for the precious metal, driven by the Federal Reserve's preparations to cut rates, believing inflation is under control," said Russell Shor, senior market specialist at Tradu.

"分析師們預計,由於聯儲局準備減息,認爲通脹可控,貴金屬長期上漲的機會較大。" Tradu的高級市場專家Russell Shor如是說。

Chicago and NY Fed directors favored discount rate cut in July

芝加哥和紐約聯邦儲備系統的董事傾向於在7月降低貼現利率。

Members of the boards of directors overseeing the Chicago and New York Federal Reserve banks voted in favor of lowering by a quarter percentage point the central bank’s discount rate during July, according to meeting minutes released on Tuesday.

據週二公佈的會議紀要顯示,監管芝加哥和紐約聯邦儲備銀行董事會的成員在7月就將央行貼現率下調一個百分點進行了投票。

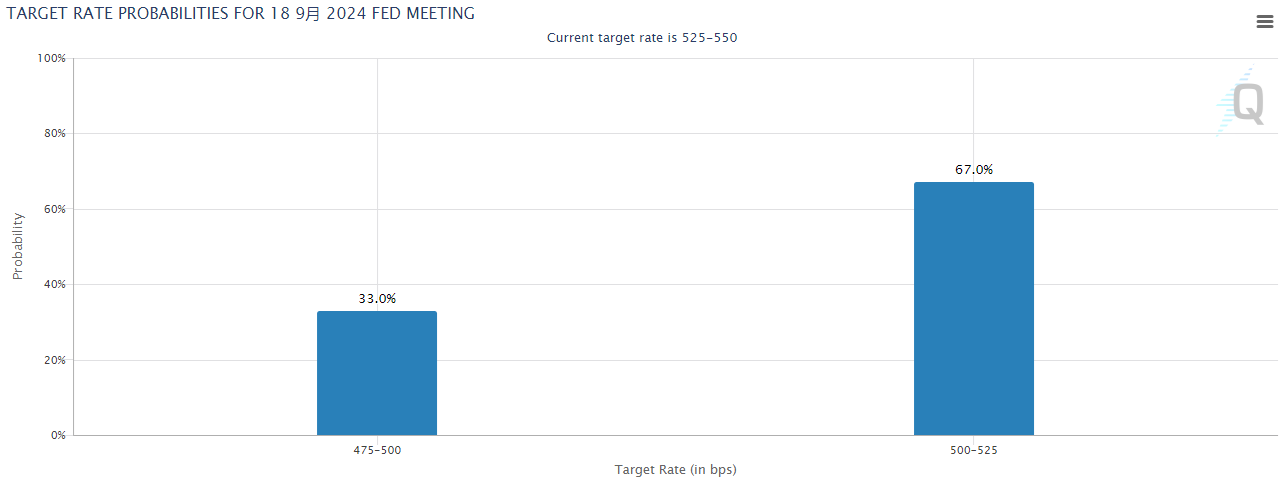

The discount window meeting minutes offer an insight into the likely direction of monetary policy. With inflation pressures easing and risks around the job market rising, the Fed is almost certain to cut its rate target at the September policy meeting. According to the CME Group's FedWatch tool, the probability of a rate cut of 25 basis points is 67%, while the probability of a 50 basis points cut is 33%.

貼現窗口會議紀要爲貨幣政策的可能方向提供了線索。隨着通脹壓力的緩解和就業市場風險的上升,聯儲局幾乎可以肯定地在9月的政策會議上減息。根據CME Group的FedWatch工具,25個點子減息的概率爲67%,50個點子減息的概率爲33%。

Source: CME Group

來源:芝加哥商品交易所

What experts are saying about gold prices

關於黃金價格,專家們的看法

In a recent note, UBS analysts stated: “Dovish Fed expectations – with UBS economists now forecasting three 25bp rate cuts this year – the move lower in real rates, and a weaker US dollar have all been positive for the gold price.”

瑞銀分析師在最近的一份報告中表示:「鴿派聯儲局的預期,瑞銀經濟學家目前預測今年將進行三次減息,實際利率下降以及美元走弱,這些都對黃金價格產生了積極影響。」

They also added that they don’t believe gold is currently overvalued and cite macroeconomic factors, investor positioning, and market dynamics as factors that show there is potential for further price increases.

他們還提到,他們不認爲黃金目前被高估,並且引用了宏觀經濟因素,投資者倉位以及市場動態等因素來表明價格進一步上漲的潛力。

Meanwhile, Citi analysts said in July that gold prices might surge to $3,000 per ounce as financial flows show potential for significant expansion. The bank said at the time that a dovish pivot by the Federal Reserve "should be bullish for gold and silver into year-end," with positive effects also expected for base metals like copper.

同時,花旗分析師在7月表示,金價可能會飆升到每盎司3000美元,因爲金融流動顯示出巨大的擴張潛力。該銀行當時表示,聯儲局的寬鬆態度"應該會對年底金銀市場看漲有積極影響",同時還有望對銅等基本金屬產生積極影響。

That bullish sentiment is shared by Alamos Gold CEO John McCluskey. “I’ve been on record myself predicting a target of $2,650 by the end of the year,” stated McCluskey, who has been in the gold mining industry for over 35 years.

阿拉莫斯黃金公司首席執行官約翰·麥克盧斯基也分享了看好的情緒。「我個人已經預測今年年底的目標是2650美元,」麥克盧斯基表示,他在黃金礦業行業已有35年以上的從業經驗。

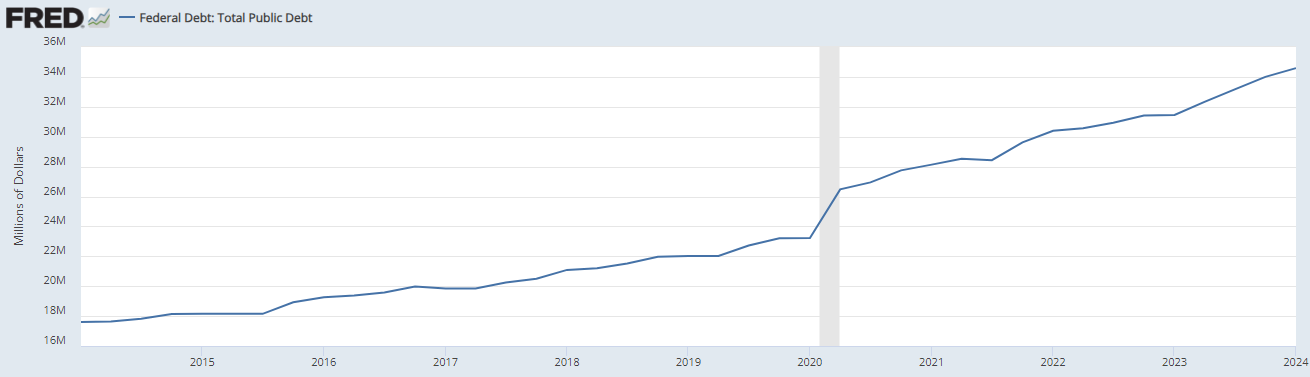

McCluskey cited political upheaval and unrest internationally, as well as the issue of U.S. debt and the strength of the economy, as long-term factors that should continue driving the price of gold to new heights.

麥克盧斯基提到了國際上的政治動盪和動盪局勢,以及美國債務和經濟實力等長期因素,這些因素應該繼續推動金價創新高。

“The U.S. debt has grown exponentially in recent months, reaching its current level of over $35T,” he adds. “Combined with anticipated rate cuts coming from the Fed and the upcoming U.S. election, as well as the growing concerns around the U.S. economy — these are all factors that can further increase the potential for gold.”

他補充說:「美國的債務在最近幾個月呈指數級增長,目前已達到35萬億美元以上。再加上預計聯儲局將進行的減息以及即將到來的美國大選,以及對美國經濟日益增長的擔憂,這些都是可能進一步推動黃金價格上漲的因素。」

How to seize the opportunity of rising gold prices?

如何抓住黃金價格上漲的機會?

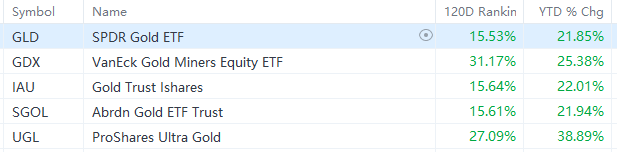

Due to the convenience and high liquidity of gold ETFs, and the ability to trade them online during trading hours, investors can seize the opportunity of rising gold prices by investing in ETFs.

由於黃金ETF的便利性和高流動性,以及在交易時間內可以在網上進行交易,投資者可以通過投資ETF抓住黃金價格上漲的機會。

As of the year-to-date performance, mainstream gold ETFs such as $SPDR Gold ETF (GLD.US)$ and $Gold Trust Ishares (IAU.US)$ have risen over 21%, outperforming the S&P 500 Index which has increased by 17.24%. Meanwhile, the leveraged ETF, $ProShares Ultra Gold (UGL.US)$, has seen a rise of more than 37%.

截至今年以來的表現來看,主流黃金etf,比如 $SPDR黄金ETF (GLD.US)$和頁面。$黃金信托ETF-iShares (IAU.US)$ 已經上漲超過21%,表現優於標普500指數的17.24%。同時,這個槓桿etf, $ProShares兩倍做多黃金ETF (UGL.US)$,已經上漲超過37%。

Source: moomoo. As of August 29, 2024

資料來源:moomoo。截至2024年8月29日。

Investors should buy gold even as the metal hovers around record-high prices, according to Bank of America investment strategist Michael Hartnett.

投資者應該在白銀價格創紀錄高位徘徊時購買黃金,美國銀行投資策略師邁克爾·哈特內特表示。

Potential gold ETFs to consider are $ISHARES GOLD TRUST MICRO (IAUM.US)$ and $Spdr Gold Minishares Trust (GLDM.US)$, which Hartnett called "top-rated."

可以考慮的潛在黃金etf有 $ISHARES GOLD TRUST MICRO (IAUM.US)$和頁面。$SPDR Gold MiniShares Trust (GLDM.US)$,哈特內特稱其爲「頂級」。

Source: Yahoo Finance, Reuters, CME Group

來源:雅虎財經,路透社,芝加哥商品交易所